Australians are living longer than ever before, and many SMSF members are understandably becoming increasingly concerned about their fund’s management should they no longer be able to take care of it themselves.

By 2050, the number of people with dementia is predicted to be almost 900,000, according to the Australian Bureau of Statistics, and people are now questioning how they would manage their SMSF should they also succumb to the disease or to Alzheimer’s.

A small APRA fund (SAF) may be an appropriate alternative for SMSF members concerned about losing mental capacity or for elderly members who no longer have the capacity or desire for trustee responsibilities.

A SAF is essentially an SMSF with a professional licensed trustee. It provides all of the legislative flexibility available to an SMSF, but without the associated trustee responsibilities and the risk of compliance breaches. Like an SMSF, SAFs are restricted to four members.

Trusteeship benefits

An attractive feature of a SAF is that the trusteeship of the fund is performed by a specialist trustee company and is not related to membership of the fund. In an SMSF, on the other hand, all members must be trustees which can create difficulties if a member becomes ineligible.

A person who lacks mental capacity is unable to be an SMSF trustee. In addition, if a person becomes an undischarged bankrupt or is convicted of an offence involving dishonesty, they are classified as a disqualified person and are also unable to be a trustee. However, there are no legal issues with a disqualified person being a member of a SAF.

If an SMSF member becomes a non-resident, it can be difficult for the SMSF to retain its eligibility for concessional tax treatment. The central management and control of super funds is required to be performed in Australia. However, in a SAF, the professional trustee is an Australian-based company so the central management and control is performed in Australia, even if the member gives investment directions from overseas.

Compliance risk

In an SMSF, the compliance risk is borne by the directors of the trustee company or the individual trustees. The ability to effectively manage the fund’s compliance and investments requires skill, expertise and time.

While many SMSF trustees perform their compliance responsibilities soundly, often with the aid of professional advisers, this is often seen as the ‘boring’ part of running the fund, and the price paid for the investment flexibility and control that comes with an SMSF.

In an SAF though, the compliance risk is borne by a professional licensed trustee whose core business is to provide trustee and superannuation services. The licensed trustee is expected to be skilled and experienced and the common breaches of legislative requirements for SMSFs occur rarely, if ever, in SAFs. In the event that a compliance breach does occur, the professional trustee is responsible, not the members.

In the current environment of strict SMSF administration penalties ($10,800 for the most common compliance breaches) this is an attractive advantage to being a SAF member.

Administration

The administration of SMSFs can vary dramatically between funds, and there are often time delays that result in up-to-date fund information not being provided to members and their advisers.

For example, determining accurate account balances and portfolio valuations as at 30 June each year is often not possible until the annual accounts for the SMSF have been prepared (often in May of the following year).

It is also common for the production of accounts to rely heavily on the SMSF trustee providing timely and accurate information. Many trustees find their funds’ administration and record-keeping requirements even more boring and time-consuming than the compliance responsibilities.

The administration of SAFs is performed by a professional organisation appointed and controlled by the licensed trustee. The administration organisation records all fund transactions including collection of fund income, payment of expenses and asset purchases and sales.

SAF record keeping is timely and accurate because a licensed trustee controls custody of all the assets and receives all the information and transactions directly from external parties. In addition, a majority of SAF members and their professional advisers have 24/7 online access to account information including daily portfolio valuations.

It is not possible for SAF members to choose an auditor, accountant, trust deed solicitor or investment platform. All service providers are appointed by the licenced trustee. However, all investment transactions are placed via a licenced financial planner or broker chosen by the member.

Investments

Like SMSFs, SAFs are able to invest in property and collectables and may acquire business real property from related parties. Among this wide range, SAFs will require a diversified investment portfolio. The fund members make all the investment decisions and direct the trustee in this regard. However, members are required to remain within the investment strategy, or change their strategy if their circumstances change. The trustee does not make decisions to invest in any particular asset or asset class.

Fees

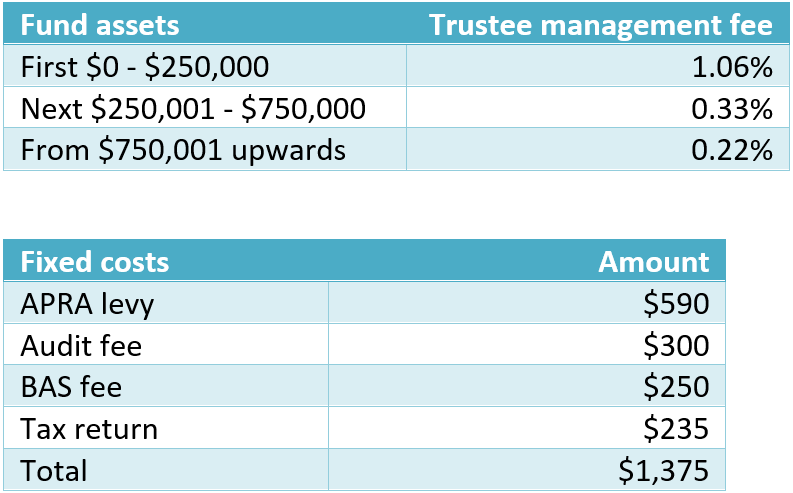

As SAFs are administered by a professional trustee, there are management fees paid to the trustee which comprise of a tiered percentage fee based on the fund’s assets plus a fixed cost fee to cover statutory expenses. These management fees are in addition to advice fees paid to a professional adviser. The annual tiered management fee is subject to a maximum of $7,500.

The fees charged by Australian Executor Trustees for managing a SAF are outlined below:

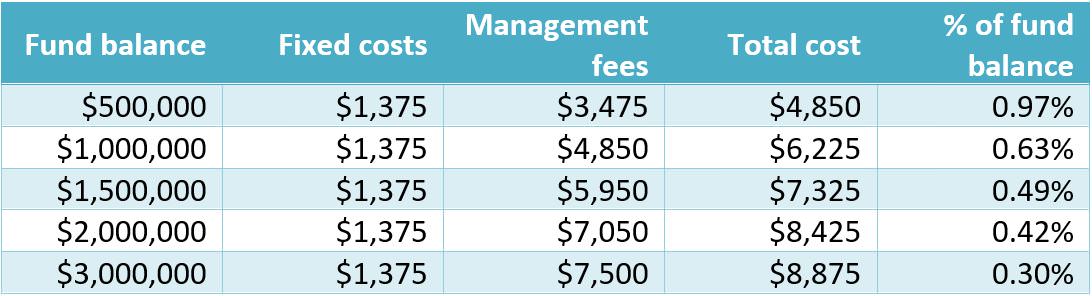

A sample of costs for various fund balances is provided below:

On a $1,000,000 fund balance the trustee management fee is calculated as:

- $250,000 x 1.06% + $500,000 x 0.33% + $250,000 x 0.22%

- $2,650 + $1,650 + $550 = $4,850

Conclusion

A SAF may be a useful alternative for members who want the flexibility of an SMSF without the compliance and administrative burden of being a trustee. They may also suit those ineligible to be a trustee such as overseas residents, bankrupt, or disqualified people.

Julie Steed is Senior Technical Services Manager at Australian Executor Trustees. This article is general information and does not consider the circumstances of any individual.