Like the track Upside Down by Diana Ross in the final series of Stranger Things, the ASX has become an upside-down world in which riskier dividend yields sit below risk-free government bond yields. Now is as important a time as ever for investors to think carefully about what bond-like stocks to hold in their portfolios.

Introduction

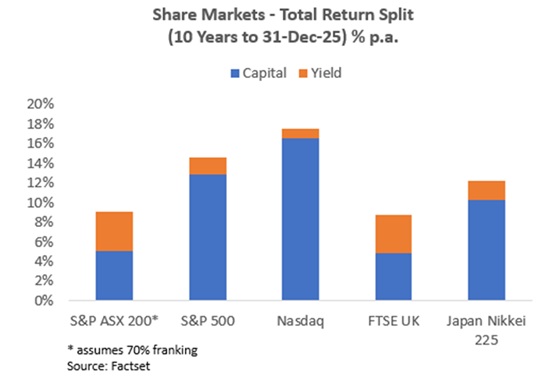

The Australian share market is known for its yield appeal. As shown in the below chart, yield comprises a more meaningful portion of total return than for a number of other offshore share markets, and especially so after allowing for Australia’s unique dividend imputation system.

Our yield status in Australia reflects, among other things, the following:

- Many companies are domestic only (ie only operate in Australia), a constraint on growth (vs major offshore markets which serve much larger addressable markets);

- Many are mature and incumbent, again limiting reinvestment opportunities (eg major banks, telcos, health insurers, and most REITs and consumer staples);

- High payout ratios (which iterates with the above two factors), limiting capital available for reinvestment to grow; and

- Taxation – Australia’s unique imputation system makes dividends a more efficient way to return capital to shareholders than other methods (eg share buybacks).

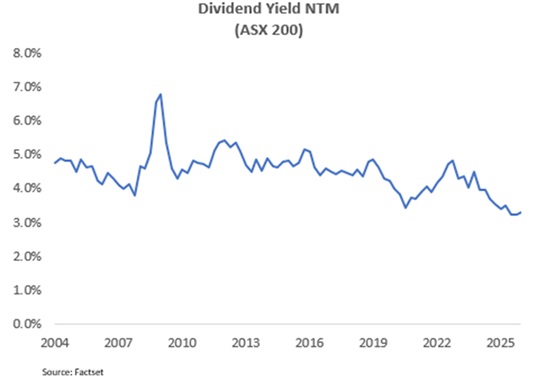

What is the yield of the ASX at present?

The yield on the ASX200 is currently ~3.4%. This is its lowest level in 20 years.

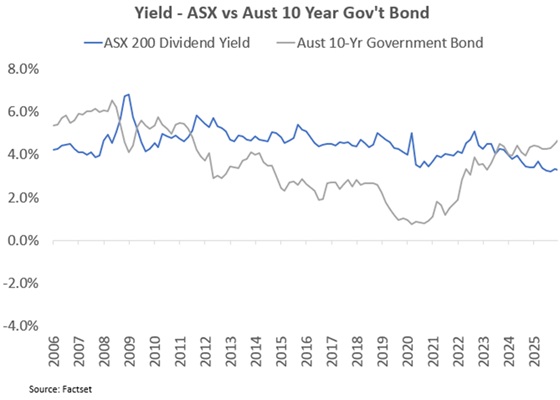

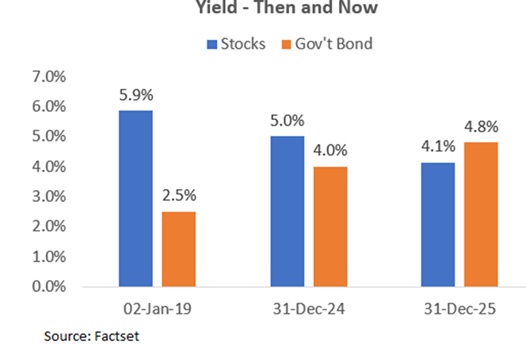

The low yield of the ASX is even more revealing when overlaying the yield of Australian 10-year government bonds. Notice in the next chart that the yield of the ASX has mainly exceeded the yield of 10-year government bonds – a sensical outcome given equities are riskier than bonds. However, since mid-2023 equity yields have tracked below government bond yields.

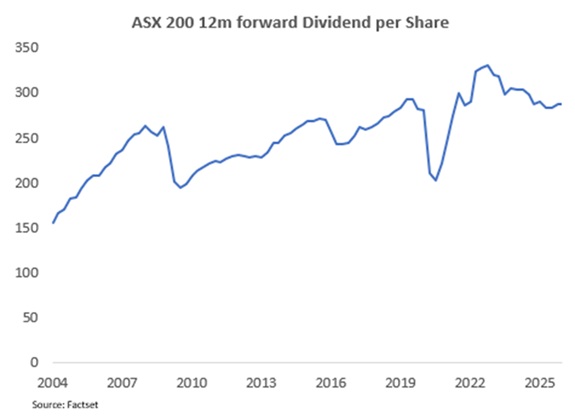

Is lack of yield made up for in higher growth?

Bond yields are fixed; dividends are not. One therefore might ask whether stronger dividend growth has compensated for today’s lower dividend yields.

Unfortunately, the answer is no. The next chart plots the rolling 12m-forward dividend per share of the ASX 200. After a collapse then spike during the COVID-19 period, dividends have since retreated to be around 2019 levels. Also note the cyclical nature of the time series, which reflects dividend volatility from the two largest sectors of the ASX – banks and resources. Overall, unlike in the pre-GFC period when low yield sat alongside strong dividend growth, today it's low yield and low-to-no-growth.

Where is the low yield of the ASX coming from?

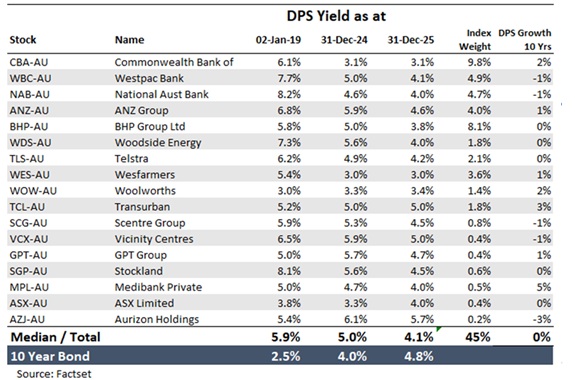

In the main, the decline in yield for the ASX comes from the big end of town being rated differently to a time ago. The table below lists 17 large cap companies known as reliable dividend payers. This group collectively accounts for 45% of the ASX 200. Note at the bottom of the table the weighted average yield of the basket (using today’s index weightings). Back in 2019, this basket yielded 5.9% (before grossing up for franking) vs the Aussie 10-year government bond yield at 2.5%. Fast forward to today and you get 4.1% dividend yield vs 4.8% for the 10-year bond. Upside down.

Also observe that the long-term growth rate in dividends from these stocks overall is 0%. This further validates why we have compared ASX yield stocks with government bonds given their fixed income nature.

Why is it so? What will it take for value to return?

We don’t have good answers on this. On fundamentals, none of the above names have changed to offer either more growth or less risk than a time ago (same for the broader market). Thus, explaining the grind down in yield has us resort to the vagaries of liquidity and sentiment. The rise of passive investing, smart beta ETFs (eg VHY.ASX), and super funds seemingly having more money than there are assets to invest in, has contributed to today’s picture. It begs the question: what is it going to take for conditions to return normal – i.e. a world not upside down? Or, more practically, how can investors find value in this environment?

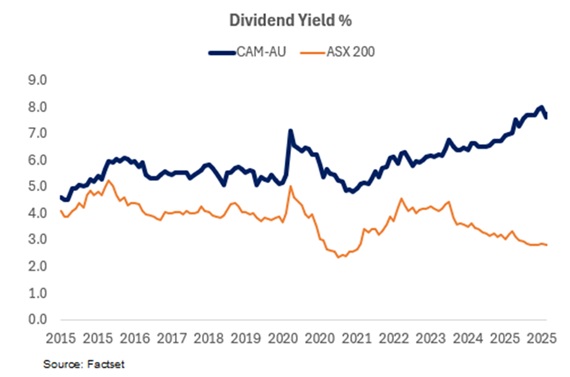

What should investors do? Is it time to buy a LIC?

The backdrop of higher bond yields and pausing policy rate cuts in Australia represents a challenge to ASX investors focused on yield. Not only has yield meaningfully declined, but it’s also not growing. It is self-evident that as demand for high yield ETFs and passive products has grown over time, return prospects have diminished. A well-known casualty of this trend has been reduced demand for listed investment companies (LICs), resulting in many trading at meaningful discounts to book value and yields well above the ASX. Clime’s own LIC, Clime Capital (CAM.ASX) is a prime example of this, trading at a 15% discount to NTA and yielding 7.7% with 50% franking.

Steve Lambeth is Portfolio Manager for Australian Equities at Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

For more articles and papers from Clime, click here.