Recent research on over 5,500 senior Australians showed most are aware of their increasing longevity, but there were some surprising findings into retirement expectations. National Seniors Australia (NSA) and Challenger surveyed a broad representation of NSA members. Regular, constant income covering essential needs came out as the major requirement in retirement, but other results were less predictable.

Limited intentional bequests

While Treasury officials might be worried that older Australians are looking to build up a tax-free super nest egg and pass it all onto their kids, that is not the motivation for older Australians. Only 3% of respondents indicated that they intended to preserve all their capital for the next generation. These are probably wealthy older Australians who can afford to live off the income from their assets, rather than having to draw down the capital.

This doesn’t necessarily mean that senior Australians have turned stingy. Indeed, the split was roughly even between those leaning towards preserving capital and those looking to spend it down. Only 10% want to spend down everything. In practice, it seems that retirees are not spending it all (at least not yet).

So, what is driving the observed behaviour?

Understanding the implications of longevity

The survey highlighted that most retirees are aware of their increased longevity. 83% reported an awareness of a likely 6-year increase in life expectancy compared to their parents’ generation. 49% reported making financial plans for retirement and 47% have plans for medical and health expenses. These are all signs that Australian retirees are aware of the need to manage for longevity.

This awareness could also indicate why they don’t think they will be leaving money for the kids. They’re not sure that they will be able to afford it.

Living longer means that retirees will have to fund their spending for longer and it is probably more that the retirees are looking after themselves first. Only if they don’t need it will they leave something for the kids. Comments from individual respondents reflected the theme that kids are in a better place than current retirees, potentially due to the existence of superannuation (i.e. they already have their own retirement savings).

In terms of planning, making sure that they have income for the rest of their lives was a high priority, but it wasn’t what they were most concerned about.

Preference for regular income

Top billing in this year’s survey went to the need for regular income to meet essential needs. A previous survey in 2012 had ranked money for health costs as the top priority, but a broader focus, that includes other essential needs, topped the list this time.

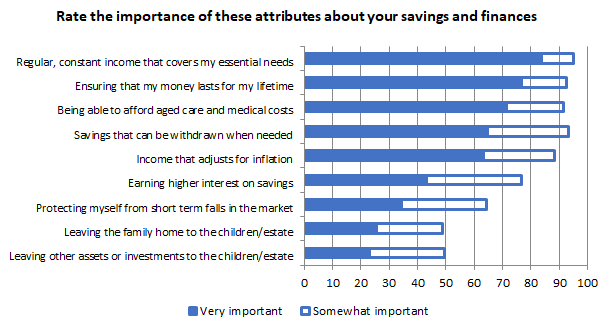

The chart below indicates the key concerns that seniors have around their finances. While lowest ranked, many still consider it important to leave an estate, suggesting it is more about the capability, rather than the intention, that is likely to limit what the average Australian retiree will bequest.

Seeking financial advice

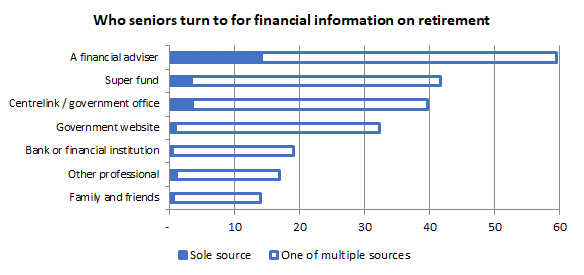

Another element of the report that might surprise was the high number (59%) who reported using a financial adviser. With around 160,000 households retiring every year, this suggests that there are around 100,000 pieces of advice (or information) from advisers about retirement. This might seem a little high, but it includes some limited advice (including general advice). Based on other surveys, it’s likely that less than half of them maintain an ongoing relationship.

With a growing number of baby boomers set to retire in the coming years, the demand for quality advice will only increase. With the increase in goals-based advice strategies, the report also gives some pointers about the key goals for retirees.

In summary, beyond the timing of the next overseas trip, the key goals are to generate a regular stream of income to meet essential spending and meet health and aged care costs later in life.

It would be hard to argue an adequate goals-based plan has been developed if it does not include solutions to meet each of these goals for a retiree.

Aaron Minney is Head of Retirement Income Research at Challenger Limited. This article is for general educational purposes and does not consider the specific circumstances of any individual.