Technology stocks surged at the start of 2020, with the main US technology barometer (US Nasdaq 100 index) rising 97% in the 12 months following Covid-19’s original lockdowns in mid-2020. Through late February and March 2021, however, most tech stocks sold off, with a leap in US 10-year bond yields from 1% to 1.75% over the two months. This sparked concerns about the value of the future earnings of leading technology companies.

Investors rotated out of ‘growth’ stocks like Tesla, Amazon and Google into ‘value’ sectors like financials, industrials and resources, on expectations of a rapid 2021 global growth recovery as Covid-19 vaccinations rolled out.

Technology's great run

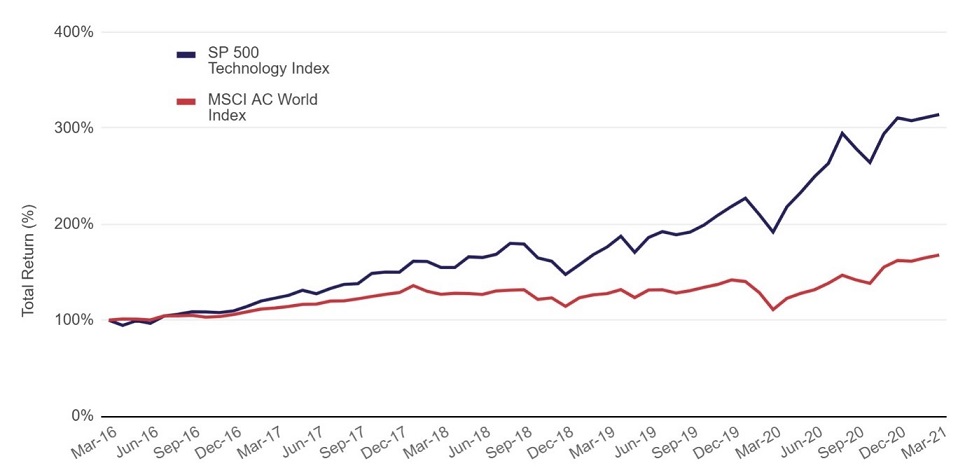

Most investors know technology has been the best-performing sector within global equity markets over the past five years, outperforming the broader MSCI All Country world index by an extraordinary 146% since March 2016.

SP 500 Technology Index v MSCI AC World Index Returns

However, a January 2021 survey of institutional investors undertaken by Deutsche Bank highlighted investor valuation fears, with 89% of investors stating that some financial markets are in bubble territory. Bitcoin was at the top of the list with a 10/10 bubble rating, while investors also felt Tesla would more likely fall 50% than double in 2021.

But rather than marking the end of this bull run for technology, we believe the recent sell-off is just a healthy market correction and is offering investors a great buying opportunity into technology leaders such as Amazon, Microsoft and Tesla that have strong long-term earnings growth.

There are five reasons we believe it would be a mistake for investors to panic and rotate out of technology stocks into traditional value stocks. In fact, the 'growth versus value' debate is the wrong focus as it deflects attention from the best long-term wealth creation opportunities and ultimately reduces the quality of the lifestyle of investors in retirement.

1. The fantastic fundamentals of tech will continue

The strong technology returns over the past few decades have been underpinned by strong fundamental factors. Consumers engage more with technology every day. Ten to 15 years ago, we were performing simple internet searches on Google, but now technology dominates our communication (social media), our consumer purchases, and is about to transform even the actual money we spend (digital currencies).

We believe those fundamentals will continue to accelerate over the long term.

Over the 2020s decade, six amazing technologies will mature and dramatically change our daily lives. These technologies are:

- 5G

- the Internet-of-Things (IoT)

- Autonomous vehicles

- Blockchain

- Biotechnology, and

- Digital Assets.

Each offers massive revenue opportunities over the next few decades.

With outstanding balance sheets and immense operating cash flow, today’s leading technology innovators are heavily investing across all of these promising technologies.

Over the next five to 10 years, this should generate strong returns for companies such as Amazon, Tesla, Alibaba, Google, Microsoft and Tencent, driving each of them towards a US$10 trillion market valuation, possibly as early as 2030. Our valuation (using a discounted-cash flow approach) work on these companies supports our view that the innovation remains significantly undervalued for patient investors.

2. Covid-19 will continue to accelerate tech adoption

The aggressive sell-off in financial markets during the first lockdown phase of Covid-19 initially occurred across all asset classes and sectors.

However, as we all turned to digital infrastructure networks to get the economy moving, technology stocks rapidly rebounded on expectations of rapid growth in revenues.

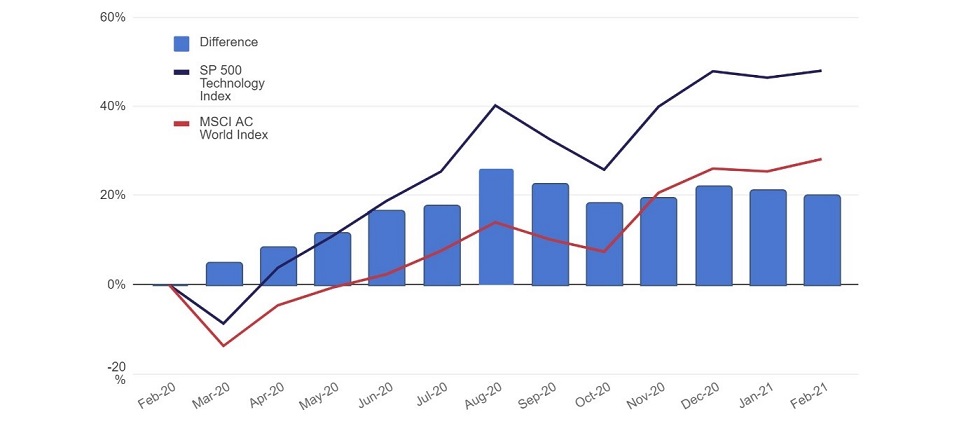

Strong inflows into growth stocks continued over the remainder of 2020, with the technology sector outperforming the broader market by over 20% (as seen in the chart).

Outperformance of SP 500 Technology Index over the MSCI AC World Index over past 12 months

We do not believe that the Covid-19 surge in both technology use and the share price of leading technology providers is over. We believe the six new technologies outlined previously will positively impact the way we travel, communicate, spend and access medical care over the next few decades.

3. The sector rotation to value is temporary

As Covid-19 vaccination programmes roll out across the world, the language from governments and central banks switched in Q4 2020 from individual income support (to cover the wage gap from job losses or reduced working hours) towards fiscal stimulus programmes targeting infrastructure that could generate quick growth and employment.

US President Biden’s proposed $2 trillion fiscal stimulus plan is an example. The economic plan is designed to drive higher revenue across the broader economy (commodities, retail, travel, industry).

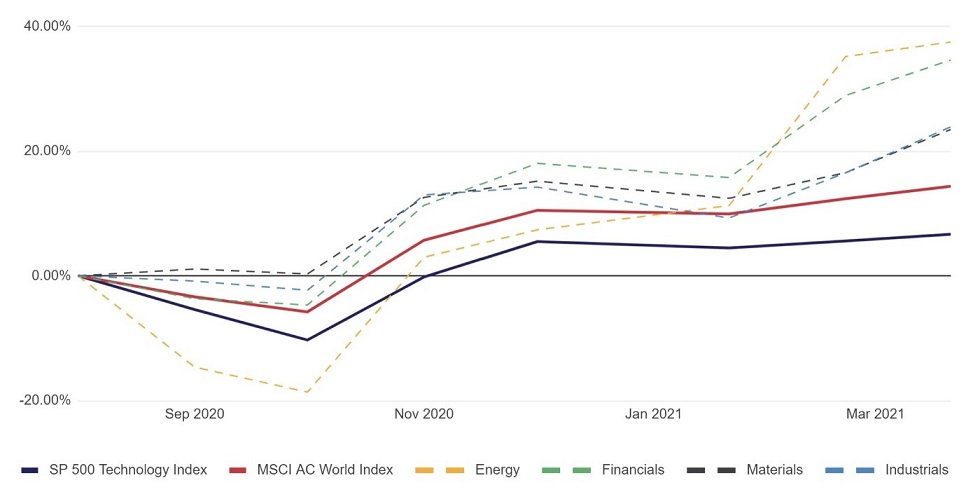

Starting in Q3 2020, investors began to rotate capital away from last year's winners (growth stocks) into sectors they believed were both undervalued and beneficiaries of the spending plans. As can be seen in the chart below, rotation towards other sectors including energy, financial services, materials (commodities) drove higher performance versus the technology sector since August 2020.

Performance of different SP 500 Index Sectors since August 2020

We believe technology companies’ recent share price underperformance is temporary, given our expectations of 25%+ revenue growth over the long-term. Traditional value stocks coming out of Covid-19 shutdowns almost uniformly have poor balance sheets (with high debts) and face rising competition from highly innovative technology innovators across most business sectors. A return of earnings uncertainty, common over most of the past decade, risks a sell-off back to deep-value levels.

4. Traditional asset allocation is challenged

Since the world stepped away from the Gold Standard in 1971, heavy central bank intervention and massive government debt has destroyed the value of fiat currencies. Add in the massive and continuing impact of Covid-19, and we now have to accept the fact that the global financial system is beyond repair.

Once we accept this, we must also accept that traditional asset allocation will almost certainly result in poor returns over the next decade. This is especially true for cash and bonds, both of which offer poor returns and possibly high risks if rising interest rates lead to corporate and possibly even government defaults.

That means growth stocks are even more important to hold across a portfolio. Rising inflationary pressures destroy long-term savings by reducing its purchasing power in the future.

5. Value stocks face structural decline

Traditional value-based investors are also likely to see far greater portions of their portfolios subject to structural decline candidates, especially if companies in their portfolios are going head-to-head with giant innovators like Amazon, Microsoft or Alibaba.

As a result, value stocks will likely remain cheap for a reason. Many must quickly innovate or die. Understanding and investing in accelerating innovation is likely to be the safest and best approach to deliver sufficient investment returns.

The retail sector stands out as a sector in severe structural decline, even before Covid-19 hit. What is most alarming is that online spending as a percentage of total retail sales increased from 12% to 16.3% in Australia over 2020 as a result of forced lockdowns. How many retail brands will be left standing when we hit 20%, 30% or 40%? Retail must urgently reinvent itself by balancing online and offline formats or die. The clock is ticking.

By contrast, technology stocks have immense structural tailwinds that we believe will accelerate as the six convergent technologies become mainstream over the next decade.

Money for traders but buyer beware over time

Bouts of outperformance in value stocks relative to technology may provide additional returns for traders, but low earnings confidence should lead to high volatility as traders lock in their trading profits. Value investing over the next decade will most likely become more difficult.

Investors embracing the ‘new model’ of accelerating change should be rewarded with higher portfolio returns that meet their retirement goals. Those who maintain or return to the old model and way of thinking run the risk of earning suboptimal returns and failing to meet retirement expectations.

Heath Behncke is Managing Director and a Portfolio Manager at Holon Global Investments. This article is for informational purposes only and is subject to change without notice. All securities and financial products or instruments transactions involve risks, and this article does not consider the circumstances of any investor.