Investment returns can be roughly broken down into the sum of two components: growth and yield. When a business generates cash flow, it can be reinvested to produce future growth, paid out to shareholders, used to pay down debt, or some combination of the three.

The growth component can be extremely valuable if management allocates capital sensibly on behalf of shareholders. The downside is that future growth is inherently unpredictable and therefore difficult to value. The yield component, the hard cash in hand today, is more predictable and easier to measure relative to the price you pay for it (e.g. dividend or free cash flow yield). The disadvantage with yield is that shareholders need to be able to reinvest the cash wisely.

In ‘normal’ market environments, we tend to find mispriced investments across the spectrum—from businesses that reinvest close to 100% of their cash flow in an effort to grow, to those that have lower growth opportunities and therefore release more profits. Yet the current environment is somewhat unusual in that we have found more opportunities toward companies in the latter camp—those with high yields on excess cash, or more simply higher dividend yields.

High yield stocks appear to be attractive

We do not control the investment environment; we are price takers. We seek to own mispriced equities, and we are not dogmatic in our search for them. Terms like ‘growth’, ‘value’, or ‘quality’ are all just different fundamental characteristics that can be more or less attractive at a given price.

That said, we do find today’s environment to be both fruitful for stock selection and perhaps even comforting in the sense that it comes with a relatively high degree of certainty, to the extent such a thing exists in investing.

Firstly, if a company is able to pay a high dividend that is well-covered by its free cash flow generation and able to keep pace with inflation over the long term, an investor doesn’t need to do much forecasting in order to earn an attractive return.

Shares that offer well-covered 5-7% real dividend yields are not typically common, but we have found more than a few of them in today’s environment. To put this in perspective, international equities have returned just over 6% per annum (in US dollars) since 1990, a return stream that has been accompanied by considerably greater risk and uncertainty.

Secondly, there has historically been a strong tailwind behind shares of businesses with above average dividend yields. If you invested $100 in an equal-weighted basket of international stocks in 1990, you’d have about $700 today. But if you only invested in the half of shares with the highest dividend yields, you’d have about $1,800! A bird in the hand has been someway better than two in the bush, and this has been especially true following periods in which ‘yield’ was on sale, as is the case today.

Emerging markets offer selected opportunities

Whilst we have found yield opportunities across the globe, a few of our emerging market (EM) equities are worthy of discussion. Somewhat akin to the ‘AI’ moniker today, ‘BRIC’ economies (Brazil, Russia, India, China) were the darlings of the 2000s. The narrative turned out to be absolutely correct—economic growth rates were indeed impressive—but the rampant influx of capital from growth-hungry investors pushed BRIC valuations to extremes and set the stage for disappointing longer-term returns. Exciting narratives and satisfying investment results tend not to be happy bedfellows. Growth is fabulous only if you pay the right price for it.

Fast forward to today, and we would argue that the longer-term growth story in much of the developing world has not meaningfully changed. Countries like Indonesia have growing populations, growing productivity, and plenty of room for further development over the next few decades. Yet investor sentiment and capital flows have changed substantially. EM equities are now characterised by depressed valuation multiples and little interest from the large pools of global investment capital.

Investor apathy has a profound impact not only on the valuation multiples applied to EM equities, but also on the fundamentals of the businesses themselves. When valuations are low, it can be a signal to management teams that it’s time to pay ample excess cash back to shareholders rather than reinvest aggressively in future growth. In EMs, one can still find a constructive blend of low valuations, high cash yields, and modest amounts of capital investing behind potentially solid and enduring growth opportunities. This is often a great setup for robust future investment returns.

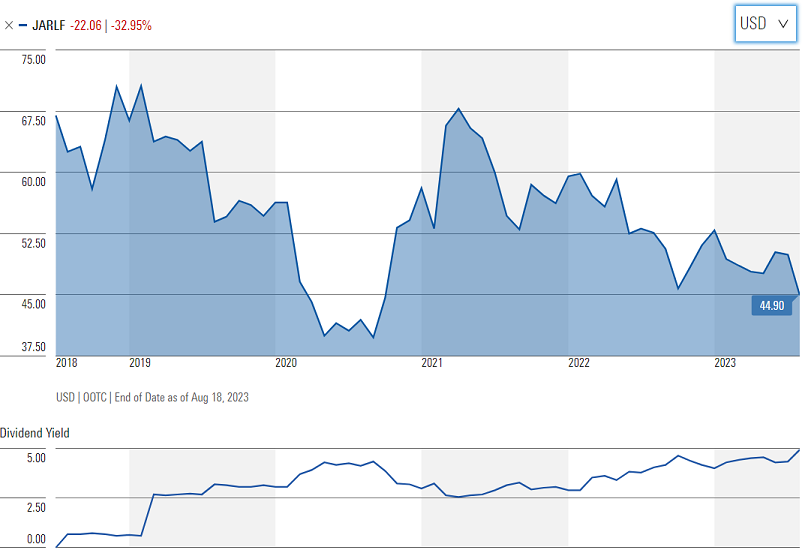

A good illustration is Jardine Matheson (JM), a Hong Kong-based industrial conglomerate with holdings across Asia in property, autos, retail, finance, construction, restaurants, transport, hotels, and industrial equipment. Given JM’s footprint in the region, the business carries substantial and diversified exposure to the continued growth and development of emerging Asia.

Jardine Matheson Holdings Ltd

Source: Morningstar.com, as of Aug 18, 2023.

Like many Asian businesses, the company has struggled to grow over the last decade in part due to the hangover after the 2000s boom. Yet given the quality of its underlying assets, JM has still managed to grow dividends per share at a mid-single digit rate. We believe this growth rate should at least be maintained, but most likely move higher going forward, assuming prudent capital allocation by management and continued recovery in some of its underlying markets. In addition to this growth, investors are paid a 4% dividend yield, and the shares trade at an approximately 40% discount to the underlying market value of its assets. The result is a solid and reasonable base case return with potential upside.

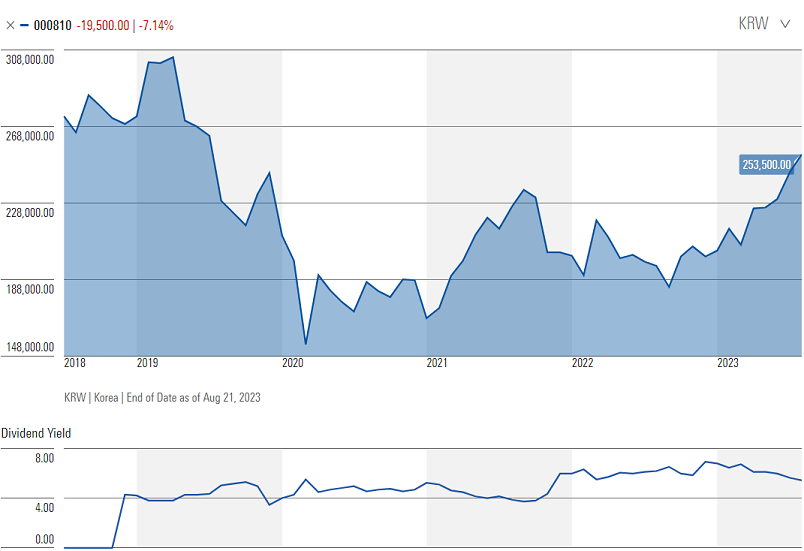

In South Korea, Samsung Fire & Marine Insurance (SF&M) provides another example of the possible value on offer in EMs. The company is South Korea’s leading auto, property and casualty, and health insurer, but it owns a stake in Samsung Electronics that accounts for a large part of its market value. To put this in perspective, this valuation implies that its core insurance business is worth roughly the same as its #2 competitor, DB Insurance (DB), despite SF&M’s superior profitability, higher underwriting quality, and more conservative accounting practices. Furthermore, SF&M’s dividend has grown fourfold over the last decade, and now yields around 6%. Like most insurers globally, SF&M is starting to benefit from both a ‘harder’ market (i.e. the ability to charge higher premiums) and from higher reinvestment income as bond yields rise.

Samsung Fire & Marine Insurance Co Ltd

Source: Morningstar.com, as of Aug 21, 2023.

Besides generous dividend yields, a common theme uniting the examples discussed above might simply be that these companies are heavily out of favour. You’re unlikely to hear much about Asian industrial conglomerates or South Korean insurance policies at a cocktail party. For value-oriented investors, that’s usually an exciting setup.

Shane Woldendorp, Investment Specialist, Orbis Investments, a sponsor of Firstlinks. This article contains general information at a point in time and not personal financial or investment advice. It should not be used as a guide to invest or trade and does not take into account the specific investment objectives or financial situation of any particular person. The Orbis Funds may take a different view depending on facts and circumstances. For more articles and papers from Orbis, please click here.