In the final stage of a bull market, equities shift up the risk scale as the emergence of a bear market starts to send alarms bells ringing. The problem is not everyone is listening.

In fact, typically there is a burst of euphoria from investors before the bull market ends. Holding a large and perhaps poorly-constructed share portfolio when the music stops can be costly.

The previous bull market ended in October 2007 with the onset of the global financial crisis. Over the next 16 months the US market barometer, the S&P/ASX200 index, fell 54%.

So where are we now? There is widespread agreement we are currently in the final stage of a bull market. At Citi we believe the current cycle will continue through 2020 but come to a close in 2021, although there are certain risks that, if inflamed, could bring about a bear market sooner. A good example of these risks is an escalation of ‘trade wars’.

What does the end of a bull market look like?

The shift to a bear market is precipitated by a plunge in market indices. By definition a bear market requires a minimum 20% fall in key indices over a two month period.

As we approach a bear market, but before the downward slide commences, markets tend to act in defined ways. We generally see a large flow of capital into equities, brisk merger and acquisition activity and heightened Initial Public Offering (IPO) activity. None of those measures are currently present and net new money into shares has been absent for the past two years.

The reason we haven’t seen these steps this time is likely the high level of volatility that has accompanied the bull market. With a heightened sense of risk in the broader market, a lot of the money that would typically flow into equities has gone into fixed Interest. Citi’s Global Head of Equities, Rob Buckland, recently described current market conditions as “a miserable bull market”.

What are the signals?

But that does not mean the euphoric burst is not coming, and the sharemarket is currently back around historic highs.

On the positive side of the ledger we have the major central banks doing what is necessary to stabilise economic growth and employment. Interest rates in most key markets have been falling and central bank chiefs have talked about alternative methods of support should it be required.

That could include things like quantitative easing and actions to reduce the cost of funding for banks so they in turn can provide loans to boost business and consumer activity.

Another positive is that the yield curve has also reverted to normal. In normal conditions you expect to receive a higher return the longer the duration of the bond, because you are taking on more risk from events that could occur in the future and impact your investment. The inversion meant investors were concerned about near term issues, principally trade wars.

Due to a yet-to-be-ratified agreement between the US and China on how to move forward on trade issues, there is improved sentiment that a solution will be found. There is also less concern over how Brexit will be resolved.

If the lowering of risk continues, it will likely see more funds flow into equites. We are already seeing a shift from defensive stocks into cyclical companies, and that’s an important signal.

Defensive stocks offer a buffer against an economic downturn, perhaps because its product is essential, like healthcare, or constantly in demand, like groceries. They also tend to have stable dividend payouts and examples of defensive stocks include Woolworths, Telstra, Wesfarmers, Coca-Cola Amatil and Cochlear.

Cyclical stocks are more attuned to cyclical spending and perform better in times of economic growth. Examples include Crown Resorts, Amcor, Harvey Norman and BHP.

If money continues to flow into cyclical stocks, it’s like a clarion call to beware. The shift to cyclicals should be based on improved economic conditions but it is coming from a perceived lowering of impediments to growth, like trade wars.

In fact, economic conditions are worsening, with recent US retail data casting doubt on the strength of household consumption. China and Europe have also reported disappointing growth and in October the International Monetary Fund lowered global growth forecasts.

Locally the S&P/ASX200 is up 24% since the start of the year and as risk lowers it means fund managers will have to follow the market higher as their investors will expect to see the benefit of those rises. It means prices can go higher but not for the right reasons - it’s like a dog chasing its tail.

How do I resist rising share prices?

As the scenario above plays out we can expect to see equity markets climb to a strong finish this year and a positive start to next year.

The tremor will begin if corporate profits fail to show improvement despite rising share prices. It will start a slide that signals the onset of a bear market and it is the point where many people become trapped and have to ride out the bear market to avoid crystallising losses. At Citi we expect it to occur in 2021.

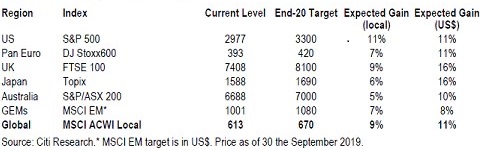

Citi’s house view is for a further 9% gain in global equities to the end of 2020. For the S&P/ASX200 we expect a further gain of 6% over the same period. The table below gives a broader outline of our market forecasts.

Citi Strategists' Index Targets

An alternative path

Predictions are all well and good but events happen that can change them. Here and now, direct share ownership is getting risker and as time progresses it will increase.

When the downturn comes, we expect growth to slow to about 1% and it will feel like a recession, even if it doesn’t hit the technical definition of two quarters of negative growth.

The message is to balance your portfolio with high quality corporate bonds and equities. You may also consider structured investments that allow investors to profit in a rising, flat or moderately declining market.

It’s also good to consider offshore diversification to give exposure to areas like pharmaceuticals, technology and digital. It may also open a pathway into foreign exchange opportunities to further enhance your portfolio, though of course FX implications should be considered.

Peter Moussa is an Investment Specialist - High Net Worth at Citi Wealth Management. This article is general information and does not consider the circumstances of any investor.

Citi is a sponsor of Firstlinks. For more Citi articles and papers, please click here.