(Editor's introduction: League tables of the best-performing managed funds of 2019 featured geared funds prominently, but it was primarily driven by leverage into a booming market. We explained what happened in this article. At the same time, Investment Trends has surveyed another form of gearing, margin lending, and here is a summary of their findings).

Key highlights from the Investment Trends Margin Lending Adviser Report are:

- Advisers’ views on gearing to invest are improving despite their subdued market outlook

- Innovative products are key to rejuvenating the margin lending space.

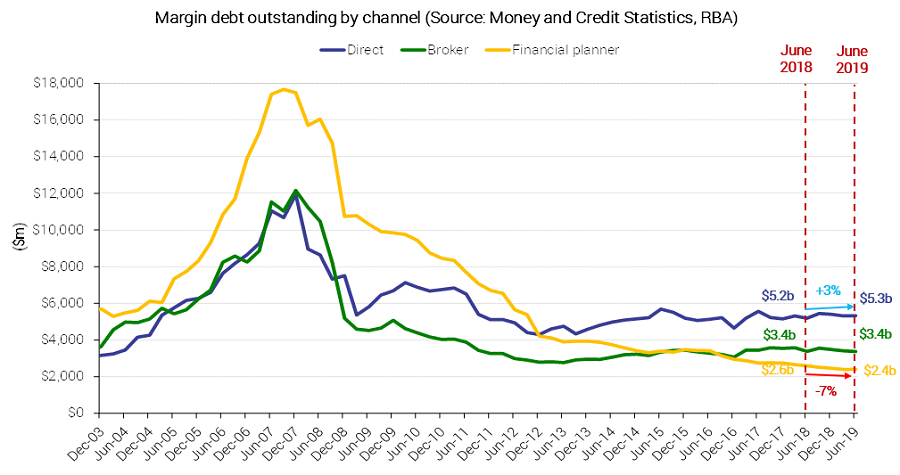

Investment Trends has kept a close eye on the use and appetite for geared investment products in Australia for over a decade, tracking the rise in the popularity of margin lending products in the build up to the GFC and their subsequent fall. Total outstanding margin debt has remained largely steady since 2012, at around $10 billion, which is well below the $40 billion peak in 2007.

Chart 1: Margin debt outstanding in the direct, stockbroker and financial planner channel

Borrowers taking on much larger loans

Our research shows the profile of margin lending users evolving markedly over the past decade. While overall user numbers have fallen, a wealthier group of individuals has remained, with the level of outstanding margin debt per investor more than doubling between 2012 and 2019 (from $111,000 to $235,000). This group is also increasingly non-advised, with the share of outstanding margin debt held by direct investors increasing from 36% in 2012 to 48% in 2019 (outstanding margin debt among non-intermediated investors increased 3% to $5.3 billion in the 12 months to June 2019).

This smaller pool of wealthier investors appear less interested in short-term speculation and more inclined to use geared investments to build long-term wealth. Compared to a decade ago, these margin lending investors are also more conservative in their gearing levels, making them less likely to trigger margin calls (also check out Graham Hand’s excellent primer on the impact of geared investments here).

In 2019, the LVR for the average margin lending investor stands at 42%, significantly lower than levels seen prior to the GFC or the maximum level offered by lenders.

Advisers use for a select group of clients

In the intermediary channel, advisers are no less prudent and selective in recommending margin lending products. While 60% of full-service stockbrokers and 21% of financial planners provide advice on margin lending products, these advisers only do so for select clients (typically using these products for only one in ten clients).

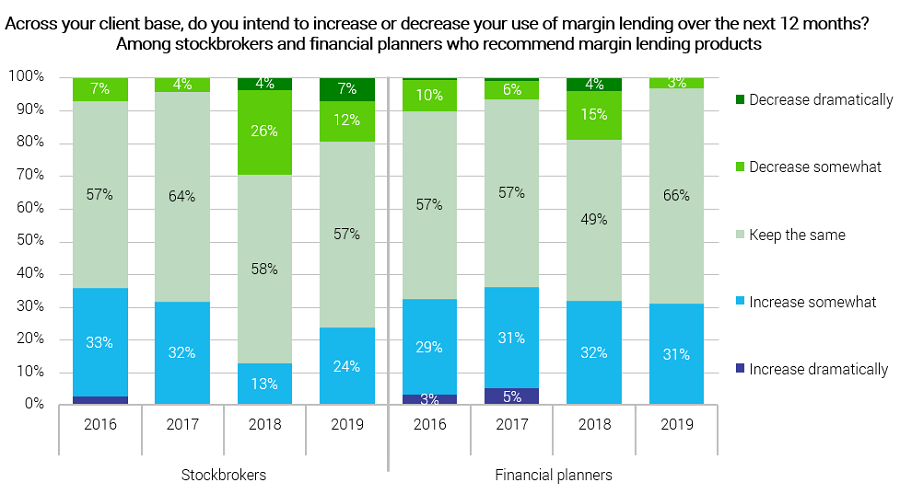

However, both stockbrokers and financial planners are increasingly consider gearing to invest to be an appropriate strategy for their clients. The vast majority of stockbrokers believe their clients can benefit from the use of borrowings to boost investment returns (87%, up significantly from 72% in 2018), and this outlook is even stronger among financial planners (89%, up from 82%). Looking forward, advisers’ intentions to use margin lending have also recovered from 2018 lows (see Chart 2).

Chart 2: Intentions to increase/decrease use of margin lending among stockbrokers and financial planners

Outlook for shares not strong

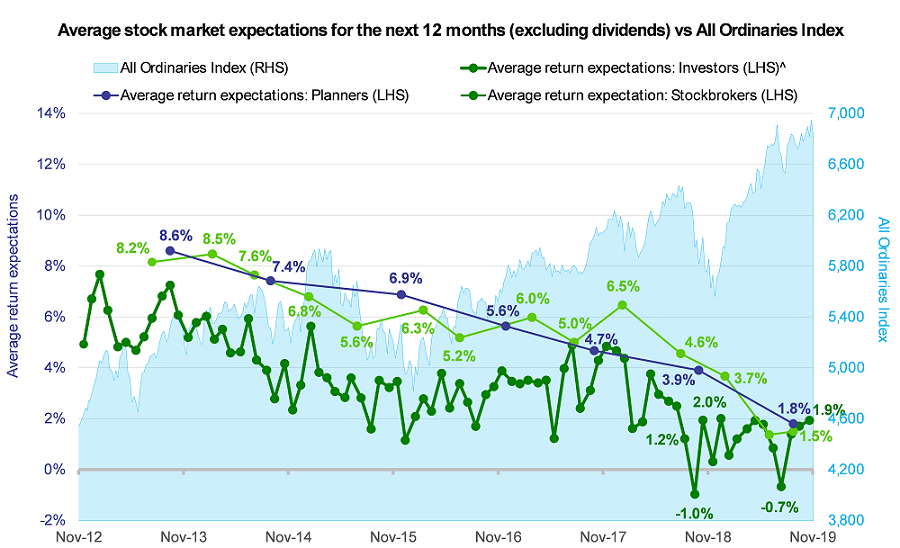

While their views on gearing to invest are improving, advisers’ outlook for domestic equities remains subdued. The average adviser expects the All Ordinaries Index to rise by less than 2% over the coming 12 months, or vastly lower than the levels observed prior to 2019 (see Chart 3). The fact remains, many advisers consider gearing products in their advice process – as part of their best interest duty to their clients – irrespective of their views on geared investments.

Chart 3: Stock market return expectations among investors, stockbrokers and financial planners

Dormant users may reactivate

Activating or reactivating the advice channel is a growing issue for the margin lending industry. A quarter of stockbrokers and nearly half of planners (43%) have used margin lending in the past with clients but no longer do so. Still, these dormant users are open to resume their usage, with 71% of stockbrokers and 78% of planners saying they can be encouraged to start using the credit product again.

A key catalyst to convert interest into action is improved product features. Compared to last year, significantly more stockbrokers tell us they would be encouraged to use these products if they could structure loans that avoided margin calls (23%, up from 9%) and were given more choices to protect their clients’ initial capital (12%, up from 5%).

While innovative products are key to rejuvenating the margin lending space, lenders must continue maintaining their high levels of service and support, particularly their Business Development Manager support. A good BDM relationship is among the top three reasons why advisers favour their main lender aside from its good reputation and range of approved shares and funds.

The greater the support and education they receive from lenders, the better that advisers will be equipped to evaluate and utilise these geared investments for their clients.

About the Report

The Investment Trends 2019 Margin Lending Adviser Report examines the use of gearing to invest among Australian stockbrokers and financial planners. The study is based on a survey of 182 financial planners and 200 stockbrokers who provide financial advice, concluded in November 2019.

Recep Peker is Research Director at Investment Trends. This article is general information and does not consider the circumstances of any person.