It may seem obvious that financial stress would have a direct impact on people’s health and happiness. However, new research from Fidelity International suggests that Australians are not making the link between financial health and our overall wellbeing.

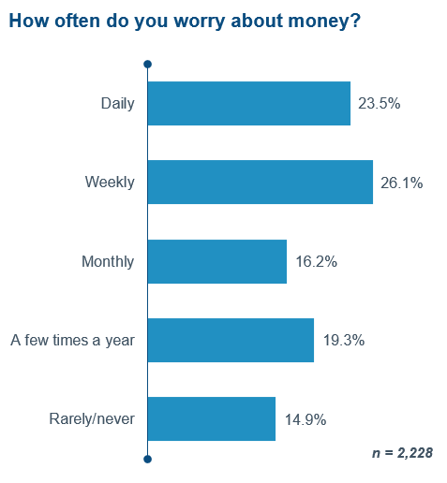

Fidelity’s survey of over 2,000 Australians shows almost half of us worry about money at least weekly, with one in four worrying at least daily. And having money doesn’t necessarily make people immune from anxiety. More than a third of Australians with more than $1 million of assets to invest still worry at least monthly.

What are Australians worrying about?

We have enjoyed more than 25 years of uninterrupted economic growth and Australia has not experienced a recession since 1991. Our superannuation system is the envy of many parts of the world and most people have now been accumulating savings to fund retirement since the Superannuation Guarantee started in 1991, a healthy last 28 years ago.

Despite this, less than one in five Australians rate their financial wellbeing as high or very high. At a time when the economic outlook is starting to look more uncertain, only one in five believe they would be financially stable if they were to lose their job tomorrow, with almost three quarters saying they could only manage for a short period or not at all.

Retirement is also weighing on people’s minds. More than half of Australians feel they are not on track financially to have a retirement they are happy with. Around 50% worry they might not be able to live where they want to in their golden years and a similar number expect to have to keep working past retirement age to fund their retirement.

The adverse impacts are not only financial

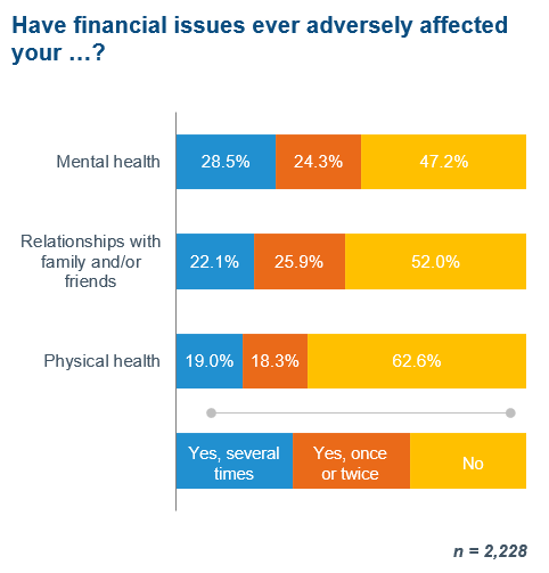

Perhaps most surprising is the extent to which these sorts of financial issues affect all facets of our lives. More than half of Australians report that their mental health has been adversely impacted by financial issues, while others say their relationships and physical health have suffered.

The benefits of seeking financial advice

It’s not all bad news. The survey suggests that the picture is improved for people who seek help with their finances. While 56% worry about money at least monthly, that number jumps to seven in 10 for those who do not receive financial advice.

Australians receiving financial advice are twice as likely to rate their level of financial wellbeing as high or very high, compared to those who are not receiving advice. And when asked how prepared they feel for retirement, 64% of people who are advised say they are either ‘very’ or ‘reasonably’ prepared, compared to just 26% of unadvised people.

Perhaps the most compelling finding was in relation to people’s overall wellbeing, 50% of Australians receiving financial advice say their mental health has improved as a result of advice, while 38% reported their family life is better.

So with so many people reporting the benefits of financial advice, why aren’t more people accessing it? Last year’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, which revealed practices that fell well short of the community’s expectations, could be one reason. However, the survey shows it isn’t the main deterrent.

A recurring theme among those who have never sought advice is they don’t believe they can afford it or they don’t believe their circumstances justify the need. And when people do seek advice, it is usually around a life event or milestone. Nearly a third of people first sought financial advice because they were approaching retirement, followed by a property purchase.

Don’t wait for the financial trigger

The problem with this that by waiting for a trigger such as retirement to seek help, we may not be giving ourselves the best chance of being in control of our futures. It is only by starting the discussion early and making a plan that we will have control over when we retire, how much we will retire with and what our lives will look like after we retire.

And this is backed up by our survey. While around 26% of people overall say they are not prepared at all for retirement, that number drops to just 10% for those who are advised. And those people who have an adviser also about the positives for their overall quality of life. These include being able to live their desired lifestyle, not having to worry about money and improved mental health.

While much of the discussion around the benefits of financial advice focuses on the amount of assets we have or the financial returns that can be achieved, our research demonstrates the wider benefits and peace of mind it can provide. People who seek advice often leave with a much stronger sense of wellbeing and control over their future and that’s something we can all benefit from.

Alva Devoy is Managing Director, Australia at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2019 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.