In basic terms, commodities are goods that are either grown, or dug out of the ground. They are often used as inputs in the production of other goods.

Commodities are broadly categorised as hard or soft:

- Hard commodities are natural resources that are mined or extracted, such as gold, copper and oil.

- Soft commodities are things that must be grown and tended to during production. They include agricultural commodities such as wheat, sugar and cotton, and livestock.

Why invest in commodities?

Commodities are one of the building blocks of a balanced portfolio. Two reasons to include commodities in your portfolio include:

1. Low correlation with other asset classes

Most investors are familiar with the idea of gold as a ‘safe haven’ in times of uncertainty or crisis. Commodities more broadly can bring potential diversification benefits to a portfolio, as their performance historically shows a low correlation with other major asset classes such as equities, fixed income and cash.

The table below shows correlations with other assets since 2000, as represented by:

- the S&P GSCI Light Energy Index (commodities)

- the S&P 500 Index (U.S. equities), and

- the Bloomberg Barclays Global Aggregate Unhedged USD (bonds).

The S&P GSCI Light Energy Index includes commodities from all commodity sectors (energy products, industrial metals, agricultural products, livestock products and precious metals).

Commodities/U.S. equities/global bonds correlations, 2000 - 2019

Source: Bloomberg. Past performance is not an indicator of future performance.

2. Benefit from demographic trends

Ongoing demand for commodities is supported by rising populations and demographic trends.

Infrastructure programmes in emerging economies, for example, support demand for materials such as iron ore, used to make steel, and other materials.

The demand for agricultural products is supported not just by rising populations but also by increasing living standards. The composition of food demand changes, and, increased demand for protein rich diets such as meat and dairy means more grain is required to feed livestock.

With a growing global emphasis on renewable energy, agricultural resources are also in demand for the production of bio-fuels.

How to gain commodities exposure

There are essentially four ways to invest in commodities:

1. Investing directly

Investing in commodities directly tends to be impractical and costly. Few investors want to take delivery of tonnes of wheat or barrels of oil!

An exception might be precious metals such as gold, which can be held in the form of gold bullion. However, while a few gold bars take up little space, there are insurance and storage costs, and often high minimum investment levels.

2. Investing in commodities futures

Traded on exchanges around the world, commodities futures are standardised contracts to buy or sell the underlying commodity at a specified date in the future. They are used by hedgers and speculators.

Investing in commodity futures is not the same as investing in the ‘spot’ (current market) price of the commodity. While spot and future prices are strongly correlated, factors including expected future supply and demand, interest rates, and storage and insurance costs mean they are unlikely to be exactly the same.

Investing in commodity futures has its drawbacks. A futures trading account is needed, futures typically have large contract sizes, there are administrative demands around margining, and not least, buying and selling futures involves open-ended risk.

3. Investing in companies that produce commodities

Another option is to invest in commodity-producing companies. While such companies may be rewarding investments, this is the least ‘pure’ commodity exposure on the list. There are many factors that affect the return on an investment in a commodity producer, over and above movements in the price of the commodity itself.

One option for investors who are interested in producers is an Exchange Traded Fund that holds a diversified portfolio of companies involved in the production of commodities. While the exposure is still not a ‘pure’ commodity exposure, it means that single-stock risk is reduced.

An example of this type of fund is BetaShares’ Global Agriculture ETF – Currency Hedged (ASX:FOOD) which provides exposure to the largest global agriculture companies (ex-Australia), hedged into Australian dollars.

4. Investing in commodity ETFs

ETFs provide a convenient, cost-effective way of gaining exposure to commodities. There are several things to consider before investing in a commodity ETF, including:

- Do you want exposure to a single commodity, or to a basket?

- How does the ETF create exposure to the underlying commodity?

- Is the exposure currency-hedged?

Single commodity exposure versus basket

Some ETFs provide exposure to a single commodity, such as gold or oil. Others provide exposure to a basket focused on a particular type of commodity, such as precious metals or agricultural commodities, or a more broadly diversified basket.

For example, BetaShares’ Agriculture ETF – Currency Hedged (synthetic) (ASX:QAG) provides exposure to a basket of the four most significant agricultural commodities (corn, wheat, soybeans and sugar).

How is exposure achieved?

Relatively few ETFs gain their exposure by holding the physical commodity itself. Among the few exceptions to this rule are ETFs that provide exposure to precious metals, such as our Gold Bullion ETF – Currency Hedged (ASX:QAU), which is backed by bars of gold held in a vault in London.

Most commodity ETFs, however, do not directly track the price of the commodity. Instead they aim to track an index based on futures contracts over the commodity.

While commodity spot and futures prices are highly correlated, you should not expect an ETF based on commodity futures to provide an identical return to holding the physical commodity itself.

As futures contracts mature, the futures position must be ‘rolled’ into a contract with a later maturity. The continual process of rolling means that the return from a synthetic ETF is based not just on movements in the price of the commodity, but also on the 'roll return'.

With an ETF based on commodity futures, BetaShares invests the fund’s assets into cash, which is held by a custodian, and enters a swap agreement to receive the performance of the relevant index. ETFs that use this type of structure are labelled ‘synthetic’.

We are asked sometimes whether the synthetic structure means increased risk. It is true that a synthetic ETF has a level of ‘counterparty risk’ to the issuer of the swap but this should be kept in context. BetaShares imposes a ‘zero exposure threshold’ on counterparty exposure. This means that we revalue the swap agreement on a daily basis, and require that where the counterparty owes funds to the ETF above a certain threshold, payment is made promptly to reduce the exposure to zero. In any event, the ASX’s rules require that counterparty exposure be managed so it does not exceed 10% of a synthetic ETF’s net asset value.

We also apply strict criteria in selecting our counterparty. Our counterparty is Credit Suisse International, part of one of the world’s largest financial institutions.

Check the currency hedging

Commodities are traded in USD. If your exposure is not currency-hedged, you are exposed to the risk of unfavourable movements in the AUD/USD exchange rate, which can have a significant impact on performance.

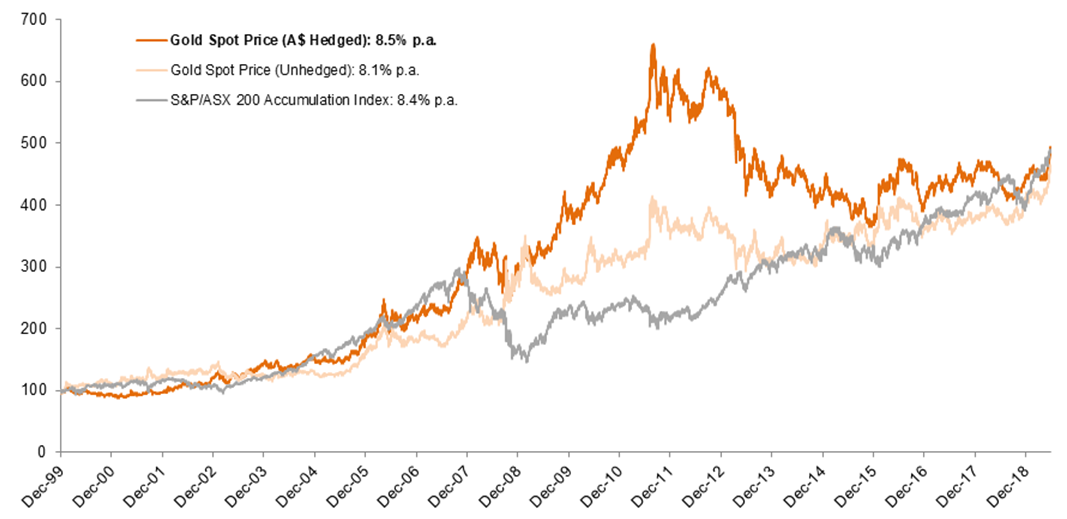

The following chart shows the difference in performance between gold in AUD terms and USD terms.

Gold Bullion spot price performance Hedged vs. Unhedged: December 1999 – June 2019

Source: Bloomberg. Past performance is not an indicator of future performance.

BetaShares currency hedges all its commodity ETFs, meaning that performance is determined by price movements in the commodity (or commodity futures) and not distorted by exchange rate movements.

David Bassanese is Chief Economist at BetaShares, a sponsor of Cuffelinks. This article is for general information purposes only and does not consider the investment circumstances or needs of any individual.

More detail on each of the ETFs mentioned in this article can be found here.

For more articles and papers from BetaShares, please click here.