This week, JP Morgan downgraded its global growth outlook for 2020 by 0.2% to 2.3%, blaming 'population ageing'. Then Treasurer Josh Frydenberg said:

"It is estimated that the ageing of the population will reduce annual average real growth in revenue by 0.4 percentage points ... this equates to an annual cost to the budget of around $36 billion ... As our ageing population puts pressure on our health, aged care and pension systems, we need to develop policies that respond effectively to this challenge."

This sounds like a new policy agenda, but the Government has ruled out many changes which might be electorally unpopular. Without heavy lifting and tough-to-sell policies, we are left with:

"However, with Australians in work currently undertaking 80% of their training before the age of 21, this will have to change if we want to continue to see more Australians stay engaged in work for longer."

'Work longer' is hardly a breakthrough policy. Last week's survey on attitudes to generational inequity was particularly timely. While I am not so brazen to claim Firstlinks created two debates in mainstream media, our recent surveys were well ahead of the curve.

The 'OK Boomer' survey received the most personal and heartfelt feedback we have ever received. The 1,800 responses included over 600 comments, many describing the decades of work and sacrifice required to build retirement independence. Pre Boomers and Boomers reveal their years without holidays, working multiple jobs, 18% interest rates and no dining out (although some reminded me of the legendary 'Four Yorkshiremen' sketch. 'Luxury'). Younger generations lament missing the major city property booms, and many will need parental assistance. Leisa Bell summarises the poll results, with complete comments in a PDF report. More feedback welcome.

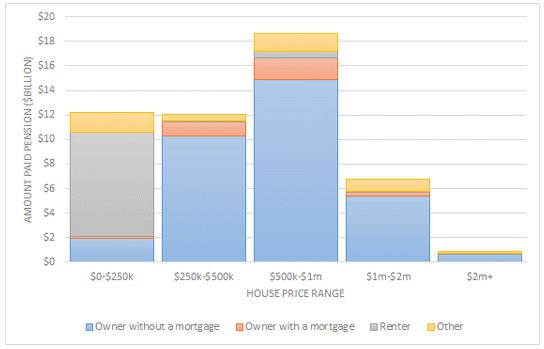

The other survey on the home in the pensions assets test has also become more widely discussed, although the Treasurer has ruled it out. Our survey results are here. New data from the ANU shows of the $50 billion in total pensions paid each year, $37 billion goes to home owners and $6 billion is paid to home owners in houses worth over $1 million.

Total pensions paid ($billion) by house value and tenure type, 2019-20

Source: ANU Centre for Social Research and Methods, 28 October 2019

We reprise a classic article with Nobel Laureate, Robert Merton, including his surprising views on pensions and reverse mortgages.

Our Interview Series continues with Peter Meany of First Sentier Investors discussing infrastructure hot spots. There are 13 listed infrastructure stocks in Australia (value $72 billion) but 350 worldwide (value $2.4 trillion). The case for investing in global infrastructure is strong.

After a good year, the All Ords Price Index all-time high of 6958 is within striking distance, and the US is in its longest and biggest bull market run in history, up about 450% since its trough on 9 March 2009.

So it is welcome, as Kate Howitt shows, that some semblance of reality and price rigour is being enforced, with active managers refusing to accept over-hyped and over-valued new issues.

We also have reality checks from both Peter Moussa, who sees room to run further but the final steps of the bull are nearing, and leading futurist Phil Ruthven, who describes the new world order as we head into the uncertainties of 2020 and beyond. The Sponsor White Paper from Neuberger Berman reports the most recent meeting of its Asset Allocation Committee.

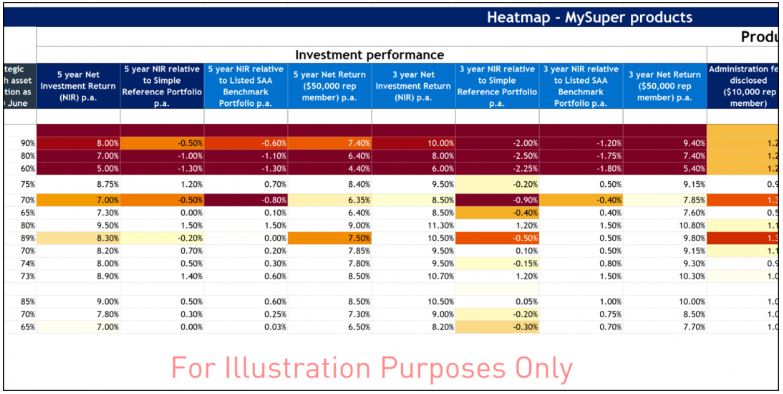

Early December will be a massive moment for large super funds, as APRA will release its 'heat maps' judging MySuper funds. Dark red is bad. Raewyn Williams explains APRA is also looking for greater innovation and funds must overcome internal barriers to creative solutions.

APRA's Helen Rowell gave a sneak peak at the heat map in this presentation, and warned:

"Unlike a sea of numbers on a spreadsheet, a row of red across the heatmap sends a message so clear and strong it nearly jumps off the screen."

Example of a MySuper heat map on investment performance

Finally, on the subject of Firstlinks leading the debate, the AFR ran a long article on Wednesday called, 'LICs in the spotlight over returns'. Chris Cuffe covered this issue in detail in this 2017 article, pointing out the inadequate reporting adopted by most LICs.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.