A Labor Party win at the next Federal election may change the dividend imputation system with potentially significant impacts on self-funded retirees. Fears that the abolition of excess franking credit refunds will cause a substantial disruption to the hybrid market are unlikely. However, as with any change there is always potential for winners and losers, and with that comes opportunity.

A long way to go in its current form

There are a number of events required prior to this policy becoming legislated, including:

- The Labor Party would have to win government at the next Federal election

- The policy would have to withstand changes to water down its impact

- The legislation would need to pass in both the House of Representatives and the Senate.

There are doubts about all three to varying degrees and the probability of all three occurring appears relatively low. The second and third points are somewhat related. The proposal as currently structured is unlikely to receive support in the Senate. Changes may be required to ensure low-income earners are protected, such as introducing a cap on claims. If the policy is watered down, the proposal may continue to struggle unless the Labor Party has a majority in the Senate.

Likely to lead to a buying opportunity

Even if legislation is enacted as initially communicated, it is unlikely to be a death knell for the hybrid market. While SMSFs and self-funded retirees account for a substantial part of the hybrid market, they aren’t the only investors who can utilise the franking credits. In the retail space, for example, SMSFs in accumulation phase and self-funded retirees with other taxable income will continue to gain the full benefits of fully franked hybrids. The market also includes institutional buyers.

That’s not to say there won’t be some dislocation. There is likely to be a sell-off of hybrids as investors who can’t utilise the franking credits transfer them to those who can. Also, given the pool of potential fully franked hybrid investors will diminish, there may be an increase in margins attached to new hybrids. For those who can use the franking credits, that is good news. The increase in margins, however, is likely to be moderate creating a relatively minor impediment for hybrid issuers rather than a permanent roadblock.

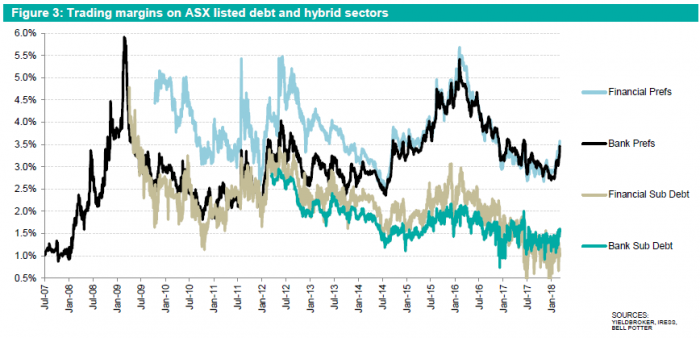

The proposed changes have already impacted the hybrid market, with bank and insurance securities experiencing a sell-off and adding to the widening trend that commenced in February. The following chart from Bell Potter shows that trading margins on the most common major bank hybrids (the black line) have increased from around +275bps to +350bps since early February 2018, a material move. We believe there may be some further weakness in the near term but ultimately this will be seen as a buying opportunity.

Click to enlarge. Source: Bell Potter Fixed Interest Weekly 16 March 2018

Notwithstanding that the impact on the more recent Basel III hybrids is likely to be less than the market is anticipating, our preferred hybrids remain the pre-GFC/legacy perpetual income style securities such as those listed on the ASX under codes NABHA (National Australia Bank) and MBLHB (Macquarie Bank). We believe that there is a high probability that there will be a buy-back and/or redemption of these securities in the next few years with either option resulting is substantial capital gains from current levels.

More detail on NABHA

The National Income Securities (ASX:NABHA) are a legacy Tier 1 hybrid that was issued in 1999. We believe NAB will look to replace the NABHAs with a Basel III compliant hybrid (i.e. Additional Tier 1 security such as the NABPDs) when the NABHA’s become inefficient capital between 2020 and 2022 and that investors will be able to exit at $100.

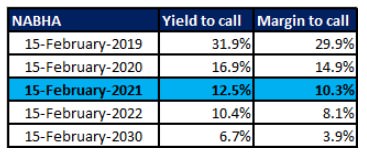

Based on a current price of $78.55 (at the time of writing), this equates to the following yields to call depending on the timing of the potential exit:

Our base case is that this will likely happen on the first coupon payment date in 2021 (i.e. 15 February 2021 – highlighted in blue) which would equate to yield to call of 12.5% (or a trading margin of +10.3% over swap). Further, NABHAs are set to benefit from any recycling out of traditional hybrids that may be impacted by the ALP’s proposed franking changes given that NABHAs do not have any franking credits attached but rather pay the entire coupon in cash.

We believe that although the documented maturity is ‘perpetual’, NAB will retire the NABHAs before 2022 for three key reasons:

- Capital/regulatory treatment – these legacy securities will no longer count towards capital ratios from 1 January 2022

- Replacement cost – NAB can replace the NABHAs with cheaper and/or more capital effective securities

- Precedent - the recent buybacks of the NAB USD Libor+15bps (i.e. very cheap) legacy Upper Tier 2 capital security.

Of course, much can happen between now and 2022 and investors must make their own enquiries and judgement, and the Labor Party policy has added an element of uncertainty to the outlook for hybrids.

Brad Newcombe is a High Yield Analyst, Fixed Income at Mint Partners Australia. Individuals should make investment decisions based on a comprehensive understanding of their own financial position and in consultation with their own financial advisors.