Tax-loss selling is a strategy where investors sell underperforming stocks at a loss to offset capital gains from profitable investments. Investors employ this strategy to minimise the taxes owed on their net capital gains for the year. It becomes popular towards the end of the financial year when investors review their portfolios and look to optimise their tax positions.

However, tax-loss selling can potentially lead to quality companies becoming oversold during difficult periods.

When investors indiscriminately sell losing stocks solely for tax purposes, it can create excessive selling pressure and drive down the share prices of fundamentally sound companies that may be going through temporary challenges. This overselling can present opportunities for investors to buy into quality businesses at discounted prices. But it also highlights the risk of prematurely exiting positions based solely on tax considerations rather than the company's long-term prospects.

Here are some ASX companies that we believe may be suffering from tax loss selling.

Close the Loop

Close the Loop (ASX:CLG) is a global player in sustainable solutions operating across Australia, Europe, South Africa, and the United States. We’ve covered the company in depth here.

Close the Loop specialises in creating eco-friendly products and packaging with a strong emphasis on recyclable and recycled materials. The firm also plays a pivotal role in resource management by collecting, sorting, reclaiming, and reusing materials that would otherwise end up in landfills. The company's expertise spans a wide spectrum of sectors including electronics, print consumables, eyewear, cosmetics, plastics, paper, and cartons.

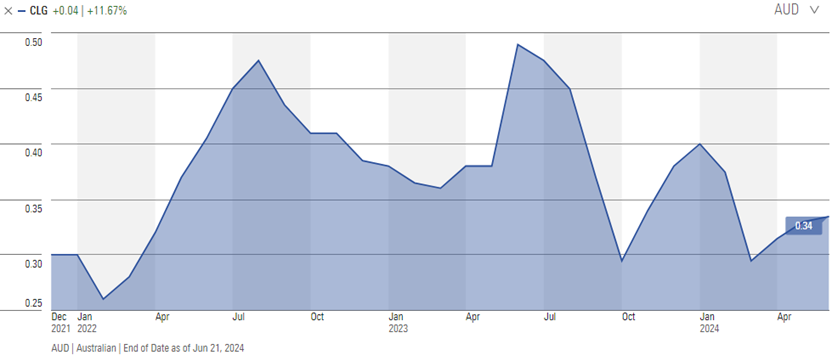

From 52-week highs of $0.50 the company’s share price has been languishing in the low 30s.

Source: Morningstar.com

So why should shareholders be bullish?

Close the Loop is well-positioned to benefit from the growing global shift towards a circular economy and increased recycling of products and materials. Major companies like HP, one of Close the Loop's key customers, have ambitious targets to significantly increase circularity and use of recycled materials in their products by 2030. This suggests substantial volume growth potential for Close the Loop's services.

Moreover, the company's financials are outperforming expectations. In the first half of FY24, Close the Loop reported strong revenue growth of 76%, with even higher increases in gross profit (94%), operating earnings (139%), and underlying net profit before tax (204%). The company is also improving its balance sheet by reducing debt.

With what we feel is an attractive valuation, Close the Loop's growth runway and financial performance provide reasons for shareholder optimism despite recent share price declines.

Corporate Travel Management

Corporate Travel Management (ASX:CTD) is a leading provider of travel management solutions for corporate customers globally.

CTD's share price experienced a significant decline in February 2024, despite reporting a 162% increase in underlying net profit and a tripling in statutory net profit for the first half of FY24. This sharp drop was attributed to the company lowering its full-year guidance, citing a $40 million operating earnings headwind from macroeconomic issues and the underperformance of its UK Bridging contract, factors beyond its control.

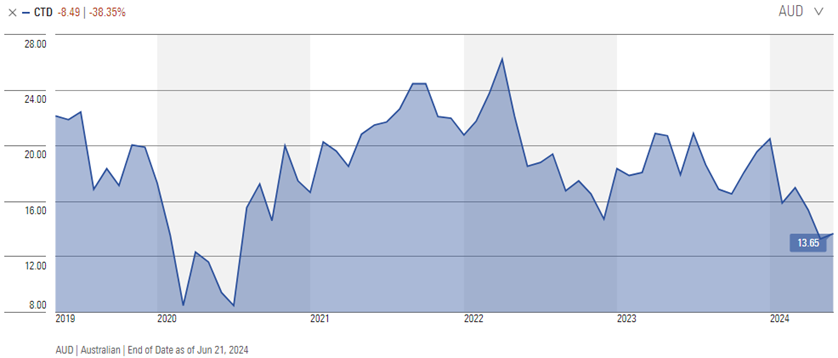

The initial sell-off slowed but has extended in recent weeks with shares trading around 52-week lows below $13.

Source: Morningstar.com

However, CTD unveiled a five-year growth strategy aimed at doubling FY24 profits organically by FY29. The key pillars of this strategy include:

- Revenue growth over 10% annually from winning new clients

- 97% annual client retention

- Productivity and innovation gains

- EBITDA growth outpacing revenue growth, with 50% of new revenue falling to EBITDA

- Acquisitions providing additional growth on top of organic goals.

Notably, key metrics like client wins, retention, and revenue per employee are already meeting or exceeding targets.

Despite the short-term challenges, shareholders could be optimistic about a turnaround. The headwinds are considered temporary, while underlying performance remains strong, with January results rebounding strongly across regions.

Crucially, CTD is well-positioned to execute its growth strategy, having a proven track record in acquisitions and synergy extraction, positioning it well for likely industry consolidation. Even with the headwinds, underlying operating earnings guidance still represents 31.7% growth over FY23 at the midpoint.

Tabcorp Holdings

Tabcorp Holdings Ltd (ASX:TAH) is Australia's largest gambling company, operating a portfolio of leading brands in wagering, media, and gaming services.

The company has struggled in recent times, with revenue for the first half of the fiscal year dropping 5% compared to the corresponding period, primarily due to weakness in the wagering segment. Group operating earnings fell 14% to $170 million, while Group earnings before interest and tax (EBIT) declined 32% to $50 million. Tabcorp also took a significant impairment charge of $731.9 million after tax to the Wagering and Media business, attributing the recent weakness to difficult macroeconomic conditions and a return to a more normal market following high growth during the COVID-19 period.

Despite these challenges, we feel Tabcorp may be an attractive takeover candidate for major international players.

With the potential exit of online competitors due to increased taxes and advertising restrictions, Tabcorp's leading Australian brands, national scale, and reach could position it strategically in the evolving landscape.

However, investing in Tabcorp may be risky, its share price graph resembling a double black diamond ski slope—steep and treacherous and it may be best left only for brave investors.

Source: Morningstar.com

The TAMIM Takeaway

While tax loss selling can create opportunities to buy quality companies at discounted prices, investors should be wary of indiscriminately selling underperformers solely for tax purposes.

A long-term view on a company's fundamentals and prospects is crucial. The examples highlighted above show how short-term challenges and tax loss selling pressure can potentially obscure the underlying strengths of a business. Investors with patience and a keen eye for value may find attractive entry points in fundamentally sound companies experiencing excessive selling. However, thorough research is essential to separate temporary setbacks from deeper structural issues.

By looking beyond the tax loss selling noise, disciplined investors can potentially uncover promising opportunities to generate substantial returns over the long run.

Ron Shamgar is Head of Australian Equity Strategies at TAMIM Asset Management. The information provided in this article is for general information only. It has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions.

Disclaimer: Tabcorp Holdings Ltd (ASX: TAH) and Close the Loop (ASX: CLG) are currently held in TAMIM Portfolios.