This might come as a shock to some, but there is a serious question whether a defined contribution (DC) system like Australia's is fit for purpose in retirement. That was the fundamental conclusion that motivated the Financial System Inquiry (FSI) recommendation for Comprehensive Income Products for Retirement (CIPRs). The FSI realised that a ‘pre-selected’ combination of products would simplify decisions at retirement and, most importantly, deliver better outcomes for retirees. The FSI envisaged a regular and stable income stream, longevity risk management and flexibility (among other features). The FSI even suggested that the design should consider the possibility of cognitive impairment at older ages. In aggregate, the FSI pointed to a lot of things super is not doing for current day retirees.

1. Fit for purpose question

This is an inconvenient truth, but even Paul Keating conceded some years ago that the super system was not designed for people who were going to live over the age of 80. The system he conceived was for the 55- to 75-year-olds. People are now typically living into their late 80s, more than nine years longer than they did in the 1990s. We need to enhance the model, which is what the MyRetirement reforms are asking us to do.

In the DC model, there is no structure to the drawdown phase. Flexibility is prioritised at the expense of risk management and income certainty and sustainability. This is the source of our current ‘growing pains’. We are trying to bolt a more DB-like solution onto our DC system, while maintaining choice and flexibility.

We are also shifting from the world of merely supplementing the Age Pension to a world of substituting or supplementing it.

2. Spending is different from saving

When a member of a super fund retires, the ‘financial dynamics’ of their long savings program are reversed. Instead of their employer making regular SG contributions on their behalf and their fund being a large scale ‘wholesale’ investor, the retired member becomes a ‘retail’ customer, but also a spender, rather than a saver. For the first time, there is a direct financial lifeline from the fund to the member. The fund becomes the source of the retired member’s retirement pay cheque. This is a fundamentally different business from accumulating savings.

And yet, in Australia, we seem to have one way of thinking about, talking about, and measuring, the success of superannuation, and it has little to do with providing regular, spendable cash flows in retirement.

3. Retirement income products

This quickly leads to a discussion of retirement income products. Products are undoubtedly important because they ultimately deliver the outcomes retirees are looking for when it comes to their financial security in retirement.

But, products are downstream from some even more important considerations in getting the right financial outcomes for retirees:

a) Retirement income philosophy

A super fund needs a retirement income philosophy. You will not be surprised to hear that I don’t think this amounts to ‘being great investors’. The return of a member’s money in the form of regular income and better managing their risks in retirement is not the same as the time-weighted returns achieved by the fund as whole.

Not all things can be addressed by asset allocation. Fund trustees should have a clear view of where they sit on the spectrum between entirely probability-based outcomes and a risk-free retirement: one backed entirely by the age pension and Commonwealth government bonds, for example. Once they have worked out this philosophy, they can work on the delivery.

Let’s use an aircraft analogy that I must attribute to UK pensions academic and expert, Professor David Blake. When an aircraft takes off, it has a very specific flight path to its destination and constantly risk manages its ability to reach it using navigational waypoints and myriad other technologies. The crew constantly check fuel and other variables. If you think about the MyRetirement reforms, they are aimed at more retirees having a smoother flight; consuming their retirement savings more evenly over the course of their retirement.

b) Trustee director duties

Most activities or outcomes that call for improvement in superannuation are connected to governance. It’s extraordinary to think that the Superannuation Industry (Supervision) Act 1993 Cth (SIS Act) is silent when it comes to trustee director duties in favour of retired members.

The relevant part of the SIS Act which itemises trustee director duties (s52) is cast in an accumulation paradigm, referring to ‘investment options’ (among other things). It makes no mention of ‘retirement income’ or the issues to which the MyRetirement reforms are directed. The trustees should be required to consider things like the pooling of longevity risk, protection from market risk and inflation, the sustainability of the income and even how the income needs of retirees with cognitive decline could be met more effectively.

c) Supervision and accountability

With such duties clearly spelt out in the SIS Act, APRA would then have a clear mandate and some signposts for building out a retirement income prudential standard. A close analogy would be the way APRA consulted with the industry in 2012/13 when it released a draft of, and then finalised, SPS 250 on insurance in super.

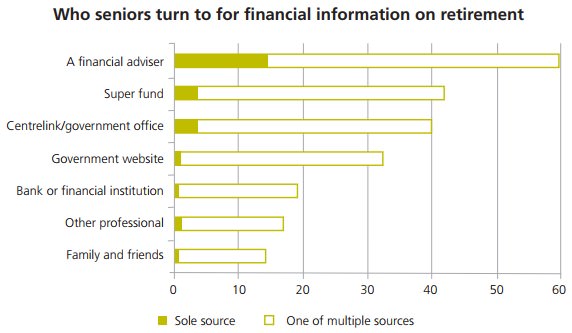

d) Seniors rely on financial advisers

National Seniors Australia (NSA) and Challenger recently released a research report on the behaviour and attitudes of senior Australians regarding their retirement finances. The report shows that six out of ten Australian seniors are turning to financial advisers for advice and information about retirement finances. This proportion is significantly higher than for superannuation member population overall, where only one in five seek advice.

The most common sources of advice and financial information about retirement are: financial advisers (59%); super funds (42%); and, Centrelink and government offices (40%). Contrary to widespread belief, family and friends are not highly rated as a source of financial information at only 14%, as shown below.

4. Measuring success in the retirement phase

The predominant goal of super is to create a retirement pay cheque; a regular flow of income to live on in retirement. In practice, consumption or spending happens at a household level. This is another big challenge: we save up super individually because it’s employment-based, but most of us spend it jointly in retirement. Sharing a roof is the most basic element of shared consumption of retirees. In the 2016 Census, 69% of people aged 60-64 were married or partnered and less than 20% were living alone. Where possible, all participants in the retirement income system need to be more accustomed to distinguishing between the solo retirement and the pooled retirement. They are very different experiences and need different treatment.

One of the problems facing the industry is determining measures of success, at the fund level, in providing income in retirement.

Measuring success in accumulation is relatively straightforward. It revolves around performance league tables. It is having a strategy with the highest net after-tax, risk adjusted returns over say a rolling 7 to 10-year period or longer. The trouble is that the sort of portfolios that are producing these returns are all built on ideas related to modern portfolio theory (MPT). The problem is that MPT doesn’t work in retirement. It doesn’t factor in the cash flows in retirement and effectively assumes an endless investment horizon. Most retirees will need to consume some or all of their savings along the way.

There are numerous other challenges in retirement: sequencing risk, inflation, longevity risk, drawdown rate and the bequest motive to name some. These factors all need to be managed to deliver a stream of retirement income for the retired member to live on. A higher accumulated balance alone will not guarantee success.

We therefore need new measures of success in retirement so that funds can better manage towards them. This needs a balanced scorecard approach, based around something like these key parameters:

- The probability of meeting the cash flows needed to support the retiree’s desired spending. This would need:

a) an ex ante measure, an actuarially-based assessment of the payments that can likely be made; and

b) an ex post measure to look at payments made through a person’s retirement;

- An estimate of the expected estate balance (where zero is the optimal outcome for any unintended bequest);

- Member satisfaction with the level of liquidity (e.g. for unexpected spending needs) afforded by the plan;

- The path and variability of income, and the impact on the member’s peace of mind (e.g. loss aversion); and

- An overall retirement plan satisfaction score.

5. Call to action

The super industry is under pressure. Thought leaders are calling for radical changes, including even nationalisation. Pressure emanates from the Productivity Commission, digital disruptors and the community at large.

What is the solution? A focus on better meeting the needs of the customers. Who are those customers? Accumulators and employers might oil the wheels, but it is a fund’s retired members who look to a fund to provide regular income and to manage risks that they cannot manage on their own. We need to accept an inconvenient truth. Our wholly individualised DC system is not up to the task for the vast bulk of retirees who cannot afford to manage those risks themselves.

Jeremy Cooper is Chairman of Retirement Incomes at Challenger. The full version of Jeremy’s FSC Retirement Income Products Conference keynote address can be accessed here.