Economic growth looks to have bottomed in calendar 2024, and we see it firming into 2025 - which means some return of select cyclical exposures in addition to key thematics like decarbonisation and technological change.

Exposures in this regard focus on profitable models to capture cyclical growth and compound the increased spending that comes with economic growth, and improvement in housing and discretionary spending.

Decarbonisation and the energy transition remain significant themes that are driving value across resources, energy, utilities and the mining services sector with respect to critical commodities. We like copper, uranium and rare earths for the central role these will play in renewable energy, energy storage and upgrading electrical grids worldwide.

We are also seeing structural earnings growth in technological transformation, the rise of artificial intelligence (AI), and the enablers and businesses that increasingly operate in the digital environment, including communications companies. These enablers include data centres, energy and energy storage that backs-up data processing, telecommunications and internet companies that support the web of connectivity and data. We also like beneficiaries of the digital revolution, companies that are able to leverage the networking and processing power offered by enablers to capture more business, more customers and at lower and lower costs.

Asian position

Australia is a young economy that is at the start of a huge story compared to other developed nations. Think America in the nineteenth century. Australia is a key part of the Asian growth engine that includes India, China and other fast-growing regional nations like Taiwan, South Korea, Vietnam, Indonesia, Cambodia and the Philippines. We are also linked closely to the developed markets like Hong Kong, Japan and Singapore. This is a privileged position strategically and financially. Many do not understand how beneficial this is for the growth path of Australia, our economy, and our global companies.

We are of the opinion that there will be a compound growth benefit in the expansion of Australia’s export markets in intellectual property, services, technology, commodities, agriculture, tourism and education. Exports and growing immigration will manifest as investment back into local construction, real estate, infrastructure, services and consumer markets.

Australia’s population will also grow to become an increasingly profitable internal marketplace, supporting large caps that are heavily exposed to Australia.

Themes position portfolios

These key themes, we believe, position Australia with significant advantages over our peers from an economic growth perspective. In our view, it makes a lot of sense to invest in Australia’s future by investing in some of the most successful companies.

Australian large-cap stocks offer an ideal vehicle in which to invest in the compounding benefits generated by key thematics, and by the ongoing compounding growth in Australia’s population and economy.

Remember, Australia is one of the safest and most regulated markets in the world from the perspective of continuous disclosure, market regulation and common law, within the context of a functional democracy – all beneficial in reducing large-cap risks so businesses can focus on what they are great

Large caps

Over the years I have observed a number of things about successful large caps.

The first is a strong business model that can generate earnings growth, year-on-year. For us, it all starts with positive earnings growth. Even better, we like finding a company that can invest cashflow from its earnings into capital expansion and business development at returns that are more attractive than the alternative, buybacks and dividend payouts. This sounds simple, but so many businesses just cannot achieve these two things, let alone compete with peers in a global and competitive marketplace.

Beyond the quality of the core business model, in very simple terms, a good large company should have a strong balance sheet, manageable levels of debt, a supportive and stable ownership structure, strong corporate governance, strong and improving ESG credentials, and a strong and experienced management team.

A good large company should have a healthy brand, a strong reputation that is guarded, a unique position or proposition that demarcates it from competitors, and potentially an element of protection or barriers to entry that inhibits competitors and enhances the value of its business.

In most cases, great companies need to be in growing markets or sectors in order to generate growing earnings. This is where our macro-economic outlook helps to determine which sectors are beneficiaries of a given economic view looking forward, and which sectors will be challenged. This allocation is important because it is hard to fight the cycle, even with great companies.

Large caps have always been of interest to me perhaps given the complexity they show, and the potential to find gems in this complexity if you take the time to analyse and know a company. This complexity accords with my naturally curious and forensic approach to finding superior earnings growth opportunities. Owning a share of Australia’s largest and most successful companies is an exciting prospect for investors.

Of course, you do not invest in large companies just because they are large, or complex. There can be both good and bad reasons why a company has become a large cap. It is not always apparent, but understanding the reasons can help focus on what matters when finding large- cap stocks.

The relativity between valuation and the earnings growth outlook is what matters for the allocation of risk capital. Investors who are serious about generating compound return on equity look at the interrelationship between earnings and earnings growth, and what assets are acquired for a return on capital that offers the potential for outperformance.

To illustrate this with a contrasting example, in passive market-cap weighted ETFs (exchange- traded funds), the larger the market cap of a company, the more investment capital it attracts, regardless of its earnings profile, growth outlook or whether the business is growing or shrinking. Hence, sentiment-pumped market caps are rewarded for being big, rather than being profitable or having a future earnings growth profile.

By contrast, our active approach allocates capital to companies that we have assessed to offer superior earnings growth and where we believe there are significant potential earnings surprises. We are earnings growth obsessed, simple as that, because in essence, companies are only as good as the earnings they can generate for shareholders.

Risks

There are a number of risks that come with larger companies. Firstly, there is the challenge of complexity that we have already discussed. To mitigate this complexity, we have a team of equity analysts and portfolio managers who study the same companies and are evaluating these companies on an ongoing basis. However, we believe this complexity also offers significant opportunities for outperformance that rewards diligence and a strong investment process.

Who owns the company and how management is incentivised makes a big difference in how they make decisions. How management and staff are aligned not just to the interests of customers but also the interests of equity holders can make a material difference to how a large cap performs. The flipside to this is that poor alignment and bad management can destroy a large cap very quickly.

Other risks which we seek to avoid through our research and knowledge of companies can include transparency problems, specific ESG issues or exposures (including negative momentum in sustainability scores), and any other element of a company or the market in which it operates that is a risk to earnings. We are vigilant on risks to our view on earnings growth, and our process allocates away from anything we think is materially adverse to our view on a company’s ability to continue growing its earnings and dividends.

Accordingly, we prefer active investing because we know over time we can improve on the market return. The value of this edge across many years is worth a lot of money to an investor.

With an active approach I don’t have to hold companies that I believe are going to be underperformers at best, will fall out of the index, or go bankrupt at worst. I can also focus my capital on companies that demonstrate mastery in their businesses and are far more likely to perform over time than their peers. By perform, I mean that they are more likely to grow quality earnings, and in many cases, generate earnings growth above that of the market.

The academic arguments fall either way on active versus passive approaches, but from my decades of actively generating alpha, I believe an active approach works across time.

Stocks

Stocks we like (and reflected in our top 10) include BHP, Commonwealth Bank, National Australia Bank, CSL, Macquarie Group, Goodman Group, ANZ Bank, Xero, Rio Tinto and Aristocrat Leisure.

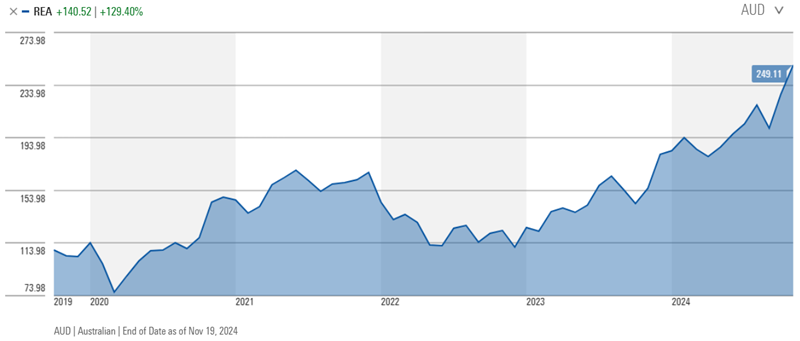

We are overweight Block, Evolution Mining, NAB, REA Group, Aristocrat Leisure and ResMed. We don't have any positions in Woolworths, Woodside Energy Group, Mineral Resources and Fortescue.

As an example, why we like REA Group (ASX:REA), is that Australia’s leading residential and commercial property portal’s 'vendor pays' business model enables it to drive strong annual price increases, coupled with product innovation, increasing market share and a forecast lift in listing volumes and top line growth should see it remain strong over the medium term. In addition, we believe REA has other favourable investment attributes including a variable cost base that enables it to manage cost growth below revenue growth, a solid balance sheet and global growth optionality.

Paul Xiradis is Co-Founder, Executive Chairman, Chief Investment Officer, and Portfolio Manager at Ausbil Investment Management. This article contains factual, general information only and does not constitute financial product advice. It does not take account of your individual objectives, financial situation or needs.