The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

The Federal Election heard the concerns of many younger people that they’re being disadvantaged by Government policies that favour older people over them. A new report suggests they might be right.

Academics from the ANU’s Crawford School of Public Policy have released a paper measuring the way that the tax and transfer system redistributes income between Australians of different ages and how that’s changed in the past three decades.

The paper, ‘Measuring the changing size of intergenerational transfers in the Australian tax and transfer system’, has found that the system has been more generous to older Australians than younger ones.

It says government spending on older people, including the age pension, aged care and health care, has increased significantly in real, per-person terms over time. By contrast, net spending on younger households has remained relatively constant.

And the figures aren’t distorted by an ageing population as they’re measured on a per capita basis.

The paper says the increase in transfers to older Australians has happened in a period where older people have also earned significantly more private income, primarily from higher capital income from real estate and superannuation.

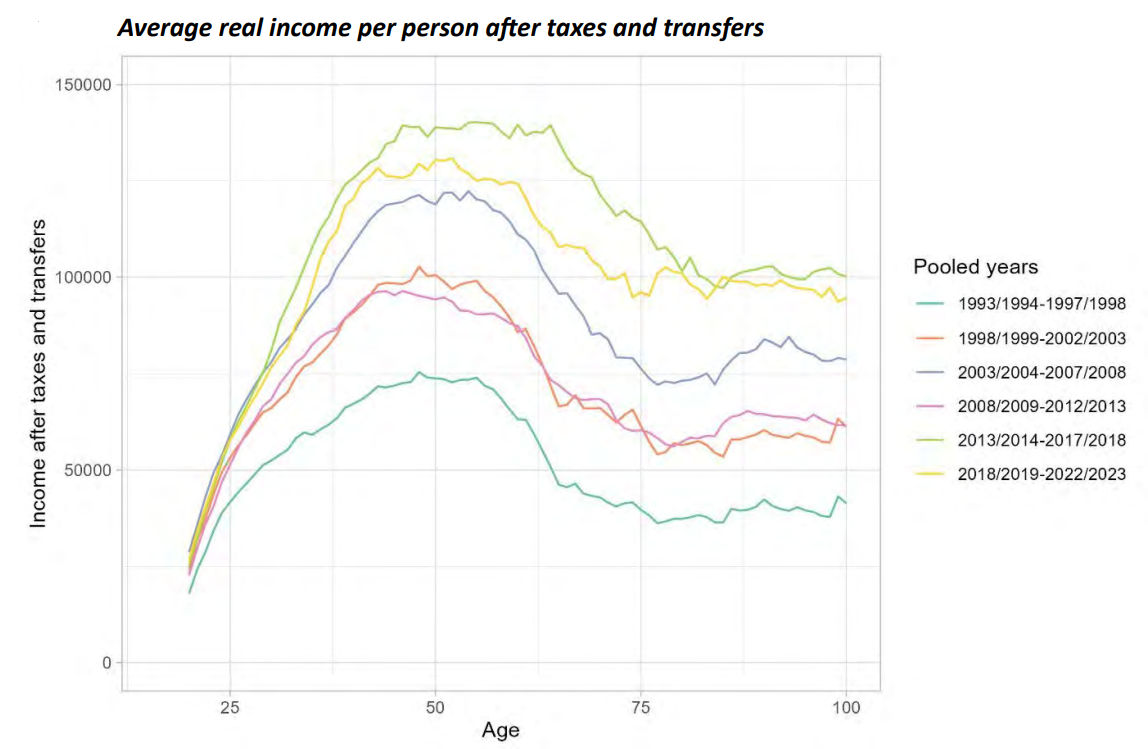

It says these two trends have had a significant impact on the nature of our tax and transfer system and income distribution by age. For instance, from 1993/94 to 2002/03, Australians aged over 60 had private income equal to 41% of the income of Australians aged 18 to 60 and average final income (after taxes and transfers) equal to 61% of the income of Australians aged 18 to 60. Yet, in the final ten years of the study, the pre-tax income of Australians aged over 60 was 65% of the population aged 18 to 60, and post-tax income was equal to 95% of their income.

It goes on to suggest that the trend is even more notable when Australians over the age of 60 are compared to those aged 18 to 30. In the past decade, the older cohort has earned an income around 11% higher ($72,000 compared to $64,000 in 2022 dollars). However, the tax and transfer system means that the older group has an average after-tax income 60% higher than the younger group.

What’s behind the trends?

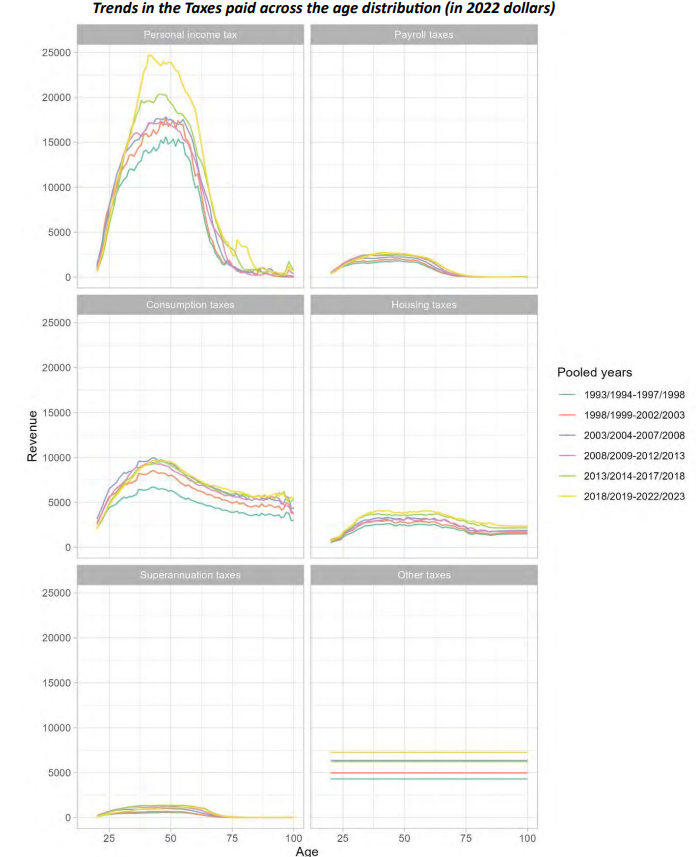

The chart above shows the six main levels of taxes and it’s primarily been personal income tax which has been a key contributor to the growing divide between old and young. The growth in personal income tax has been driven by an increase in real incomes along with the average tax rate on income remaining relatively stable during the period. Numbers for the other taxes haven’t changed as much.

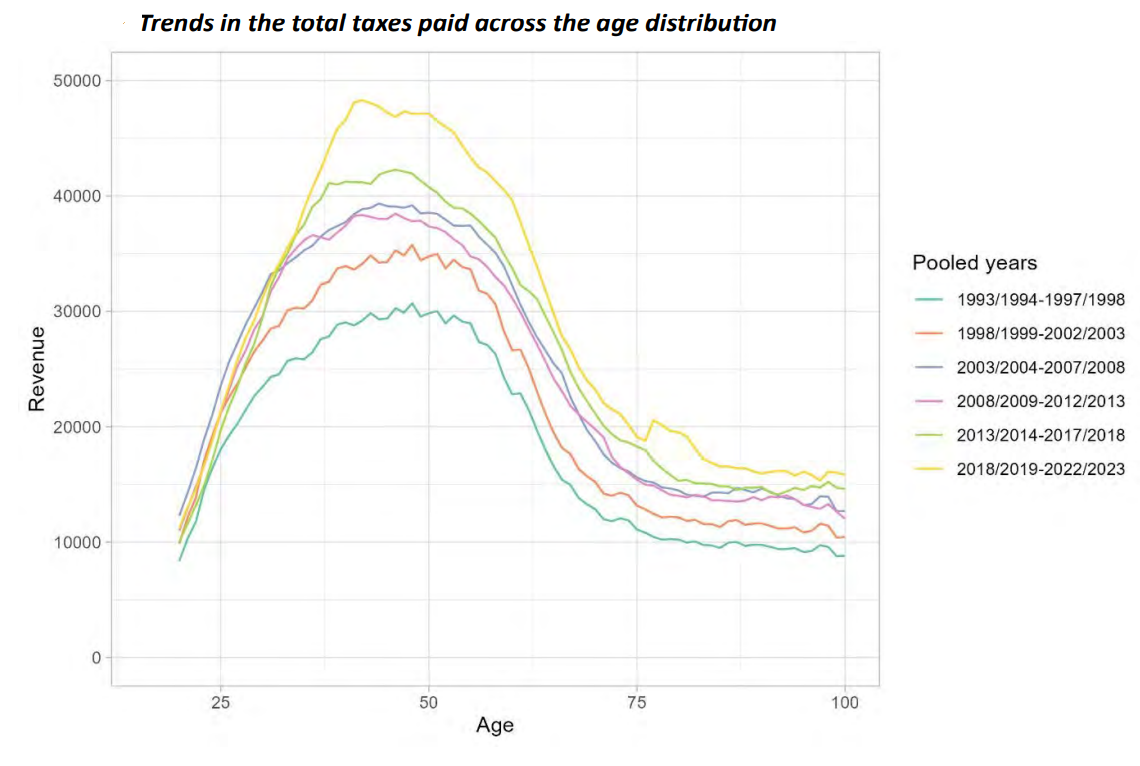

The next chart shows the change in aggregate taxes for different age groups. It reveals that total taxes paid have increased meaningfully for those in the highest earning years. Meanwhile, taxes have also increased for older people but remain low in absolute terms. And taxes paid haven’t risen for the young reflecting the low growth rate in earnings for this group.

The other change has been in Government spending on different age groups.

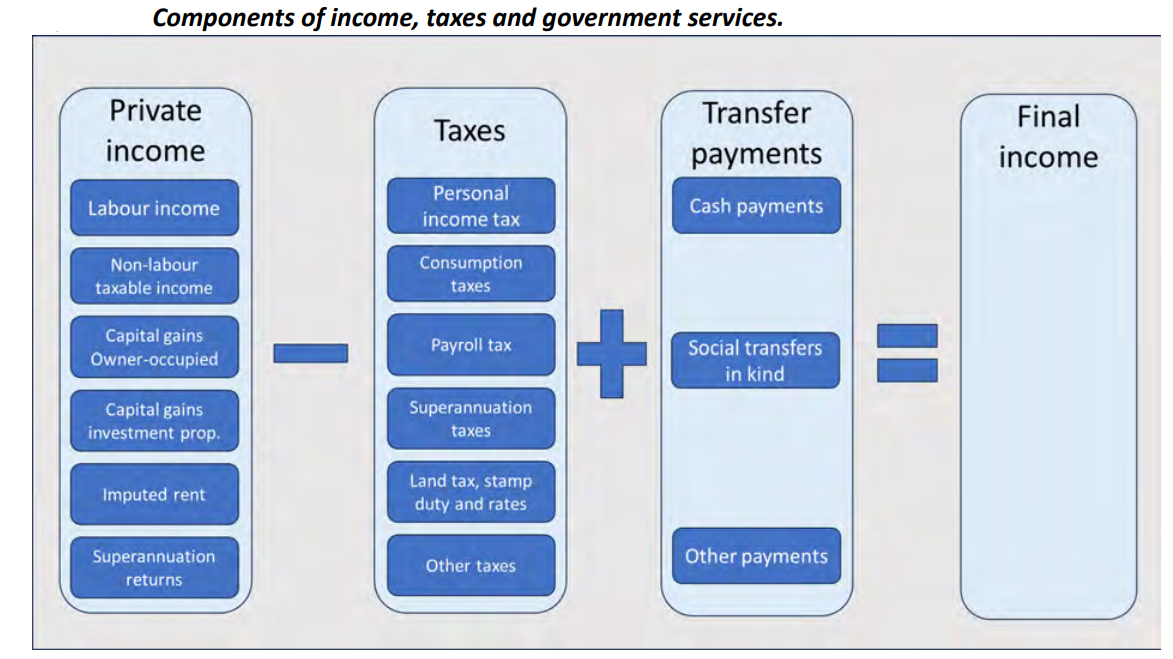

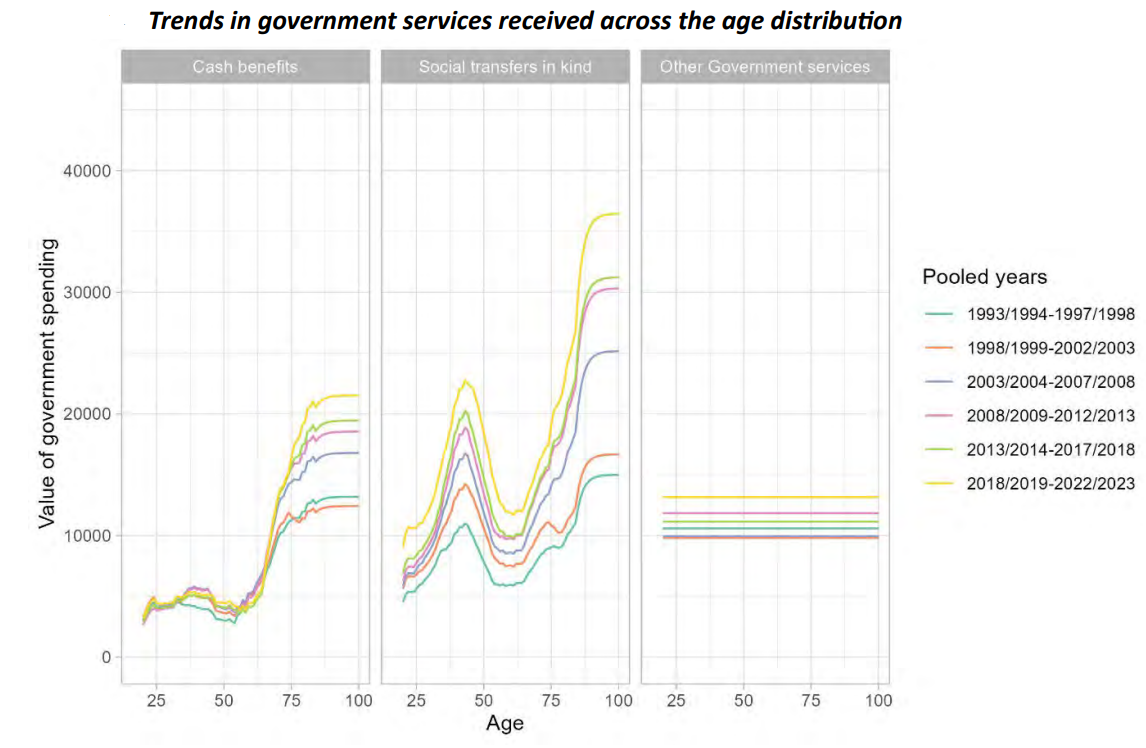

The paper breaks down Government expenses into three categories:

- Pensions and other cash benefits

- Social transfers in kind, such as health and education, where the spending has a clear recipient.

- All other government spending such as infrastructure costs or defence is assumed to be spread equally across all people above the age of 15.

The chart suggests that older people have benefited disproportionately across cash benefits and social transfers when measured on a real, per-person basis.

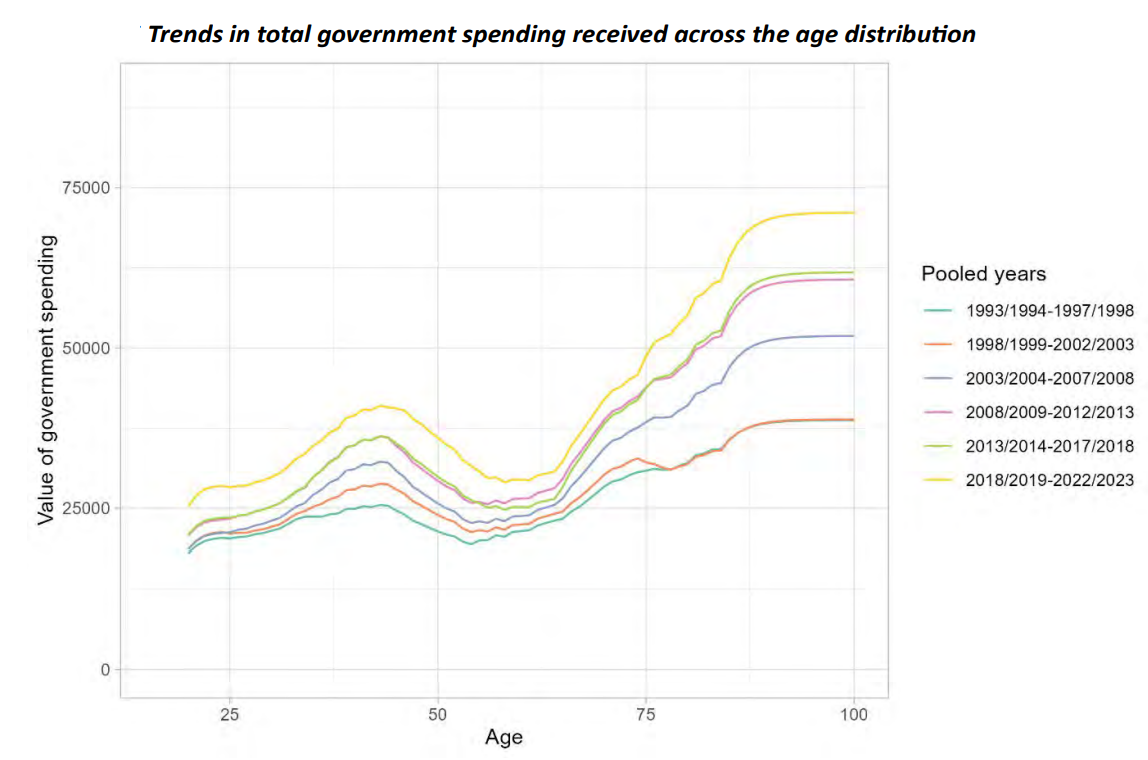

The next chart aggregates all Government spending across age groups.

Adding it up

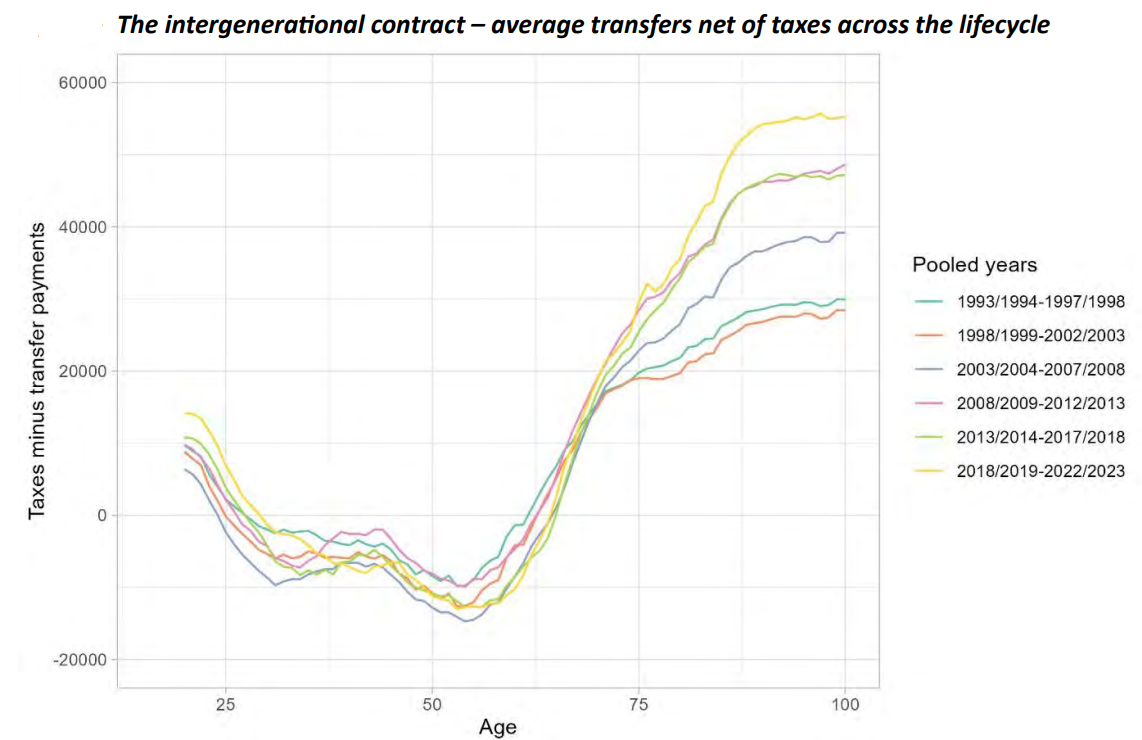

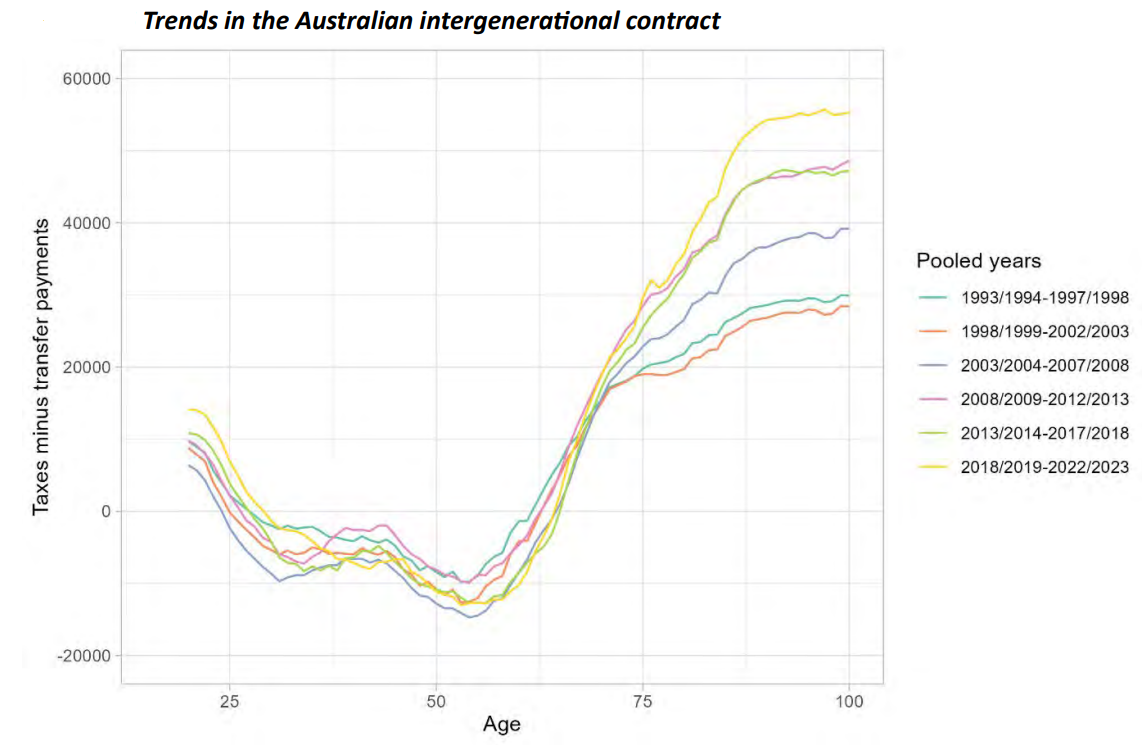

So what does this all add up too? The paper says that by combined the net impact of taxes less transfers, you can gauge the impact of the tax and transfer system on different ages over time. And here’s the result:

This shows that the system has transferred money from people of working age to those of older ages in every period. But the net transfer to older Australians has increased most in real terms in recent years. And transfers to younger cohorts have not increased to the same degree.

Key findings

From the data, the paper reaches several conclusions:

- The tax and transfer system has not adjusted to the changing age profile of income in Australia. It increasingly favour older Australians at the expense of the young. Unless we want to explicitly favour older Australians, policies should be considered that reduce payments to older people and shift the tax burden away from the young towards the old. Policy rules around means testing could be an important part of such a shift.

- The personal income tax system captures only around two-thirds of household income, leaving income generated from owner-occupied housing and superannuation lightly taxed. This has important implications for efficiency and equity.

- Growth in land prices has created large transfers of wealth between generations. This price growth is driven to some extent by government policies, such as restrictive zoning and planning practices. Removing these barriers makes sense.

- To achieve a fiscally sustainable budget over the coming decades, Australia must choose between increasing taxes and reducing government expenses. The consequences of this adjustment should be borne, at least in part, by older Australians. Achieving budget sustainability solely by increasing taxes on Australians of working age (mostly by growing personal income tax revenue through bracket creep) will worsen generational inequities.

****

On the topic of Government expenses, Peter Swan and Dimitri Burshtein say Labor should make spending cuts a top priority. Reining in spending wouldn't just address our budget concerns but they say it would also clear the way for the meaningful tax reforms that are needed to boost Australia's ailing productivity.

****

In my article for this edition, I look at Buffett's shock announcement to depart as Berkshire Hathaway CEO and reflect on his extraordinary legacy as an investor and teacher. I also address some of his concerns about America's future, as he warns of unsustainable deficits and a fragile US currency.

James Gruber

Also in this week's edition...

Former Liberal Party minister, Arthur Sinodinos, breaks down what went wrong for his party in the election. He says the Liberals pursued ideology over the values and needs of mainstream Australia. He believes the party needs to return to its Menzian, pragmatic roots and integrate those values with those of the broader community. And it wouldn't hurt to get some senior party elders to lead this so it happens well before the next election, he says.

For the fist time in more than a decade, gold is getting news headlines and retail investor interest. And, predictably, we're starting to get outlandish forecasts for the gold price. US$5,000 an ounce? There's even been a US$20,000 prediction of late. Research Affiliate's Campbell Harvey digs deep into the key drivers for gold and gives a balanced assessment of what may be in store for the yellow metal.

Pelin Akyol and Kadir Atalay says Australia’s push to delay retirement has boosted workforce participation - but at a cost. Their research reveals the measures have unintentionally impacted fertility rates, and the trend will be hard to reverse.

Contrarian investing lost its lustre in recent years as momentum driven markets reached new highs. This year's market volatility though has brought more opportunities for the contrarians. Among the tribe is MFS Portfolio Manager Zahid Kassam who details his views on the benefits and potential pitfalls of contrarianism as well as his favourite global stock picks.

The wheels are falling off the green transition in America, according to Peter Zeihan. He says it's largely due to economic pressures, lack of financing, and the new tariffs instituted by Donald Trump.

Two highlights from Morningstar this weekend. Joseph Taylor explores how similar BHP and Rio Tinto really are, while Gregory Warren shares his five big takeaways from Berkshire Hathaway’s eventful annual meeting.

This week's whitepaper is Neuberger Berman's latest Fixed Income Investment Outlook looking at ways to ride out the Trump administration’s tariff storm.

****

Weekend market update

In the US on Friday, stocks traded virtually unchanged in a snoozer of a session featuring the lowest trading volumes on the SPDR S&P 500 ETF Trust since February, wrapping up the week with a 0.3% rise on the blue-chip gauge as last month’s stomach-turning volatility has seemingly gone by the wayside.

Treasurys likewise finished flat on the long end of the curve with two-year yields ebbing to 3.88% from 3.9% Thursday, while WTI crude stayed on the front foot at US$61 a barrel and gold bounced back to US$3,229 per ounce. Bitcoin ripped higher yet again at US$103,300 and the VIX settled south of 22 for the first time since April 2.

From AAP:

The Australian share marketfinished the week basically flat, with investors wary ahead of the first round of US-China tariff talks. The benchmark S&P/ASX200 rose 0.48% to 8,231.2 on Friday, as the All Ordinaries lifted 0.49% to 8,462.6. The top-200 finished the week barely seven points lower than 8,238 at last week's close.

Nine of 11 local sectors made gains on Friday, as materials gave up 0.5% and real estate stocks finished just below flat.

Banks helped lift the bourse as financials rose 1.1%. Westpac led the big four with a 2.3% gain to $31.21, after selling off for most of the week, with 6.9% wiped from its market cap since last Friday. Macquarie rallied 3.8% on better-than-expected results, capping a fifth-straight week of gains for the investment and financial services giant.

Large cap miners BHP and Rio Tinto weighed on the materials sector, down 1% each as iron ore futures failed to reclaim Thursday's price slump.

Energy prices pushed 0.8% higher as oil prices ticked up, but the sector is still down almost 14% in 2025, tracking with a 15.5% slide in crude prices.

IT stocks outperformed the broader market, up 1.8% on Friday after slipping as much as 2.5% earlier in the week.

Next week, all eyes will be on what, if any, outcome arises from US-China trade talks, while US inflation data later in the week also has market-moving potential.

With the Reserve Bank's next meeting less than two weeks away, Australian jobs data on Thursday could provide the last obstacle to a widely expected interest rate cut.

Curated by James Gruber, Joseph Taylor, and Leisa Bell.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website