The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Even local investors are getting fed up with ASX stocks. There’s been a rush of money heading out of Australian equities into overseas markets, especially the US, of late. No doubt, part of that is chasing momentum in America, especially that of the Magnificent Seven. Yet, there’s also growing disillusionment with the ASX: with its old world companies, its short and long term performance, and its prospects given a sputtering macroeconomic backdrop.

A new report by Boston Consulting Group (BCG), Australian Value Creators: Two Decades of Excellence, suggests the pessimism may be overdone.

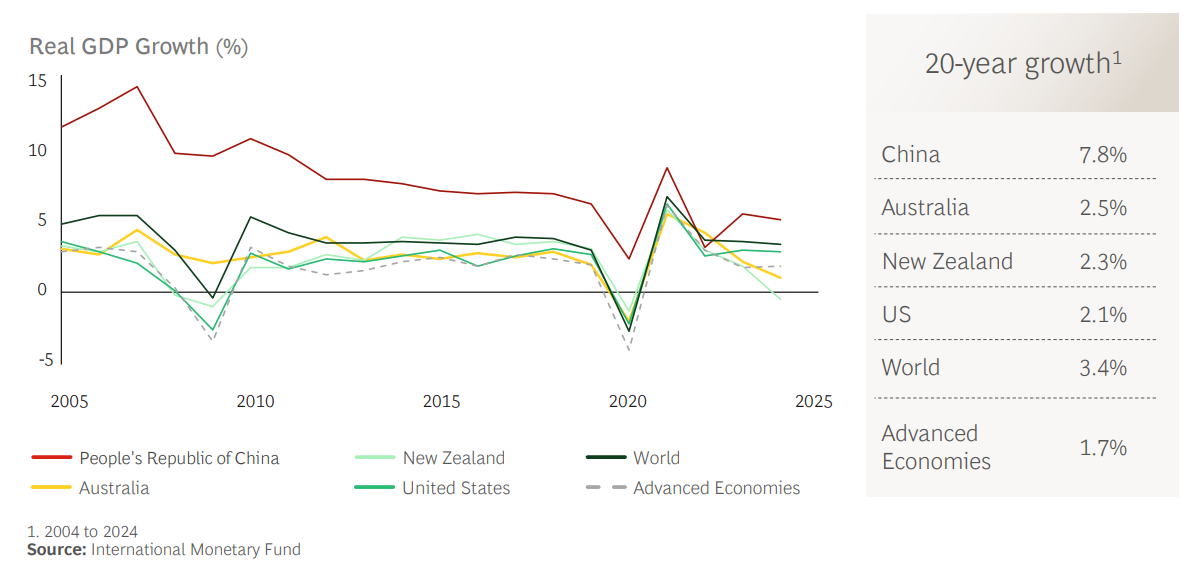

First, though the Australian economy has undoubtedly slowed, GDP growth here has been far better than most other advanced countries, even the US, over the long term.

Australia’s economic growth has been primarily driven by exports - mostly mining - and the property market. And commodities are likely the key to Australian growth perking up again.

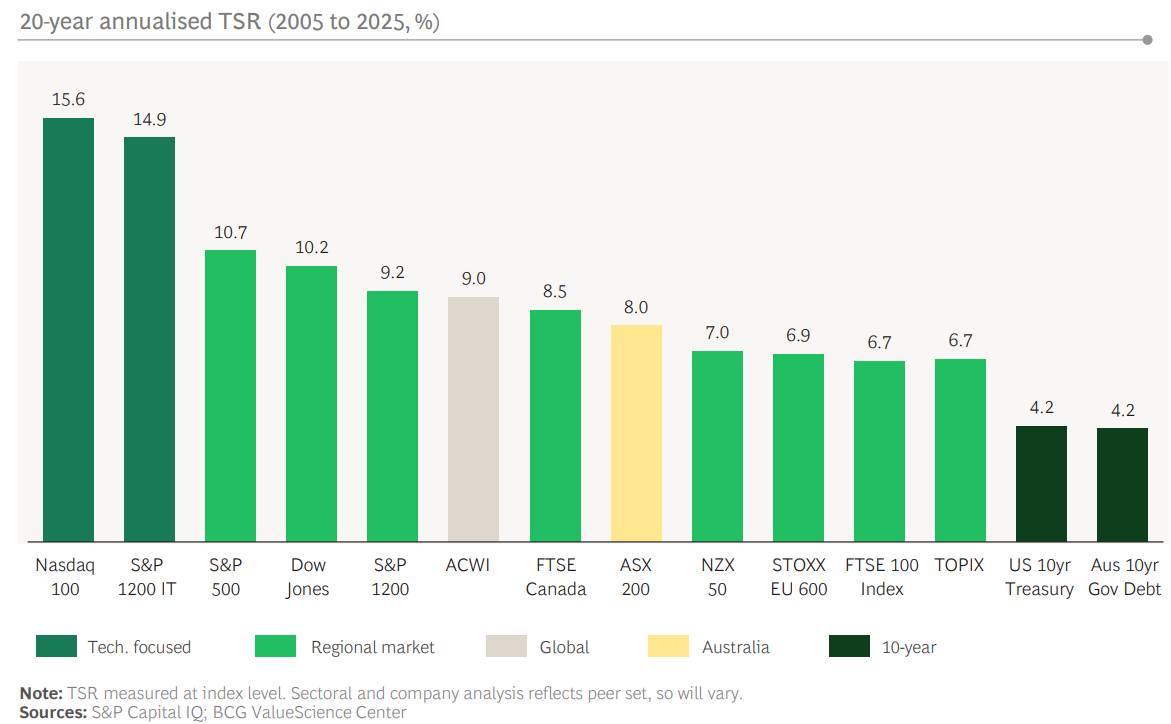

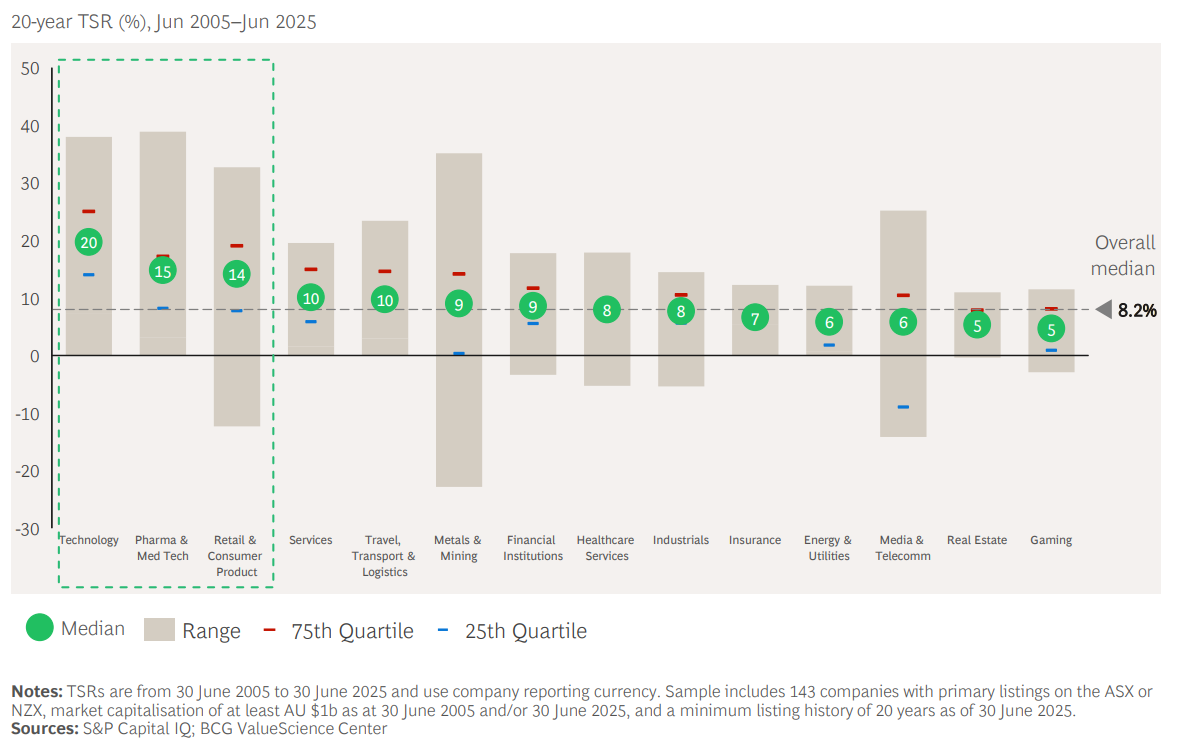

Second, while the ASX has badly lagged US markets of late, it’s performed ok versus other global counterparts. The 8% total return from the ASX 200 over the past two decades has also meaningfully exceeded the risk-free rate of 4.2%.

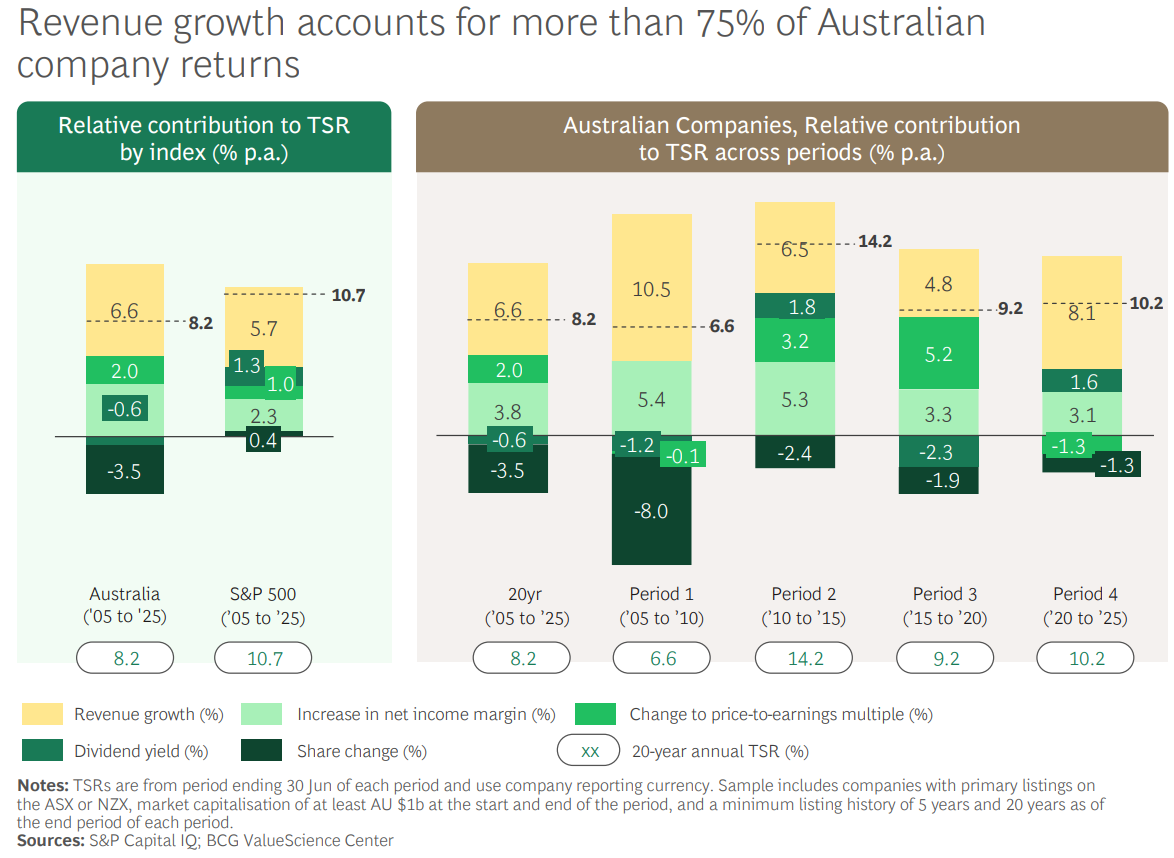

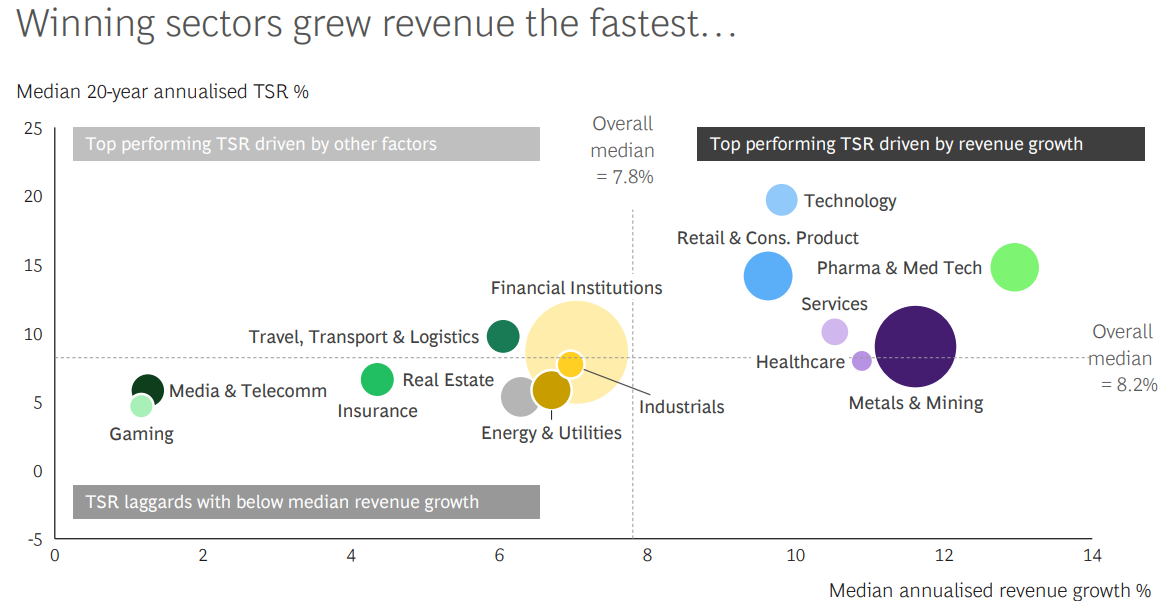

Third, breaking down the sources of ASX performance during the period shows that Australian companies aren’t as stodgy as they’re made out to be. An amazing fact: revenue growth from ASX companies above $1 billion (6.6% per annum) has been higher than that from S&P 500 counterparts (5.7%) since 2005.

The above chart reveals that the key difference in ASX and US total shareholder returns (TSR) has been the much higher issuance of shares in Australia. A higher share count reduces company earnings per share and, ultimately, shareholder returns.

The share issuance has been used to fund both growth and dividends.

“This can be explained, at least in part, by a tax system that encourages companies to pay high levels of dividends to deliver the value of franking credits to Australian shareholders,” BCG says.

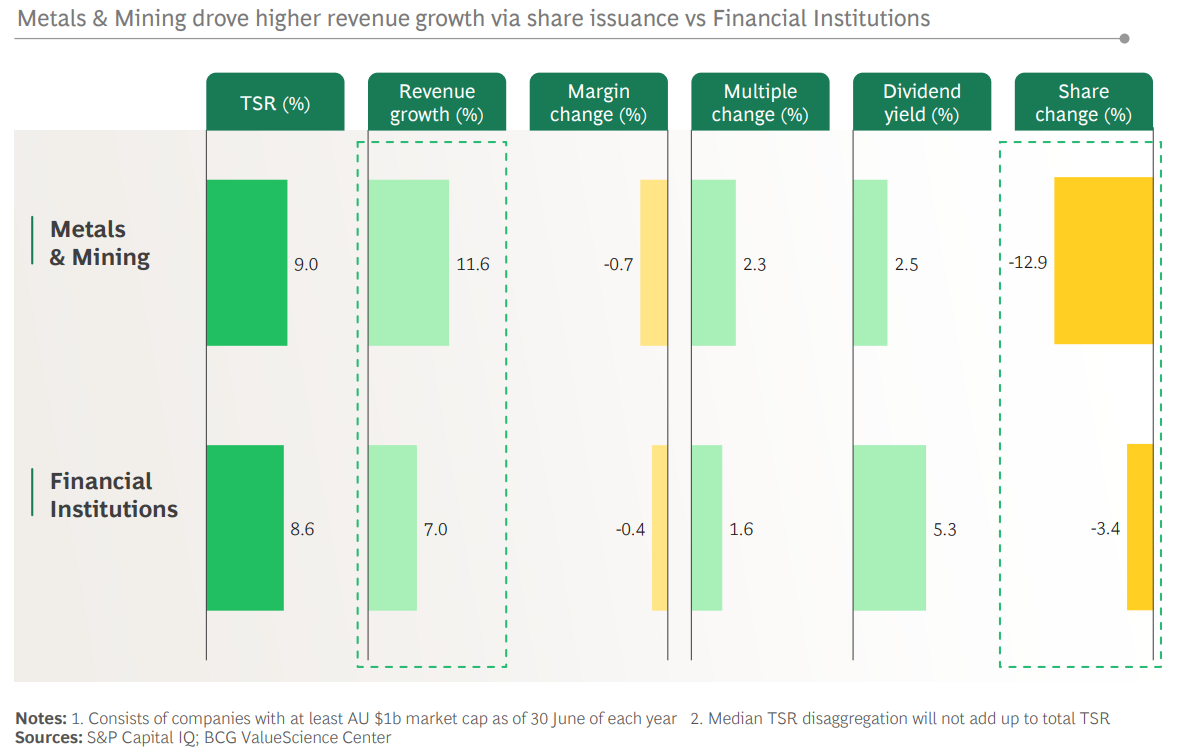

Mining companies have been the biggest culprits when it comes to issuing shares.

Fourth, the ASX has several sectors that have achieved S&P 500-like returns. The ASX technology, pharma and retail and consumer products sectors have returned 20%, 15%, and 14% per annum respectively since 2005.

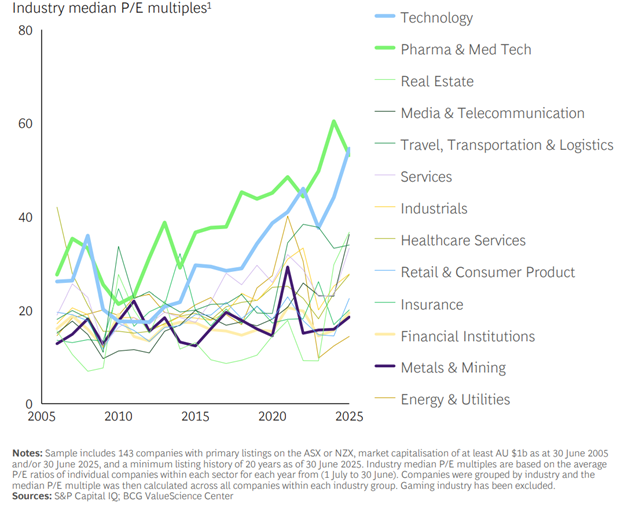

An expansion in valuation multiples has driven part of their outperformance.

But better revenue growth has been the principal drive to their superior performance.

The top 20 ASX performers

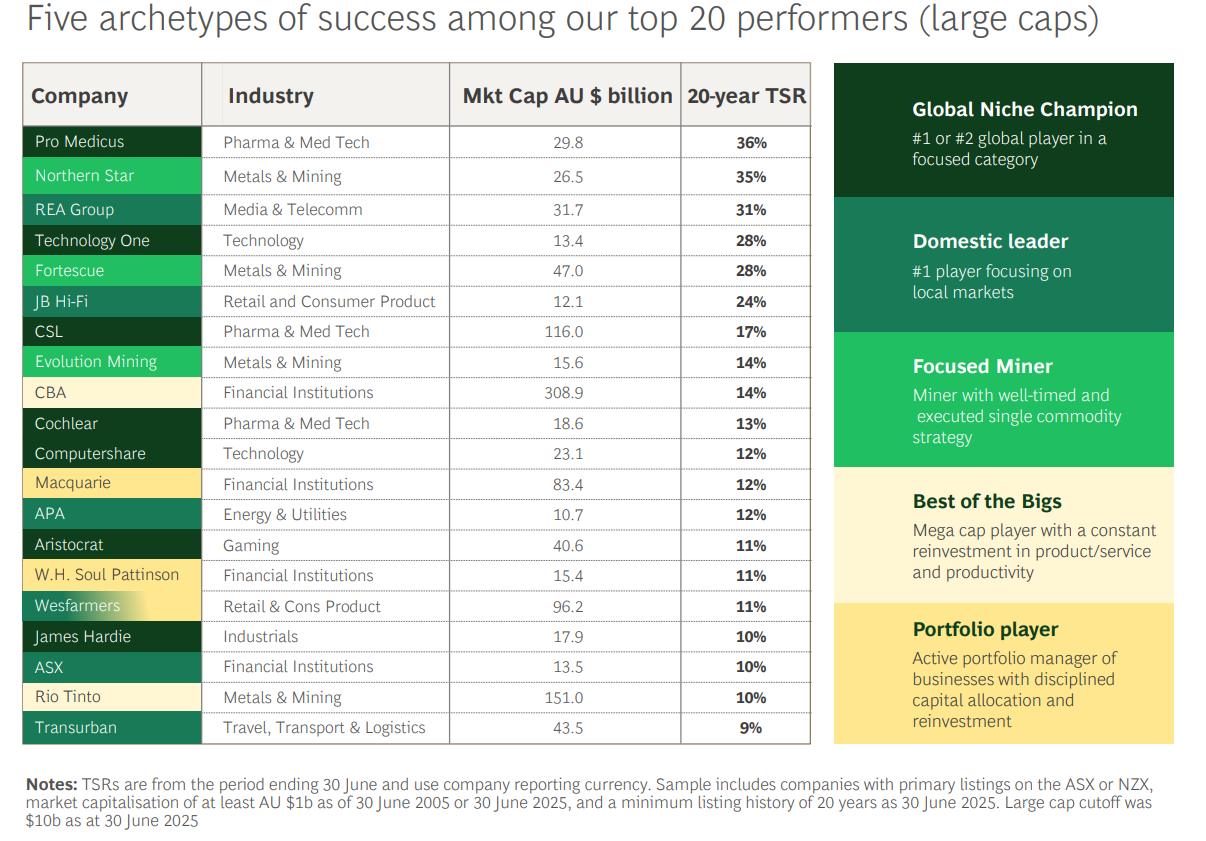

So, which companies have performed best over the past 20 years? Unsurprisingly, Pro Medicus heads the list, with total returns of 36% per annum. It’s closely followed by Northern Star, and REA, Technology One, and Fortescue round out the top five.

BCG groups the best performers into five categories:

Global niche champion: These are companies that have global footprints though operate in niche markets - niches that are big enough to allow sustainable, above-average growth but small enough to allow sufficient share to reinvest with scale. Examples include Cochlear, CSL, and Aristocrat.

The domestic leader: These companies have their niche, but their success comes from one, or only a few, local markets. REA is a good example of this.

The focused miner: BCG says the two gold miners in the list, Evolution Mining and Northern Star, have both shown operational excellence and focused on cashflow generation, over pursuing growth just to add size.

The best of the bigs: Both CBA and Rio Tinto have been able to grow despite their enormous size. CBA has done it by focusing on improving internal operations, while Rio has been a world leader in bringing automation to its mining and rail fleet.

The portfolio player: This includes companies that manage a portfolio of multiple businesses such as Wesfarmers and Washington Soul Pattinson. Their key defining features are skilled management teams with a constant focus on returns and active use of buy and sell-side M&A to upgrade the portfolio.

Lessons for the next 20 years

Being a consultancy, BCG mostly focuses on what companies can do to better shareholder returns.

For investors, the archetypes that the report uses to describe the best performers offer a useful template to pick future winners. Ideally, you want leaders in markets, often operating in niches that offer a large runway for growth yet are small enough to dominate and not attract too much competition.

For miners, focus is the key. Resource companies that habitually issue shares to fund big acquisitions with questionable return prospects should be avoided.

Otherwise, there are conglomerates like Wesfarmers and Soul Patts that are quasi investors themselves. They are a little like fund managers, and as with fund managers, backing great leaders is important, though it comes with key person risk too. In Soul Patts’ case, Rob Millner, won’t last forever, however the company seems to have a deep bench of able managers. For Wesfarmers, balancing the continued growth of Bunnings with allocating cashflow to newer ventures will require both skill and patience.

****

In my article, a stand-in Prime Minister makes an important speech on fixing housing. It starts: “Fellow Australians, I want to address our most pressing national issue: housing. For too long, governments have tiptoed around problems from escalating prices, but for the sake of our younger generations, that stops today...”

James Gruber

Also in this week's edition...

Family trusts have long been a cornerstone of wealth planning in Australia, but with the ATO tightening its grip and compliance becoming more complex, some are rethinking their value. From stricter scrutiny of family trust elections to looming tax reforms, the landscape is shifting. Peter Bardos assesses whether these structures are still worth the effort.

Vanguard built a $14.8 trillion empire on a simple idea: do less, stay the course, and let the market work. But while passive investing has gone mainstream, too many investors use passive products in decidedly active - and harmful - ways. In an extract from their new book, Investing Your Way, Morningstar's Mark LaMonica and Shani Jayamanne challenge you to rethink what it really means to be a long-term investor.

With housing risk rising and defined benefit pension liabilities climbing, the Future Fund may become more than a buffer - it could become a bailout mechanism, according to Clime's John Abernethy. If at some point in future, mortgage defaults accelerate and bank balance sheets falter, he thinks the government could look to the Fund’s capital as a backstop for systemic risk.

Managed accounts are fast becoming the cornerstone of modern portfolio design, blending the best of institutional rigor with personalised investor control. With more $230 billion under management, VanEck's Arian Neiron says the challenge now lies in ensuring governance, independence, and strategic agility amid growing complexity.

We've all heard about the significant supply challenges facing the residential property market, including rising construction costs, land shortages, regulatory red tape and so on. It turns out commercial property is suffering from the same problems. And with demand for commercial real estate turning back up, Charter Hall's Steve Bennett thinks we're in the early days of an upswing in the sector.

Hands up, who likes toll roads? Me neither. Yet, they're part of everyday life in Australia. Milad Haghani and David Henscher weigh up the pros and cons of privatised toll roads, and conclude that the current system needs a shake-up.

Two extra articles from Morningstar this weekend. Jon Mills on a solid start to fiscal 2026 for BHP and Seth Goldstein analyses Tesla's third quarter result.

Lastly, in this week's whitepaper, Tanarra - a GSFM affiliate - looks at the case for a rotation into private credit.

****

Weekend market update

Cooler-than-expected inflation data and upbeat corporate earnings lifted all three major U.S. stock indexes to all-time closing highs on Friday, setting the stage for next week's earnings reports and an expected interest rate cut by the Federal Reserve.

The Dow, S&P 500 and Nasdaq rose by 1%, 0.8% and 1.15% respectively.

CPI increased 0.3% in September, slightly down on the 0.4% of August.

Five of the 'Magnificent Seven' - Alphabet, Microsoft, Amazon, Meta and Apple - will report results next week.

From AAP:

Australia's share market limped to the finish line in an almost flat session on Friday but held onto some of the week's gains that took it to all-time highs.

The S&P/ASX200 slipped 0.15% to 9,019 on Friday and gained 0.3% for the week.

Five of 11 local sectors pushed higher on Friday, led by a 1.3% lift in IT stocks, while a weaker banking sector and a continued sell-off in gold stocks weighed on the bourse.

Financial stocks fell 0.5% in the last session of the week as ANZ lost 1% and CBA fell 0.8% to $170.37.

The raw materials segment rose on Friday but finished the week 2% lower after surging to a record high on the back of peaking gold prices and a critical minerals deal between Australia and the US.

Both gold producers and rare earth miners have faced a volatile ride since then and have been broadly weaker since.

Lithium plays have enjoyed a solid bounce however, with Pilbara Minerals and Liontown Resources notching double-digit gains since Monday.

Rio Tinto was the best of the large-cap miners on Friday, rallying 1.5% to $131.82 as BHP gained 0.5% - both buoyed by their copper exposure as iron ore prices lingered just above US$105 a tonne.

IT stocks outperformed the market, rallying 1.3% after a strong lead from the Nasdaq following encouraging earnings from Tesla and Intel.

Local names like WiseTech Global (up 3%), Life360 (up 1.9%) and Megaport (up 1.3%) were stand-outs.

Health care stocks snapped their three-week winning streak, falling 1% since Monday as CSL dip-buyers took profits on the "easy money" rebound from the blood plasma giant's September lows.

Consumer staples stocks have fallen for eight of the past nine weeks, tumbling more than 8% in the process as investors eschew defensive stocks in favour of growth while global equities continue to break record highs.

Curated by James Gruber

Latest updates

PDF version of Firstlinks Newsletter

Plus updates and announcements on the Sponsor Noticeboard on our website.