The Labor Party has announced that if elected, it will end cash refunds of imputation credits on dividends paid by Australian companies. It would reduce cash returns to Australian shareholders by about 25%, and it would reduce total returns (including capital gains and income) by about 1% per year. The change would have significant impact on taxpayers paying little or no tax, especially retirees in pension phase.

Cash returns from the overall Australian stock market are currently running at around 5.7% including 1.5% in franking credits. Without the franking credits, the cash income from a broad portfolio would be reduced to the unfranked 4.2% dividend yield, which is a drop of around 25% in the cash yield on the portfolio.

There would be no direct impact on foreign shareholders as they are not entitled to franking credits or cash refunds unless they have other Australian tax payable.

Background

Dividend imputation was introduced by the Hawke/Keating Government from July 1987 starting from the 1987-1988 tax year. Before 1987 company profits in Australia were taxed twice – first as company tax on the profits in the hands of the company, and then if the company paid out its profits as dividends to Australian shareholders, it was taxed again in the hands of shareholders.

Dividend imputation (‘franking’) credits meant tax already paid as company tax were available to Australian shareholders to offset other tax payable on other income. Cash refunds of excess franking credits were introduced by the Howard/Costello Government from the 2000-2001 year.

Impact of franking on returns to Australian shareholders

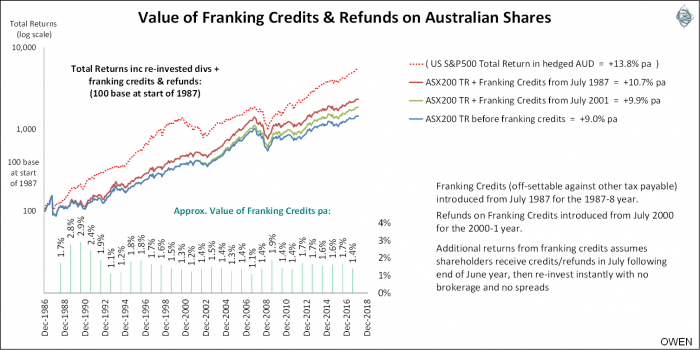

The net impact on investment returns experienced by Australian shareholders in Australian listed companies has been significant. For taxpayers who had enough other income to use the franking credits fully from 1988, the franking credits have added an average of 1.7% per year to their total returns from the broad Australian stock market (S&P/ASX200 index).

Click to enlarge

The net benefit of franking credits has remained more or less constant over the period. The company tax rate has reduced from 39% to 30%, but the dividend payout rates across the market have risen from 60% to near 80%. On the chart I have added the total returns from the broad US market (S&P500 index) in hedged Australian dollars to remind investors that even including full re-investment of franking credits since 1988, the Australian market still lags the US market (in Australian dollar terms) by more than 3% per year.

If franking credit refunds are removed, it may lessen the myopic ‘home bias’ that many Australians suffer from and encourage them to increase their interest in other opportunities in global markets.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.