Australia’s superannuation market is rapidly maturing, with 65% of Australia’s $2.8 trillion super assets sitting in the hands of fund members aged 50 years and older.

Balances on average are also increasing and, with Australia having one of the longest life expectancies in the developed world, people will be spending a lot of time – 30 years or more – in retirement. The cash rate is also sitting at an unprecedented low, offering those approaching retirement little comfort.

It is obvious that a fundamental shift in the investment strategies offered to Australians will be required to meet the needs of future retirees.

Low rates increase need for sensible risk-taking

Investing in low-risk investments such as cash in today’s low interest rate environment is likely to result in mediocre outcomes. Those approaching retirement and retirees themselves need to consider taking sensible investment risk but this also requires the ability to adequately manage these risks at a time when wealth preservation is vital.

When people are saving for retirement, the focus tends to be solely on performance. While that may be appropriate during the so-called ‘accumulation phase’, it fails to address the complex needs of those people approaching retirement or in retirement, the ‘decumulation phase’.

When approaching retirement, an investor’s risk appetite instinctively decreases. The tolerance for risk is much lower than in the many years of accumulation where workers, via their superannuation contributions and longer-term outlook, cultivate a pot of money to retire on comfortably.

So, how do retirees and those approaching retirement marry wealth preservation and a sufficient amount of investment risk together?

Common assumptions may not work in decumulation

Retirees still need to take appropriate investment risk to address inflation and longevity risk, but there also needs to be a focus on the impact of market volatility on retirement outcomes, known as sequencing risk.

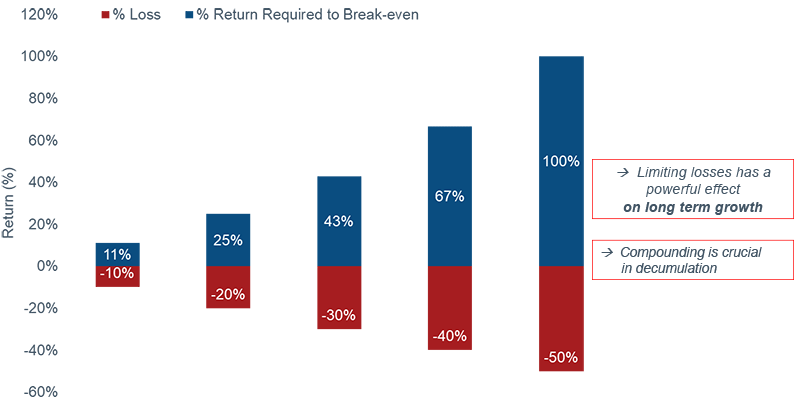

While the effects of compounding and dollar cost averaging are positive for savings and accumulation, the opposite is true during decumulation. In fact, limiting losses in retirement has a more powerful effect on long-term growth than capturing the full upside of market gains.

For instance, a 10% investment loss requires an 11% gain to simply return to the original point before the loss occurred. A 20% investment loss requires a 25% gain, and so on, to the point where a 50% loss needs a 100% gain to return to the original balance.

Compounding is not well understood

What positive returns are required to break-even after market losses?

The following examples provide a stark illustration of the impact of losses on a retiree’s portfolio during drawdown (decumulation).

Assuming a starting balance of $500,000 and a drawdown of $3,000 per month, the corresponding performance of four different investing options over the 20 years between August 1999 and August 2019 (20 years) are as follows:

- An investment in the MSCI World Index would see the investor run out of money by May 2014.

- An investment in a fund capturing 80% downside and 100% upside has a final balance of $402,000 in August 2019.

- An investment in a fund capturing 80% of the downside and 110% of the upside has a balance of $1,102,000 in August 2019.

- But, an investment in a fund capturing 40% of the downside and only 80% of the upside, has a balance of $1,600,000 at the end of the 20 years.

Reduce risk during retirement

Clearly, while taking some risk in retirement is needed to avoid unpalatable outcomes, limiting downward movements in retirement portfolios is even more important than capturing the full upside in markets.

While products with a guarantee attached can offer comfort, the cost of that guarantee can be high. The challenge for retirees is to find an investment that provides high participation in equity up markets but consistently limits the downside impact of markets at a sensible overall cost.

One option is a low volatility equity fund which offers access to equity markets but aims to lower risk through careful stock selection. By choosing a diversified portfolio of high quality stocks that are expected to fall less than the market, the portfolio manager's focus is on limiting the impact of falls.

Another approach used by financial advisers and superannuation funds is the bucketing framework.

Bucketing allocates part of the portfolio to cash and other income for the next two to three years of income needs, while taking market risk on other assets. If there is a period of volatility, retirees don’t need to draw down on the growth assets and can better ride out the volatility. At the same time, if markets are prosperous, then they can top up the income bucket. This approach is becoming increasingly common, with most advisers having at least two buckets at their disposal, sometimes more.

In summary, investors in retirement still need to take on equity risk, but the compounding effect of investment losses can have a devastating effect on retirement portfolios. The right kind of equity exposure in retirement should come with downside protection and a capture spread that enables sufficient participation in the market upswings.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2019 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.