Online stockbrokers are in a new phase of disruption not seen in over a decade and they’ll have to move quickly to stay ahead of the game or risk losing their customer relationships.

A wave of new ‘fintech’ is the catalyst for this change but it’s not the robots and cryptocurrencies that are causing the disruption. It’s the resulting changes in consumer behavior and expectations that are forcing online brokers to redefine their business. Online brokers have always been more consumer-focused than their institutional counterparts but they still struggle to innovate beyond the technical aspects of their craft. This is where fintechs are starting to redefine the game for the industry, particularly regarding information, research and advice. These entrants have paved a new path for equities that is changing the way that consumers want to trade, leaving online brokers in a strategic minefield.

Investors are doing it differently

Products such as Simply Wall St, Livewire, StockLight and Cuffelinks are all redefining the way that investors find and research investment opportunities and strategies and make trading decisions. Twitter and HotCopper are in the tool box of many investors, and StockTwits will no doubt make its way to Australia in the near future.

Furthermore, as Google has improved its quality measures of content, online publications have been forced to produce high quality original content, making them a great source of insight. The significance of this shift is that investors are less likely to be using their online broker as the primary source of information for trades.

A sample of over 10,000 users of Canstar’s online share trading comparison table showed that only one in four were refining their results based on broker recommendations, access to company reports or daily market updates. This could mean one of two things: either investors are automatically expecting those services as part of the platform or investors aren’t looking to their online broker for recommendations and market information. In either case it suggests that broker-generated content may not have the same impact that it once did on investor behavior.

In contrast, according to Andy Rogers, Head of Stockbroking at CMC, their most popular online resources are the Morningstar quantitative reports and theScreener equity reports:

“Having multiple sources of information for clients to review and cross reference means they feel more confident about validating their investment and trading decisions”.

My hypothesis is that investors will eventually complete most of their primary research off-platform and use the on-platform data as a sanity check or to fill in the gaps. Perhaps what was once a competitive differentiator is now a hygiene factor in this ever-evolving investment information landscape.

Brett Grant, Head of Self Directed Investing at nabtrade, agrees that investor needs are constantly changing and becoming more demanding:

“Innovative and relevant products, underpinned by a rich information experience, ease of use, smart device-accessibility and cost-effectiveness, will be the key determinants in consumers’ minds going forward when it comes to selecting a broker. Players in this industry will need to disrupt themselves and think big and yet be nimble to stay ahead.”

Mobile is crucial

Looking at the investing context alone will only tell half the story. Consumers have a life outside their bank accounts and this life is a major driver of the expectations they apply to financial services. Consumers want:

- A simple mobile experience

- Everything for nothing (or very little)

- Immediacy

Right now you can decide to listen, on our smartphone or laptop, to almost any song ever recorded. You can either do this for free or pay a small monthly sum to bypass the advertising via a premium model. You can order a car to pick you up from your destination right now within three clicks (including opening the app), or four clicks if you want a quote for the trip. Just over a decade ago having a GPS in your car cost several hundred dollars, was on a 2D map and was out-of-date very quickly. Now you can street view Moscow’s Red Square from your mobile phone and navigate anywhere in the world for free. You can pay for your lunch by tapping your phone.

Anecdotally, mobile logins to trading platforms have taken off significantly in the past two years and 20-30% of total executions are now done via a mobile app (for those with a dedicated app). All providers in Canstar’s recent online share trading platform research had a mobile responsive website but not necessarily a dedicated mobile app. I would suggest that this should be a key focus for all providers in the coming years.

More for less

Conventional wisdom would suggest that with better features, new technology should come at a higher cost for consumers but in fact the reverse is true.

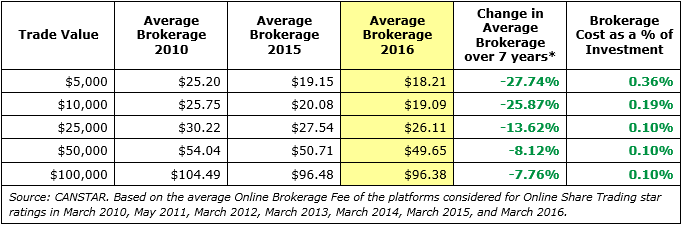

Canstar’s most recent research shows that the average cost of trading at all dollar amounts has fallen – in some instances quite significantly, over the past five years.

Lack of innovation will mean lack of customers. Failing to gauge both changing investor preferences and the level of fintech disruption will be a death knell for complacent companies. The next few years will be fascinating.

Josh Callaghan is General Manager, Wealth, with CANSTAR and Wealthbricks