The ethical and business dilemmas about whether financial advisers should accept ‘selling fees’ from fund managers took a dramatic twist last week with the release of documents under a Freedom of Information (FOI) request. Although the internal memos from the regulator, ASIC, are not released publicly on their website, they are available on request following the FOI inquiry by The Australian Financial Review.

We have written extensively on this subject, such as here, as it is crucial for the future success of Listed Investment Company (LIC) and Listed Investment Trust (LIT) issuance. Investors have pumped $4 billion a year into the sector in the last two years, and so settling the debate has major implications for thousands of investors, especially those whose investments are guided by a financial adviser.

It's a fact that it is impossible to raise a billion dollars in a month for a relatively unknown fund manager without paying selling fees (officially, 'stamping fees') to financial advisers and brokers. In the wake of the Royal Commission and the industry's new Code of Ethics, the advice industry must answer the question:

Why would an adviser put clients into a new LIC or LIT when there are hundreds of similar choices readily available if not for the incentive of earning the selling fee?

The ‘made things and provided services’ exemption

The FOI release (a zip file of emails and documents) shows the regulator feels the scope for conflicted advice is amplified by section 7.7A 12B of the Corporations Act, which allows financial advisers to collect a stamping fee. The most telling section comes from Anna Dawson, Senior Specialist, Financial Advisers at ASIC, who says:

“The initial carve-out was given because of an argument that companies would not be able to raise capital. The carve-out was restricted to companies that ‘made things and provided services’ – hence investment companies were excluded unless they were investing in infrastructure, so, the initial carve-out for stamping fees did not apply to LICs and REITs.” (my emphasis)

This is a fascinating revelation. The carve-out from FoFA which has encouraged billions of dollars of LICs and LITs to be issued was not initially available.

And here’s the sting in the tale, as ASIC continues:

“ASIC was consulted on the ‘streamlining’ package which extended the stamping fee carve-out by including investment companies. In December 2013, ASIC wrote to Treasury again opposing the expansion of the carve-out for the following reasons …

Broadening the exemption will expand the scope for conflicted advice and corresponding consumer detriment. It will also cause an undesirable market distortion by preventing conflicted advice in the secondary market (transfer acquisitions) but permitting conflicted advice for the whole primary market (issue acquisitions). From a consumer protection perspective, we do not see any policy rational for this distinction.

We are also concerned that any broadening of the exemption will lead to arguments by other industry sectors that they have been put at a competitive disadvantage by the uneven playing field that the exemption creates. Subsequent relaxing of the FoFA reforms will inevitably lead to consumer detriment.” (my emphasis)

So what happened? ASIC’s advice was ignored under intense lobbying from sections of the financial services industry which benefit from allowing advisers to receive selling fees.

Why do the businesses that rely more on unlisted funds, including many of the major platforms, not object to this special treatment which allows a competitor product (in the listed market) a special ability to pay a fee to an adviser?

In Item 20 from the ASIC file, this time written by David Dworjanyn, Senior Specialist (Legal & Policy), Markets, ASIC, he says:

“The poor performance of the majority of these funds don’t justify the fee structure generally and it makes me question any advice to go into these products, particularly at the issuance stage.”

Meetings between ASIC and Treasury

It’s also fascinating to see how many resources Treasury and ASIC have devoted to this problem. The emails include detailed analysis of the LIC and LIT market. The email below shows David Dworjanyn copying 10 people into the analysis on stamping fees in August 2019.

However, these results are not as clear cut as ASIC suggests. For example, some of the LICs that did not pay fees were not new issues, but rather, LICs involved in some internal restructuring that did not involve funding. Furthermore, analysis of LIC prices is fraught as discounts and premiums change almost daily, and prices are affected by modest amounts of supply and demand.

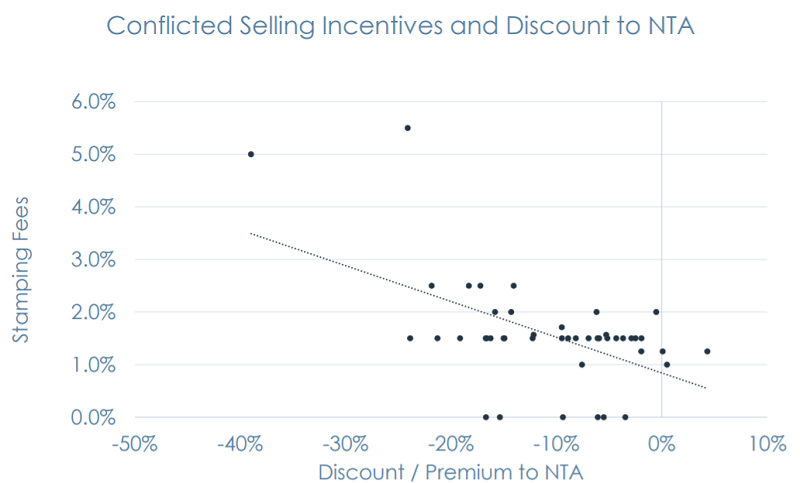

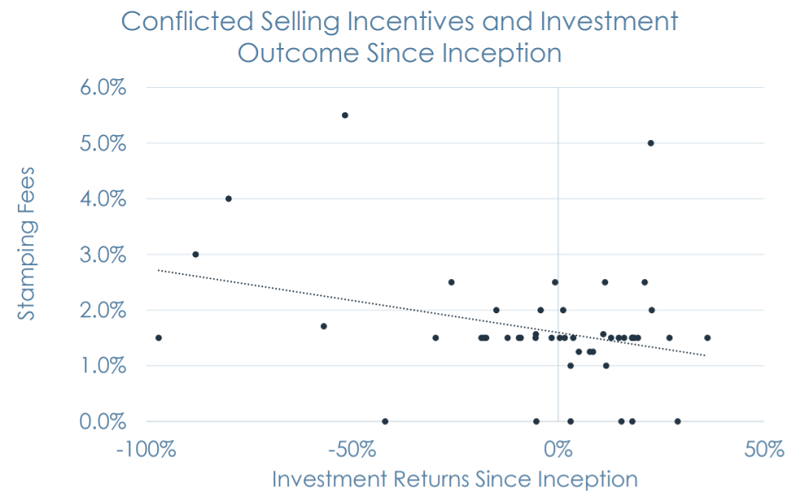

Nevertheless, regulator opinion of the market is shown by the following charts from the slide presentation. They indicate the higher the stamping fee, i) the greater the discount to NTA and ii) the worse the investment outcome.

With the dispute on adviser selling fees growing in the media, Treasurer Josh Frydenberg recently wrote to ASIC saying:

"I am sure you share my concern that ASIC's analysis revealed some correlation between higher stamping fees and underperforming LICs. Can you please provide me with details as to how ASIC is monitoring LICs and other investments to which the stamping fees exemption applies to ensure that the interests of consumers are not being compromised."

Advisers don't know how much will be issued

The float of a company that ‘made things and provided services’ differs from an investment company. When a company such as Afterpay or Xero is floated, there is a set amount of stock available, valuing the floated company at a specific price. There is often a scramble for the limited supply.

With a LIC or LIT, the fund manager can accept every dollar offered and then simply buy more assets. There is an enormous incentive to ‘back up the truck’, as L1 Capital did with its $1.3 billion raise and KKR did with its $925 million issue. Both then struggled in the secondary market under the weight of supply and traded at discounts to NTA.

Yet financial advisers and brokers put $2 billion into these two issues, readily accepting the selling fees, even after the originally-advised minimum transaction amounts were massively exceeded, with the inevitable oversupply issues

How can an advice licensee assessing whether an adviser’s action was motivated by the selling fee argue that a LIC or LIT that trades at a discount is in the best interests of the client?

What is the relevance for investors?

Many SMSFs and more sophisticated retail investors assemble their portfolios using ASX-listed investments, and Exchange-Traded Funds (ETFs) have now reached $60 billion, while LICs and LITs are about $50 billion.

But there's a difference between the two. Demand for ETFs is primarily driven by cheap and easy access to index exposure, with many funds available for less than 10 basis points (0.1%). ETF providers devote considerable resources to investor education rather than paying promotional fees to financial advisers and brokers (there are no stamping fees paid on ETFs).

How can LICs and LITs charging active fees of 1% or more compete with such low fees? Some such as Magellan rely on the long-term reputation of the manager, with a direct client base built over a decade of success, engagement and marketing effort. But managers with lower market profiles must pay selling fees to advisers to promote their products. From the manager's perspective, this is fair enough as it rewards the adviser for their distribution.

Without the selling fees, many of these transactions will not come to market. If the latest review by ASIC and Treasury, and the ethical questions raised by FASEA's Code of Ethics, lead to a change in treatment of selling fees, then ETFs will receive a boost, and investors and advisers may need to focus more on unlisted funds.

Graham Hand is Managing Editor of Firstlinks. This article does not consider the circumstances of any investor.

Any financial adviser or industry participant is welcome to provide a constructive article explaining why selling fees are appropriate for new issues.