The past 12 months have been good for shares in Australia and around the world. In the local market, upward profit revivals in the large miners were triggered by last year’s commodities price rally following the Chinese stimulus announcements in March 2016. South32 (spun off from BHP) was up 74%, Fortescue +49%, Rio +39%, BHP +25%. Also benefiting from the mining and oil rebound were Orica and Worley Parsons, both up more than 50%. (However, share prices in the resources and mining services sectors are still well below their boom-time peaks). The big banks ended up with double digit price rises apart from Westpac dragging the chain. Telstra (telco), Santos (oil/gas) and Newcrest (gold mining) were the only major losses over the year.

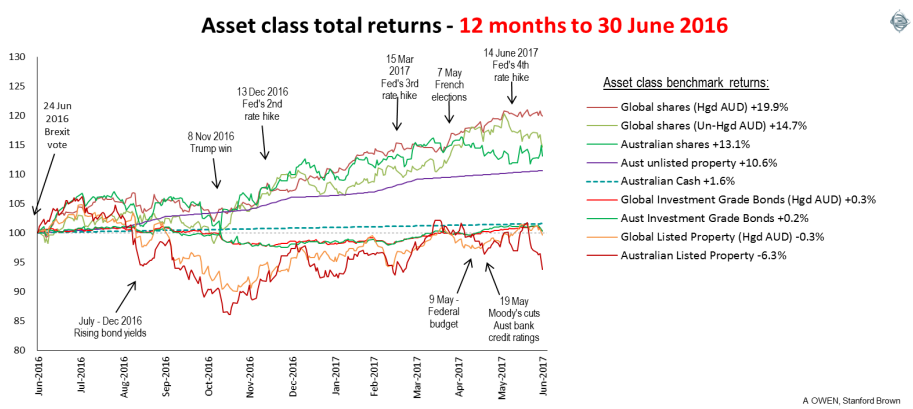

Global stock markets also had a good run. The big Asian markets were all up by more than 20%, as was most of Europe, and the US was not far behind. We remained relatively bullish on shares throughout the period despite the regular media frenzies about the potential negative impact of the Brexit vote, Trump victory, US rate hikes and a steady stream of other ‘end of the world’ panics and red herrings that may have scared investors off.

Currency hedged global shares did better than unhedged as the Aussie dollar rose over the year, especially since the Trump election.

Click chart to enlarge for clearer image.

While shares did well, so-called safe haven ‘defensive’ assets were flat. Australian and global bond markets fell as bond yields rose from July (after the Brexit vote in June) to the end of 2016, spurred by early signs of economic recovery and inflation in Europe and Japan and by the Trump victory. Bonds managed to claw their way back up to finish square by June 2017 when yields fell back again as the premature confidence waned.

Listed property markets here and globally were also dragged down by the rises in bond yields in late 2016 but prices recovered a little in 2017. In contrast, unlisted property generated steady returns as rents and capital values continue to remain relatively strong, especially in Sydney and Melbourne.

Three most common questions for the year ahead

In the year ahead the combination of economic recoveries, rising inflation and interest rates in the US, Europe and Japan are likely to continue to favour risk assets like shares more than defensive asset like bonds.

On the three most common questions I receive from investors, the answers remain little changed from the start of the year.

‘Will China slow?’ is a question that has topped the list since the peak of the mining boom in 2011. The Chinese stimulus spending that began in the depths of the GFC has been the driving force in global commodities prices and Australia’s mining export revenues ever since. Global markets sold off during late 2015 on fears that the Chinese government would drop the ball and rely more on structural reforms for growth rather than straight out stimulus spending. In March 2016, the government gave up on reforms and addressing the mountain of bad debts in the banks, and instead said it would increase deficit spending to keep the train running. This triggered an immediate rebound in commodities prices, share prices and credit markets, and the effects carried into 2017.

‘Will rising US rates hurt share prices’ and its cousin ‘Will rising bond yields hurt share prices’ also have the same answers as before the first Fed rate hike in December 2015. The US economy is still relatively weak and cash rates and bond yields are still very low. So far, we are still in the early stages of the economic cycle and this is where rate hikes and bond yield rises have historically not been damaging to share prices. These early stage recoveries are when share prices do best because rate hikes and bond yield rises are more a reflection on confidence in the economic recovery than they are of fears of over-heating.

However, over the past year the jobs market has improved significantly, wages are now rising, manufacturing activity has revived, confidence and spending are improving, and we are seeing signs of inflation returning. As the economy is still weak it has been our contention that the Fed’s plan to keep raising interest rates will probably keep the brakes on the economy, and that should keep bond yields low for some time. In the second half of 2016 bond yields rose with the early signs of inflation and on the Trump euphoria, but yields have fallen back this year and share prices have kept rising.

The answer to the third question, ‘Will house prices fall’ in Australia, has two answers - individual and aggregate. At an individual level, it depends largely on whether you paid too much for your place and if you are highly leveraged and vulnerable to becoming a forced seller when mortgage rates rise or if your income falls.

Watch the implications of a property slow down

In aggregate, there is a bigger issue at stake. If you are a shareholder or an unsecured lender (via hybrids or subordinated note holders) to the banks, then you are financing the current housing boom and your future wealth is highly dependent on the cycle not turning into another bank bad debt crisis. Worse if you have been lured recently into mortgage funds to chase higher yields. You are now a low-ranking unsecured lender to high risk property developers who have been rejected by the banks, or to high risk, high rise unit buyers who also have been rejected by the banks.

The vast majority of home (and unit) buyers bought many years ago and have plenty of equity. They present little risk to the banks as mortgage rate rise. The problem is the flood of buyers who came late to the party and are geared to the hilt. Many thousands of recent buyers and hundreds of property developers will be sold up by the banks and will lose everything. What is not as clear is whether it will infect the banking system enough to force a restructure of one or more of the banks (possibly), and whether it will hurt the broader economy (almost certainly). Another issue is timing - booms can run for years before finally collapsing.

Ashley Owen is Chief Investment Officer at privately-owned advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.