When Warren Buffett stepped onto the podium at the Berkshire Hathaway shareholder meeting in Omaha last weekend, only two people knew of the statement he would soon make that would shake the investment world. They were his children, Howard and Susan, who were also company board directors. The rest of the board was kept in the dark. As was his anointed successor, Greg Abel.

When Buffett announced that he would step down as CEO of Berkshire Hathaway by year-end, the initial shock quickly turned to gratitude as the tens of thousands in attendance at the meeting stood and applauded for several minutes. It was moving and seemed an appropriate end, albeit without Buffett’s long-time sidekick, Charlie Munger.

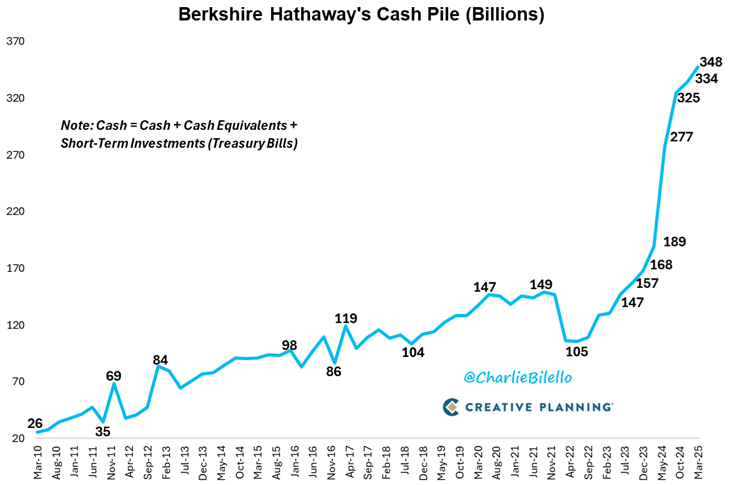

Buffett is leaving Berkshire Hathaway in terrific shape. This year, Berkshire’s stock is up 13%, easily topping the S&P 500’s 4% rise. And over the past year, the stock has returned 28% against the index’s 10%. That’s while carrying a record amount of cash on the company’s balance sheet.

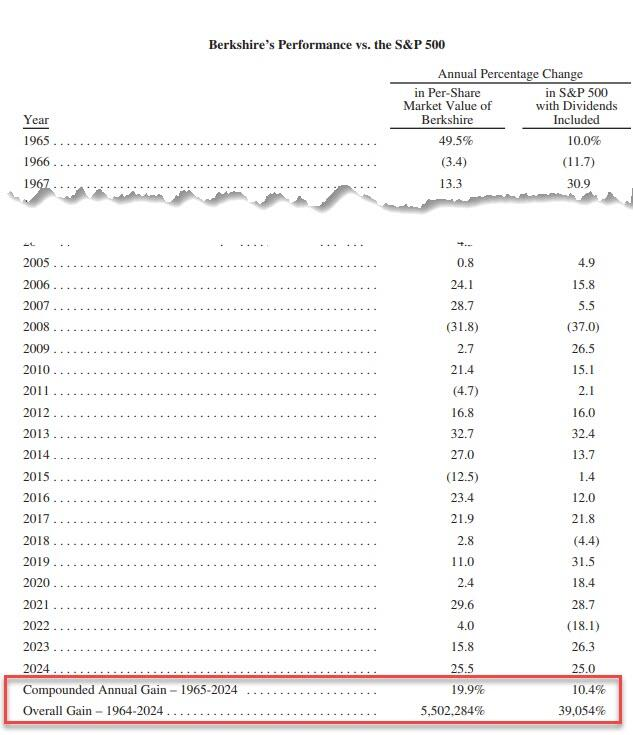

Meanwhile, Buffett’s long-term track record is unparalleled. Since Buffett became CEO in 1965, Berkshire Hathaway shares have returned 20% per year compared to the S&P 500’s 10%. That represents a cumulative return for Berkshire of 5,500,000%. Put another way, a US$10,000 investment in Berkshire in 1965 would be worth US$550 million today.

Source: Berkshire Hathaway

Buffett’s announcement had me reflecting not only on this remarkable record but also how the arc of Buffett’s career had mirrored the rise of the US as a superpower.

Buffett’s formative years were at the University of Pennsylvania and Columbia University in the late 1940s and early 1950s before he set up a fund in 1956. The fund achieved incredible returns of 32% per annum over 11 years and it was in the latter stages of the fund’s life that Buffett took over a then small company called Berkshire Hathaway.

He turned the business into an investment machine, buying since storied companies such as See’s Candies and Washington Post in the 1970s. His investment performance started to gain national media attention then, though it was his shareholder letters from 1977 that turned him into a cult hero.

These letters showed that Buffett wasn’t just a great investor but a great teacher too. His folksy stories, humility and ability to simplify complex financial jargon endeared him to shareholders and investors alike.

The trajectory of Buffett’s rise mirrored America’s advance as the world’s superpower. With World War Two decimating Europe and Asia, the US became all powerful in the 1950s. US share of global GDP went from 16% in 1900 to a peak of 40% in 1960, just as Buffett’s career was taking off. That economic might took a hit in the inflationary 1970s, though since 1980, US share of GDP has stabilized at close to 26%.

From the 1960s, America became a cultural power too. It exported cars, movies, music, books, advertising, and language to the world.

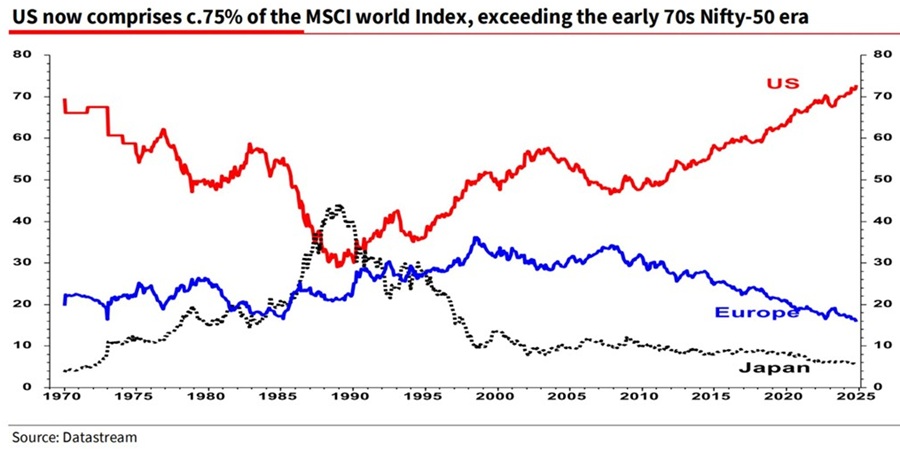

And from the 1990s, the US also became the dominant stock market globally. From then, whatever happened on American markets on any day impacted every other market.

It’s funny how Buffett is departing soon after the phrase ‘American exceptionalism’ became commonplace in markets. In many ways, Buffett represented American exceptionalism over his 60-years as CEO of Berkshire Hathaway. And I wonder if Buffett may be bowing out on top as some of America’s problems come into focus under the Presidency of Donald Trump.

Buffett says don’t worry but …

Buffett has always been an optmist on America, sometimes sqeamishly so. Though at this shareholder meeting, some concerns also became apparent.

Previously, Buffett has acknowledged how luck played a role in his career. He’s called it winning the ‘ovarian lottery’, having been born in the United States at the time he was.

He again reiterated this at this meeting:

“The luckiest day in my life is the day I was born, you know, ‘cause I was born in the United States.”

And he was seemingly still bullish on America’s prospects:

“I was lucky … We’ve gone through all kinds of things … If I were born today, you know, I would just keep negotiating in the womb until (they) said you can be in the United States…

The United States has changed since I was born in 1930. We’ve gone through all kinds of things, and we’ve gone through great recessions, we’ve gone through World Wars. We’ve gone through the development of an atomic bomb that we never dreamt of (at the) time I was born. So I would not get discouraged.”

Yet, Buffett was discouraged by several things. He indicated that he wasn’t in favour of higher tariffs as “trade can be an act of war” and the US “should be looking to trade with the rest of the world. We want a prosperous world”.

His views were even more pointed on the prospects of the US dollar:

“Things happen in the United States that … make us want to own a lot of other currencies. I suppose if we made some very large investment [in a] European country … there might be a situation where we would do a lot of financing in their currency.”

And Buffett was especially negative on the growing US budget deficit:

“Fiscal policy is what scares me in the United States…

We’re operating a fiscal deficit now that is unsustainable over a very long period of time. We don’t know whether that means two years or 20 years … because there’s never been a country like the United States, but you know, this is something that can’t go on forever…

We’ve got a lot of problems always as a country, but this is one we bring on ourselves … If you picked a way to screw it up, it would involve the currency … That’s happened in a lot of places.”

Is Buffett right to be concerned?

Buffett’s views on tariffs align with almost every economist: that they’re bad for global trade and are effectively a consumption tax.

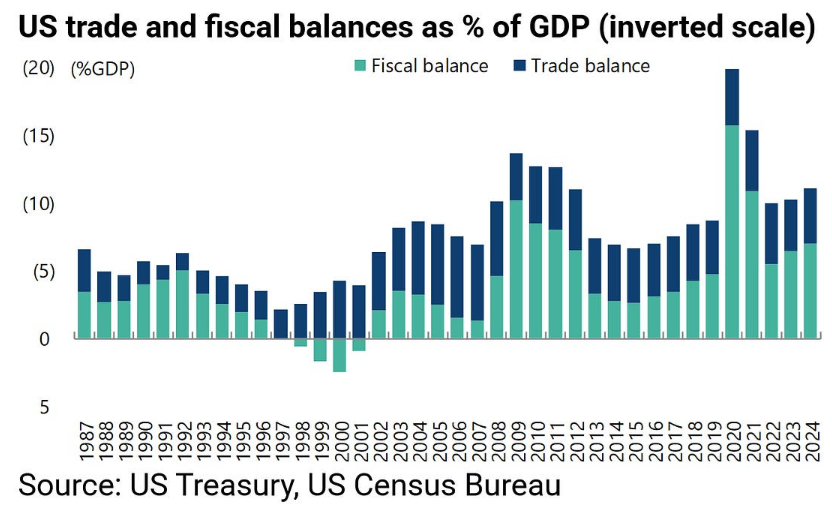

And his comments on the trade deficit aren’t new – he first expressed concerns more than two decades ago. However, he did spend more time on the issue at his meeting and the impact that deficits may have on the US dollar.

Are Buffett’s worries valid? On tariffs, no doubt. On trade deficits, stock and bond markets have been remarkably sanguine about them for a long time, however recent turbulence suggests that’s no longer the case.

The markets and Buffett are right to be concerned. After all, the trade deficit has rarely been his high, aside from the Covid period.

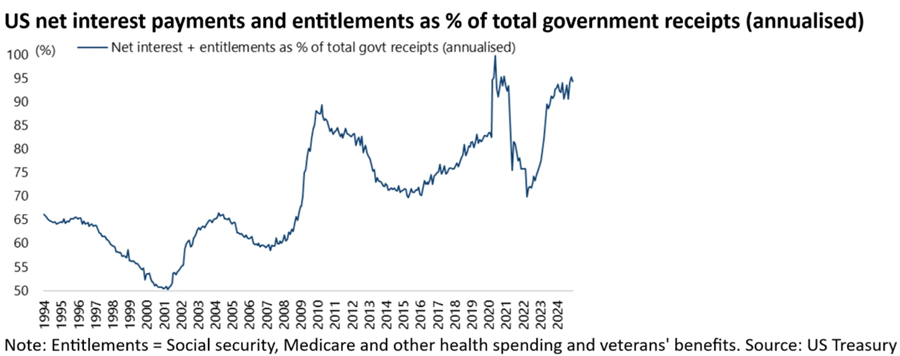

The scariest chart that you’ll see is the following one, which shows that net interest payments and entitlements accounted for 94% of total government receipts in the 12 months to December 2024.

As Buffett says, this is clearly unsustainable and could impact confidence in US bond and currency markets, as we’ve already started to see this year.

There was initial optimism that Elon Musk and the ‘Doge’ department might address the deficit by savagely cutting Government spending. Musk promised US$2 trillion in cuts, though that’s since been scaled back to US$150 billion, and even that amount is probably overcooking it.

The issue for the stock market is that a loss of confidence in the US bond market can lead to higher bond yields, which results in tighter money supply and lower terminal multiples for stocks. And waning confidence can also lead to foreigners selling out of US assets, including shares. We’ve seen bouts of these things in 2025.

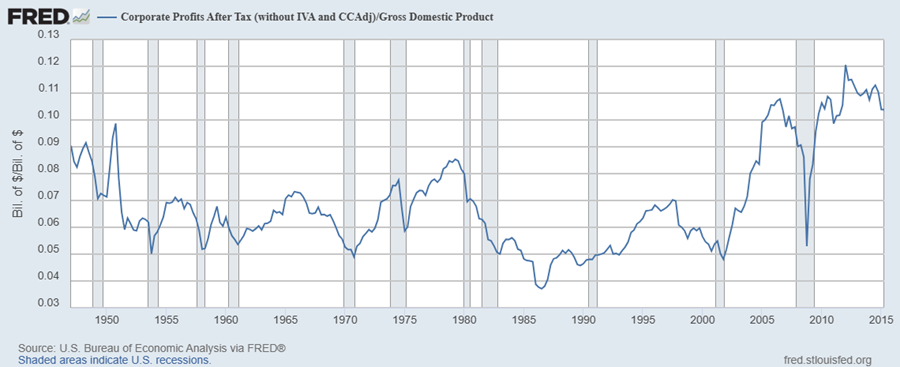

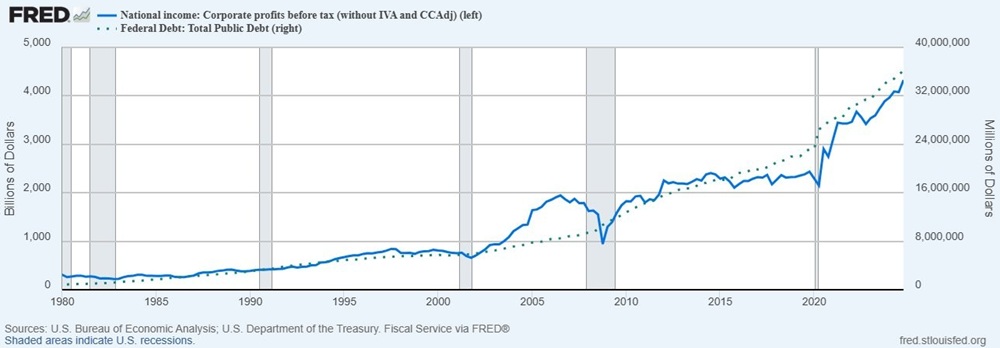

The bigger issue for the stock market is one less spoken of. And that’s how Government spending has turbocharged demand in the economy and fuelled record high profit margins and profits for US listed companies.

There’s a correlation between growing US debt, via the rising trade deficit, and the record profit margins.

Therefore, the growing US trade deficit has been a boon for corporate profit margins and S&P 500 earnings. If further action to reduce the deficits seems inevitable, that would be negative for corporate earnings as well as the steep valuation multiples currently attached to those earnings.

A more optimistic take

Going back to the question posed in the title: does Buffett’s farewell represent peak America? From a stock market perspective, I suspect the answer may be yes. Though commanding a 26% share of the global economy, the US has managed to garner 75% of the MSCI world market index. That’s unprecedented and given the current record high profit margins and near record company valuations, that could well represent a peak both in the short and long terms.

From an economic viewpoint, I’m a little more optimistic than Buffett. For all of Trump’s faults, he’s brought Government spending and the deficit into the spotlight and now politicians and the public are aware of the reckless path that the country is on. That spotlight should ensure more action to address the deficit.

This, plus US global leadership in technology, access to cheap energy, and positive demographics, should ensure a prosperous America well beyond Buffett.

James Gruber is Editor of Firstlinks.