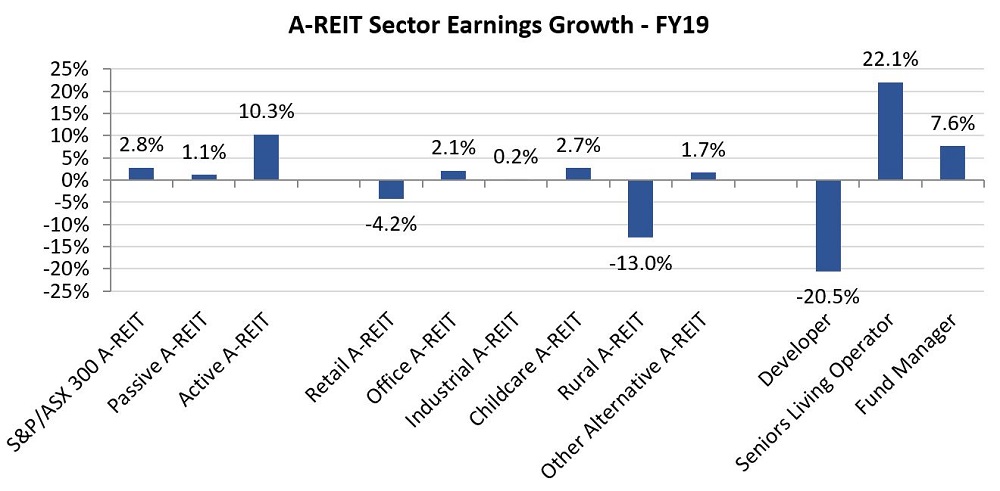

The A-REIT results from the August 2019 reporting season were generally positive and in line with our expectations. On average, A-REITs delivered annual EPS (earnings per share) growth of approximately 2.8% for the period ending June 2019. There were strong performances from retirement living operators and property fund managers, which delivered EPS growth of 22% and 8% respectively, and weak performance from residential developers, which delivered EPS growth of -20% for the year ending June 2019.

A key theme to emerge this reporting season was a moderation in underlying revenue growth across the A-REIT sector, offset by lower borrowing costs in most cases. Other themes included:

- continued solid performance from industrial and office portfolios

- weaker performance from retail portfolios, particularly those exposed to discretionary retail

- a deterioration in residential development performance and sectors linked to the housing market like storage and retirement-living development, and

- strong FUM growth from property fund managers who are benefiting from the lower interest rate cycle and the ‘hunt for yield’-orientated investments.

Office and industrial the standout sectors

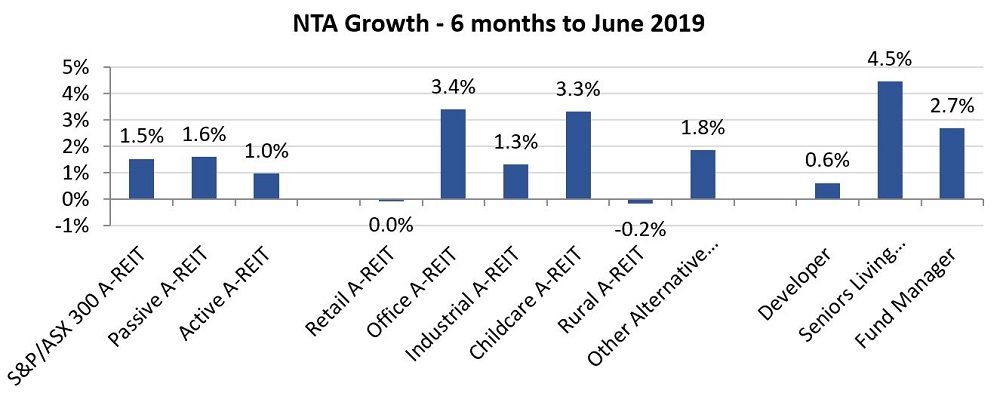

Turning to the A-REIT core sectors, both office and industrial continued to shine through the reporting season, with A-REIT results showing average like-for-like rental growth of 4.1% and 3.4% respectively. There were positive re-leasing spreads for many A-REITs.

Cap rate compression also continues to be evident for both sectors with office portfolios typically firming by 0.20% over the year and industrial portfolios even better with roughly 0.50% of compression. In contrast, results from the retail A-REITs were weaker, with average like-for-like rental growth of 1.3% and negative re-leasing spreads. Most retail portfolio values remaining largely unchanged on the prior year, but the stronger performance of non-discretionary retail A-REITs remains apparent.

Non-core REITs provide opportunities

Amongst the non-core property sectors, we noted positive results from childcare A-REITs, based on the continued under renting that exists in the sector. Solid results also came from service station A-REITs based on their long contractual leases.

However, there were mixed results for the rural-focused A-REITs. Rural Funds (ASX:RFF) delivered a solid result while Vital Harvest (ASX:VTH) was negatively impacted by weaker conditions in the berry market. A portion of its rent is derived from a share in the underlying earnings of its tenants.

Residential developers delivered much weaker results this reporting period, reflecting the weak housing market. Typically, volumes were 20% lower on the prior period and margins were in most cases were lower. This underlying performance translated to many listed residential developers delivering EPS growth which was roughly half the prior year. However, a more favourable outlook has emerged given positive sentiment returning to the sector, and we note most residential developers were experiencing increased inquiries, which have yet to translate into any meaningful lift in pre-sales.

While Retirement Living Operators continue to benefit from Australia’s ageing population and low levels of supply of quality seniors living, the sector has recently been negatively impacted by the downturn in the residential market. The weak housing market has been increasing sale lead times as many retirees are taking longer to sell their existing homes, and this has had a negative impact on settlement numbers for retirement living operators.

Despite these challenges, we note strong results from Lifestyle Communities (ASX:LIC), Eureka Group (ASX:EGH) and Ingenia Communities (ASX:INA), with a weak result from Aveo Group (ASX:AOG). These differences largely reflect the recent emergence of more rental-type models in the sector (commonly known as MHE), as opposed to the Deferred Management Fee model which AOG still focuses on.

Property fund managers continue to benefit from low interest rates and the relative attractiveness of their product offerings for yield-orientated investors. This was again apparent at reporting season, with average annual FUM growth of 20% delivered by these groups for the year ending June 2019. We note strong results from Charter Hall (ASX:CHC) and Goodman Group (ASX:GMG) in particular.

Investment case still compelling

A-REIT balance sheets remained in good health with average sector gearing of approximately 30%, which was slightly lower than the prior year and over 10% lower than the levels recorded leading into the last sector downturn during the GFC.

Looking forward, the earnings guidance from A-REIT management teams implies a similar top line EPS performance over the next 12 months to the one prior. It also appears that lower debt costs will continue to be a positive tailwind to earnings for most A-REITs and in some cases lead to likely positive earnings surprises. Other contributors to earnings such as rental growth, funds management fees, and development profits should be incrementally better in most cases, meaning the underlying performance of A-REITs remains sound.

With this backdrop, and with the sector trading on near record yield spread to government bonds, the investment case for A-REIT investing remains strong.

Jonathan Kriska is Portfolio Manager, Listed Securities at Charter Hall Maxim Property Securities. Charter Hall is a sponsor of Cuffelinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall (and previously, Folkestone), please click here.