New index-based strategies known as ‘smart beta’ appear to be growing in popularity, but not all these strategies are created equal and investors should be mindful of implementation. These indices seek to outperform conventional market cap-weighted indices by breaking the link between a stock's desired weight and its market cap, instead deriving desired weights from characteristics such as book value, earnings or recent performance.

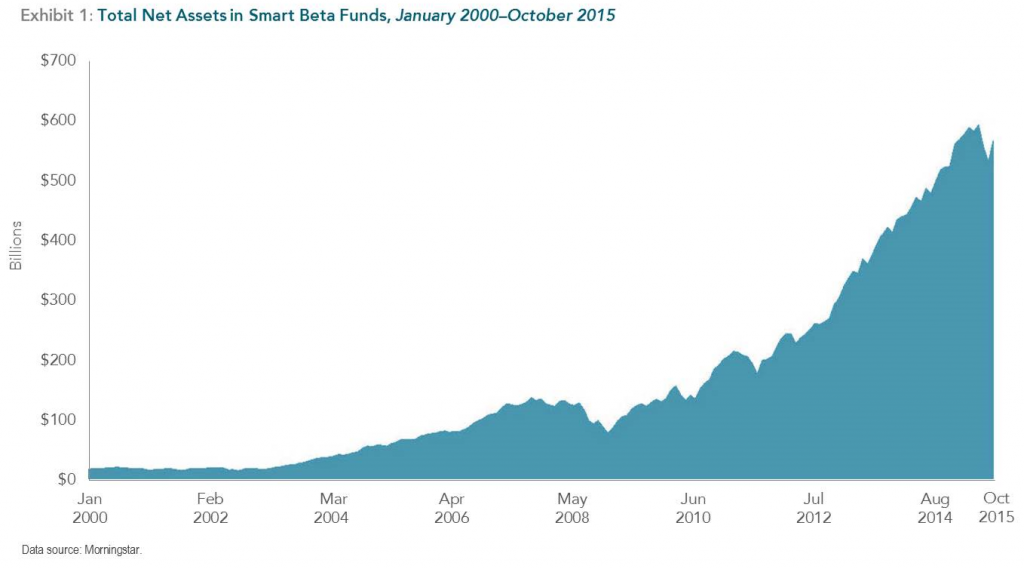

While many names are used for this approach, smart beta is the most common. The chart below shows assets managed under the smart beta label have grown to more than $US500 billion over the last 15 years. While still a small percentage of the overall market, this growth implies they are becoming a more popular choice. But are they the right choice?

Data show smart beta indices can provide exposure (sometimes inadvertently) to size, value and profitability premiums, but they may do so inefficiently and may subject investors to unnecessary risks. Also, there is no compelling evidence that aggregate long-term demand at the security level has changed because of inflows to smart beta strategies.

Without such evidence, it’s not possible to say that there is ‘more money chasing value’ today than in the past. Instead, flows into these indices may represent a transfer of assets from managers who target a similar set of securities using a more traditional active approach.

Identifying differences in expected return

Just as it is reasonable to expect equities to have higher expected returns than bonds, it is reasonable to expect different securities to have different expected returns. Different stocks can provide different hedging needs and risks. This may be investor-dependent if some investors are the natural holders of certain risks and others are not. Alternatively, in behavioural finance, tastes and preferences drive expected returns without associated ‘real’ risks or hedging preferences. Under either framework, there is a very low possibility of all stocks having the same expected return.

To identify information that can be used to determine differences in expected returns between securities, it is useful to begin with the valuation equation which links expectations about a firm's future profits to its current price through a discount rate. A low relative price is one indication that the market has discounted a company's expected future profits more heavily. Applying the same valuation logic, companies with similar price characteristics but different levels of expected profitability should have different expected returns.

What happens if everyone becomes a value investor? The answer is that it isn’t possible. Collectively, all investors must hold the entire equity market. For every investor who wants to overweight stocks with low relative price, there have to be investors who want to overweight stocks with high relative price.

As long as market participants apply different discount rates to different stocks, a strategy that uses a combination of current market prices and up-to-date firm characteristics can identify those differences today, tomorrow and into the future. Using current prices is the key to identifying these differences in discount rates.

The risk from ignoring prices

While we expect positive size, value and profitability premiums, not all strategies that pursue those premiums are created equal. Investors always have the option to invest in a plain vanilla broad market index fund. This is a decent option as these funds are transparent, low cost, low turnover and well diversified. The success of conventional market cap-weighted indices can be explained in part because they have delivered what they set out to deliver - market rates of return.

However, it is not clear whether smart beta indices will be able to deliver their goal of outperforming the market. Unfortunately, good back-tested research does not provide enough information to make this assessment. The implementation details matter.

For example, if a smart beta index ignores market prices, it is difficult to infer if it will have a higher expected return than the market going forward. In back-tested research, the index may have provided inadvertent exposure to stocks with low relative prices and high profitability, and outperformed the market. If current market prices are ignored in index construction, this implies the index is not directly managing that exposure and may not outperform in the future.

A smart beta index also may generate excessive short-term demand for less liquid stocks and create unnecessary turnover. As the assets attached to that index increase, there may be a drag on returns due to an index reconstitution effect.

So when evaluating a strategy, there are a number of questions to consider, including:

- Does the strategy use current prices when choosing securities? If a strategy ignores current prices, a vital component of what drives differences in expected returns is omitted.

- Is there unnecessary turnover? Security weights that are not tied to market cap weights may incur excessive turnover that increases implementation costs without increasing expected returns relative to a market cap-based approach.

- How is the strategy rebalanced? Trading that demands immediacy from the market can be costly, even if turnover is low.

- Are there avoidable risks and is the portfolio well-diversified given its mandate? Investors should be cautious about an approach that allows for extreme positions in a few securities. While this can yield good back-tested results, it can also result in significant company-specific risk.

An alternative solution

A better approach is to begin with research into how markets work. A sensible story can boost one's confidence that a premium is positive in theory, while a low-cost approach improves the chances of capturing premiums in practice. No premium is a sure thing. Costs, on the other hand, surely lower investors' net returns. Investors should consider whether a strategy would be a good investment even if the premiums are smaller in the future or do not appear at all.

It’s important to have a solution that will be at least as good as the market portfolio in most scenarios, including if the premiums do not show up. A strategy with high implementation costs will have lower expected returns than the market portfolio if the targeted premiums do not exceed the costs. Keeping opportunity costs low helps a strategy maintain market-like expected returns even if premiums do not appear in the future.

A well-designed strategy that seeks to capture size, value and profitability premiums should minimise its opportunity cost relative to a broad market index. Key tools for doing that include using current prices in every part of the investment process and remaining well-diversified. As well, one should pursue premiums that lead to low strategy turnover and that eliminate unnecessary turnover. The final key is adopting a flexible approach to portfolio management and trading that balances competing premiums and considers explicit and implicit trading costs.

Marlena Lee is a Vice President, Research, and Gerard O’Reilly is Co-Chief Investment Officer and Head of Research with Dimensional Fund Advisors, an institutional asset manager with about $500 billion under management globally. This article is general educational material and does not consider the investment needs of any individual.