This is an interview between Firstlinks’ James Gruber and Zahid Kassam, Portfolio Manager at MFS Investment Management. Kassam co-manages MFS’ Contrarian Capital Strategy, a global long-only equities fund, and he recently visisted Australia.

James Gruber: How would you define contrarian investing?

Zahid Kassam: I think it's recognizing that human nature is enduring, first and foremost. It's the classic fear and greed cycle, and Mr. Market going into bouts of excessive optimism and pessimism. And it's the classic Warren Buffett: you want to be greedy when others are fearful and vice versa. Philosophically, I would say that's where we start.

In practice, we're looking for areas of controversy in the market, companies that are having a tough time, tough end markets. Maybe management has stubbed their toes on the way, and they've put the business in a tough spot, and then we dig under the hood to see if there's an asymmetric upside/downside opportunity.

We're trying to build in a margin of safety by paying a low enough price relative to the intrinsic value of the business. And that's really how we think about the process of contrarian investing.

We think probabilistically as well. I think that's an important part of being a contrarian and the simple way is: when something is out of favor, the odds might be in our favor.

JG: In other words, when it's out of favor, the pricing might be such that you can get above average returns…

ZK: That's right. The other thing is that the lower the price we pay, the less certain we have to be about the future as well. So a lot more upside and optionality in a good outcome and hopefully the downside is already in the price.

JG: Contrarianism could open you up to catching so-called falling knives. How do you avoid this?

ZK: Lessons learned the hard way, multiple times, and then hopefully we avoid making the same mistakes and learn from them.

But I think there are some key enemies of the contrarian and value investor. Balance sheet leverage is first: you want a good balance sheet position so that you have the duration to see a crisis through with the company. Turnaround plans often take longer than you would think. My rule of thumb is, if you think it's going to take two years, double it, it's going to take four years.

You want to avoid the debt spiral. Imagine a company undergoing a turnaround, a tough part of the cycle hits, and they have to sell their best asset at a fire sale price at the wrong time. That is the enemy of a value investor.

Then, highly complex businesses as well. Complicated business models, a lot of policy sensitivity, those types of things - it's hard to underwrite. We've found over time, a lot of those end up in the value trap category as well.

JG: You are a bottom-up investor – does that mean ignoring macro news altogether or does it still play a role in your stock picking?

ZK: We don't forecast, but I'd say we are macro aware.

We do think about a very wide range of outcomes for each company. What does the blue sky scenario say as opposed to running into a recession on the downside? What do trough conditions with trough valuations look like for a company? And then we try to figure out, what is that individual security pricing in within that macro range of outcomes as well, and so we use macro in terms of what's in the price and when bad news is already discounted in the price.

Does that give us an opportunity to step in, do more work, and buy the security? That's when we're more likely to be interested.

JG: Value funds have had a tough few years – do you think the tide has finally turned for value?

ZK: It's always tough to make that prediction. Over the course of the last 100 years, value investing has worked, and humans haven't changed. So hopefully yes, but it's hard to say.

A couple different things we're looking at around that question. Valuation dispersions in the market have stepped up a little bit relative to the recent past. They're not as high as prior peaks - for example, during the COVID pandemic - but they have stepped up a little bit, and that's usually a decent sign for value.

Interest rates are higher and valuations are elevated. And if you want to look elsewhere for value, maybe prospective returns going forward might be better for those types of value opportunities.

In the meantime, we focus on individual stocks in the portfolio. So we're not just a value factor or value bet.

There are three areas of opportunity that we look at. There are the deep value ideas - capital cycle investing I mentioned, the restructurings, which I've referenced as well, and then compounders with controversy. We'll call them distrusted quality. These are not your classic kind of value types of opportunities, but they're great businesses that come at value prices every once in a while.

That’s a long-winded way to answer your question. Is this the moment for value? We try to make the portfolio asymmetric regardless, and then hope the market comes our way.

JG: Your fund is significantly underweight the US. Does that simply mean that you're finding a lot of other opportunities elsewhere?

ZK: That's right. Bottom-up stock picking, stock by stock, more asymmetric opportunities in Europe, for sure, a little bit in Asia as well.

An interesting thing is when you look at long run valuation, US markets have traded at a 15% premium to Europe, but it peaked at something like 40% premium. That was probably the day Trump was elected. The phrase, US exceptionalism, it was the first time I had heard that phrase – it was probably that day that it was a 40% premium for the US market versus Europe.

I think in the US, there are a lot of companies with peak multiples on peak earnings. Europe, on the other hand, great bottom up valuations, and not a lot has to go right in Europe. Peace with Russia and Ukraine, lower energy prices, room to cut interest rates, trade deals, fiscal stimulus in Germany - not a lot of this is in the price for a lot of these securities, and that gives you an insight into the shape of the portfolio.

JG: One of the larger holdings in your portfolio is the Irish low-cost airline, Ryanair – tell us why you’ve invested in that company?

ZK: In terms of the opportunity to buy airlines, you get lots of shots on goal anytime there are worries about the consumer. There was Brexit, then COVID, of course. Lots of opportunities to buy airlines in a value-oriented portfolio.

The reason why we like Ryanair is they have a structural low cost advantage over all the other airlines, which results in a virtuous cycle - the lower their costs are, the cheaper they can make fares for passengers, the more revenues they generate because they have more passengers, the more they can scale their costs over a larger base, which means lower costs. And you can pass it back to passengers again. And so that cycle continues.

The other thing what they do in a down cycle, they buy planes when no one else wants to buy planes because everyone is worried about the world. So they're acting counter cyclically, which is great for economics.

Then, they also buy back shares and return capital again at times of the cycle when you would want.

That makes them a well-positioned business in a tough neighborhood. They will be the ones that will last, and that's really the thesis.

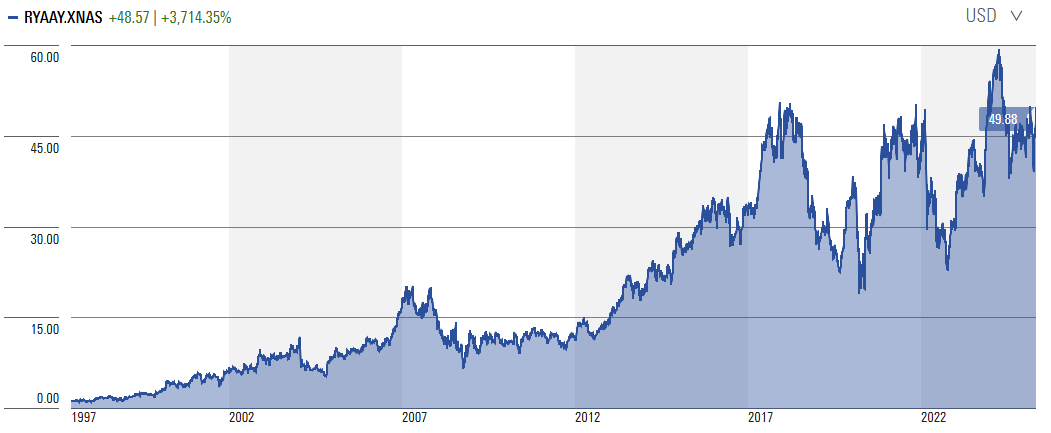

Ryanair Holdings ADR

Source: Morningstar

JG: Digressing from markets. You’re based in Canada – what are your thoughts on the results of the recent election there and the changing dynamics between Canada and the US?

ZK: The dynamics are definitely more challenging. We have the term ‘elbows up’ now on the Canadian side. So that tells you where things are going.

There are a couple of silver linings I would point out, though. First, the political drama and attention has led to really high voter turnout and civic engagement. And that's a good thing in the long run.

The other thing is, if you think of Canada as if it's a company, it had a very concentrated customer base, ie, the US. Maybe this is a wakeup call to say, let's think about our economic model. Maybe we should diversify our revenue base and lower the risk.

Not an ideal situation, but as they say, you should never let a good crisis go to waste.

Zahid Kassam is Portfolio Manager at MFS Investment Management, a sponsor of Firstlinks. Kassam co-manages MFS’ Contrarian Capital Strategy, a global long-only equities fund. Recently, MFS launched its Global Contrarian Equity Trust for Australian institutional and wholesale investors. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.