APRA and ASIC’s review of the implementation of the retirement income covenant (RIC) had a clear message: super funds need to do better. The report found that “overall, there was a lack of progress and insufficient urgency from [funds] in embracing the retirement income covenant to improve members’ retirement outcomes.”

The regulators’ concern is understandable. While there were only a few months between the deadline for funds to publish their RIC strategies (June 2022) and interviews for the review, retirement has long been a high-profile area. Any superannuation industry conference or Board strategy day agenda will include retirement strategy as a key topic. The regulators have been pressing trustees towards action (albeit without ‘teeth’) for many years. And from a commercial perspective, funds are well aware of the hundreds of thousands of members, and billions of dollars, at stake for those who ‘win’ the retirement game, and the potential penalties for those who fall behind.

Barriers to progress

Many reasons for the slow progress have been well canvassed. For years, funds used the small share of overall fund assets in retirement as a reason for treading slowly. That rationale has disappeared, with the retirement phase share of APRA-regulated fund assets now at 26% and projected to reach 35% by 2032.

Funds believe they are constrained by law from providing more guidance or soft defaults for members in retirement. The Quality of Advice Review seeks to address these constraints, though the Government’s response could take years to be formulated and legislated.

And yet, there is progress being made, even if it is not as visible as the regulators would prefer. An example of this is the establishment by several leading funds of a ‘chief of retirement’ role, focused on developing the fund’s overall retirement strategy.

Such appointments are surely a powerful statement of a fund’s commitment to escalating its retirement thinking. In many cases, the role is at a senior executive level, sitting alongside other ‘heads of’ including investment, member experience, technology, ensuring that the incumbent has a seat at the table when key decisions are made, and resources allocated.

Beyond the ‘chief of retirement’ appointment, however, a deeper question emerges: how does the fund organise its people and resources to develop and implement effective retirement solutions? Which functions within the organisation – often long established – fall under the retirement ‘segment’, and which are better designated as ‘whole of fund’ functions? How do existing member touchpoints and service propositions need to evolve to meet the retirement challenge? In short – what does ‘retirement’ mean, in an organisational sense?

A changing landscape

Even as recently as 15 years ago, funds were much simpler organisations. The predominantly outsourced resourcing model that had existed for decades was still largely intact. Growth, fund mergers and internalisation have led to the mega-funds of today, with hundreds of employees and assets in the hundreds of billions.

As fund organisations have grown, the various business functions (such as investment, operations, technology, member servicing, advice) have become more clearly delineated, with the potential for siloing and even cultural differences between these different functions emerging. Despite these inevitable frictions, the more separate operation of these functions has allowed for a clearer purpose and greater accountability for each at a senior level.

Within this framework, the natural home for the ‘retirement’ segment is not obvious. It does not sit neatly within, or on top of, any of the existing functions. Retirement is a ‘whole of enterprise’ initiative requiring input from virtually all the existing business functions, together with new thinking and resources. How to organise these parts into a successful retirement ‘segment’ is therefore complex, requiring a reimagination of a fund’s current retirement proposition. This task remains a work in progress in most funds.

Retirement segment models

Let’s consider two potential models that could be used to organise the retirement segment:

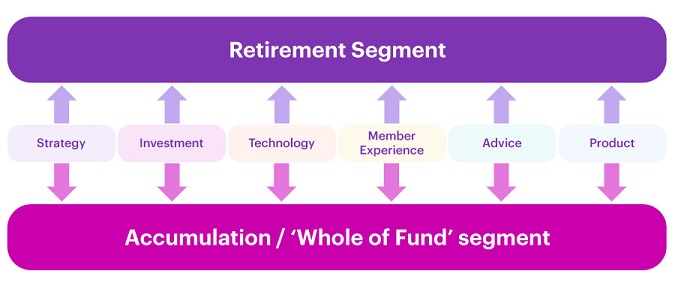

- ‘Shared functions’ model – where the various business functions remain ‘independent’ and service the retirement segment as needed, while also retaining their existing role in servicing the fund’s operations (including both operations attributable to the ‘accumulation phase’, and operations which relate to the fund as a whole).

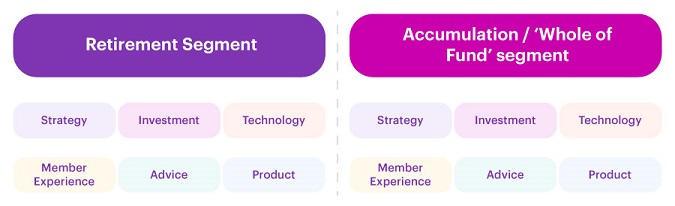

- ‘Dedicated functions’ model – where business functions are established under each segment (retirement or accumulation/whole of fund) as required, with the focus of the service dedicated to that particular segment of the business.

These are depicted (in simplified format) below.

‘Shared functions’ model*

‘Dedicated functions’ model*

* The business functions shown are illustrative and are not intended to be comprehensive, or representative of any particular fund

Each model has its strengths and weaknesses – for example, a ‘shared functions’ model allows the new retirement segment to remain lean and focused, minimising organisational complexity while drawing on functional resources only as needed. On the other hand, getting the required level of focus and priority from those resources may be a challenge.

Conversely, the ‘dedicated functions’ model enables the development of functions specialising in retirement. A retirement investment function, for example, could explore those aspects of investing specifically relevant to the retirement phase and how the investment component of any retirement solution would be designed. A downside of this model, however, is the more complex organisational structure and the scope for costly duplication of resources.

There is no single ‘right’ model. A fund’s existing resources and structure may well point to a more sensible approach to be taken, at least in the medium term.

In future, it is even possible that the retirement segment of large funds will become separate entities, focusing on managing money safely, getting closer to their members and continually developing innovative solutions for delivering retirement incomes. Accumulation phase entities would remain focused on scale and investing assets for long term growth.

While such a model might be decades away (if it emerges at all), it is an interesting one to consider as the industry matures, and retirement phase assets become more dominant. Meanwhile, funds will need to reimagine their existing structures, and formulate an operating model that allows them to accelerate the development and implementation of their retirement strategies as the pressure from regulators, and competitors, continues to grow.

Nick Callil is Head of Retirement Solutions, Australia at WTW. This article contains general information only and does not take into account your particular objectives, financial circumstances or needs.