Companies hit by technology disruptions from competitors often face tough decisions hanging on to customers. It's why investment analysts look for strong 'economic moats' in the best companies. For example, Morningstar's definition is:

"An economic moat is a structural feature that allows a firm to sustain excess profits over a long period of time. Without a moat, profits are more susceptible to competition."

Technology can destroy moats, and it's happening to Foxtel. Two years ago, I was paying Telstra $238 a month in a bundle for high-speed broadband and Foxtel. Realising we did not watch many channels, we separated Foxtel and reduced the channels, paying $113 to Foxtel alone. With the growth of streaming services such as Stan and Netflix costing $10 to $14 a month, and sport on Kayo for $25, our Foxtel cost was too high. Worse, Foxtel was offering new subscribers the service we wanted for $58 a month.

In calls to Foxtel asking for the $58 rate, we were reminded we had been "loyal for 19 years" but we were told the $58 rate was only for new customers. How do we become a new customer? By returning all the Foxtel equipment at their cost, waiting 30 days, then they would post the equipment back to us and we could go on the $58 rate. So that's one strategy to retain customers.

Foxtel's 'churn' rose to 14.4% in 2019 versus 12.9% the previous year, and parent News Corp has lent it $700 million as the losses build. We have realised the streaming services and free channels on chromecast meet our needs.

Foxtel's business decision is the same reason banks offer worse home loan and deposit rates to existing customers, and inertia pays off for a while. However, it's possible that the new flexibility of Open Banking will do to the incumbent banks what streaming has done to Foxtel. A moat is a moat until it leaks.

There are few greater changes in our lives than the smartphone, and on the just-passed anniversary of Steve Jobs launching the first iphone on 9 January 2007, it's fascinating to see how far we have come in only a dozen years. Said Jobs at the launch:

"Every once in a while, a revolutionary product comes along that changes everything ... today, we’re introducing three revolutionary products of this class ... an iPod, a phone, and an internet communicator. Are you getting it? These are not three separate devices, this is one device, and we are calling it iPhone."

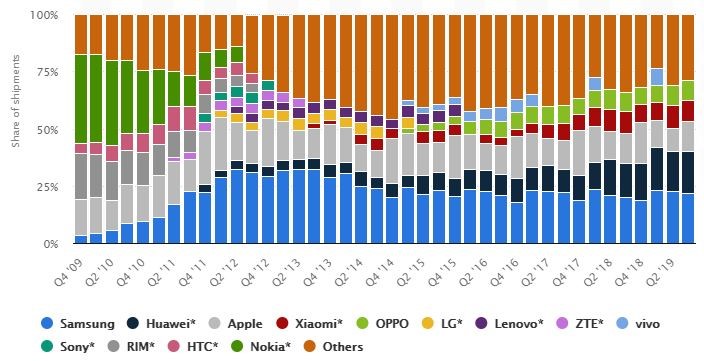

These early Apple launches were like religious events, and they destroyed competitors. No doubt Nokia once had a moat. As the following chart from Statista on smartphone shipments shows, Apple's ongoing success comes not from dominating sales, but its remarkable ecosystem and quality that commands a price premium.

In this week's edition ...

In a year when many funds delivered stellar results, geared funds are near the top of 2019 league tables. We explain how this was achieved, but warn about the asymmetry of results. For those tempted to borrow to invest in shares, Roger Montgomery describes his optimistic assessment of the market.

Given the confidence sweeping global equity markets, many at all-time highs, it's surprising to read Louise Watson's report on new research into attitudes of large investors. Their pessimism includes a majority expecting GFC-like conditions within a few years.

Over many years, state and national governments have introduced a wide range of benefits for retirees, but as Brendan Ryan says, not many people tap into them fully. See his enticing list of 20 opportunities.

Bank hybrids are a highly-popular alternative to term deposits despite the added risk, and Norman Derham provides a simple way to measure the yield pick up and whether the risk is worth it.

Rob Garnsworthy was a senior wealth executive at the top of the industry, but now long-retired, he admits he has turned from poacher to gamekeeper in his attitude to investing.

If you want to give to bushfire victims but are wondering if the money will be used properly, philanthropy expert Antonia Ruffell provides a list of charities and activities with strong bona fides.

This week's White Paper from BetaShares is the 2019 review of the Australian Exchange Traded Fund (ETF) market, reaching a remarkable $62 billion with 52% growth in only one year.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.