This is an extract of an interview between Steve Bennett, Direct CEO at Charter Hall, and Firstlinks’ James Gruber.

James Gruber: Let’s first explore the macroeconomic landscape for property. We’ve had interest rates come down a little, which seems to have helped retail activity and the economy. Does that bring optimism for commercial property prospects versus six or 12 months ago?

Steve Bennett. Absolutely. What it's done is remove that uncertainty on whether interest rates would keep going up, and equally, when they would start coming down, and regardless of the type of real estate you're talking about, debt is a significant component, often around 30% to 45%, so falling interest rates mean that valuations are supported and there are lower interest costs.

Going forward, the market is changing rapidly. You had peak valuations in most commercial property sectors in June 2022. Fast forward to now - inflation has stabilized, interest rates are falling, unemployment is still in the low to mid 4% and then you combine that with some of the supply challenges of bringing new property to market.

Regardless of the commercial property segment, it's very challenging to make feasibility stand up, and that means developers won't undertake projects that are going to make them losses. And in Australia, where the population continues to grow strongly, demand is very robust and yet there is a challenging supply pipeline - so we are confident for those investors who own existing commercial property, the next three to five years should achieve outsized returns from core real estate.

JG: Can you just speak to those supply challenges a little more?

SB: Yes. Everyone's very familiar with the supply issues in the residential space. I would argue that exactly the same challenges exist whether you're trying to build a CBD office tower or a new convenience retail centre. Land's gone up. There are issues around getting skilled labour, the cost of labour, financing costs and delays in planning and approval processes add complexity and hurt your returns.

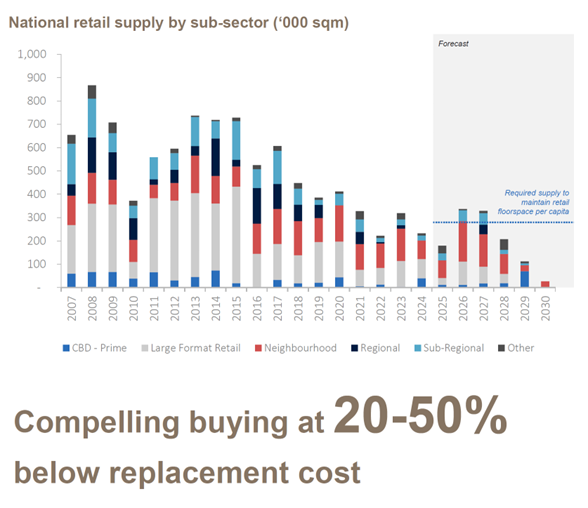

What it means is that for most sectors it is 20 to 55% more expensive to build something new than it is to buy existing property stock.

So, two things will tend to happen. Either the supply will slow down and demand will continue, and you get rents going up, or the supply that does come out of the ground needs to attract those premium, elevated rent levels to justify development. And in residential, that's why you're seeing - a lot more development at the premium luxury end of the market. Unfortunately, social housing and the lower price point properties get left behind because they don’t have those higher sale prices to justify the costs.

JG: Let's talk about office property, which has been the trouble child for the commercial property sector. Things seem to be turning around with supply remaining tight, people returning to the office. Do you see the turnaround underway?

SB: Yes, and I'd highlight that the challenges we've really seen in Charter Hall portfolios and assets haven't been occupancy related. We've continued to keep our buildings almost full, typically a 3% vacancy rate, far lower than the PCA [Property Council of Australia] benchmarks.

But the valuations have undoubtedly been under pressure, and many people are surprised to hear that the valuation decline in some office markets throughout Australia in this cycle fell more than they did in the GFC.

Pleasingly, we are now seeing areas of the office market that have valuations increasing. So, markets like the Sydney CBD, Brisbane’s CBD, Fortitude Valley in Brisbane. Then there are some other markets which have stabilised, such as Adelaide and Perth. The one laggard is parts of Melbourne. And that's more about some of the challenges for the Victorian economy more broadly.

JG: Industrial property returns have come down over the past 12 months, even though vacancy rates are very low. Why have returns softened and what do you see going forward?

SB: Let's put the vacancy rate in context to start with, because you're right. Vacancy is still low, around 3% on average nationally. Many of Australia's industrial markets are in the top 10 in terms of lowest vacancy rates globally.

What's come off, though, is the level of rental growth. The last few years, depending on the market, you've seen 12 or 13% per annum rental growth, all the way up to low 20%. We never thought that was sustainable long term. Over the last 12 months industrial rents have printed growth of around 4.5%. as the national average. Look, that's still a great return. It's outpacing inflation. If you can get that kind of return longer term, it looks good. So, what you're seeing is a normalization in the market rather than any issues in that sector.

JG: Retail more recently has been the strongest segment in commercial property. Capitalisation rates remain low though demand seems to have several tailwinds. Do you see demand for retail remaining strong?

SB: I should talk to the Charter Hall experience, and we focus on convenience retail.

You've seen a lot of new products come to market, syndicates, where it's one asset, often a big regional mall. We like to focus on retail property serving everyday needs.

We've just raised $1.8 billion from institutions into a new institutional convenience retail fund. And what those investors - and remember, these are some of the largest superannuation funds, sovereign wealth funds, offshore pension funds globally - are increasingly doing is moving the property allocation that would have historically been in the big regional malls and putting it into this convenience retail part of the market.

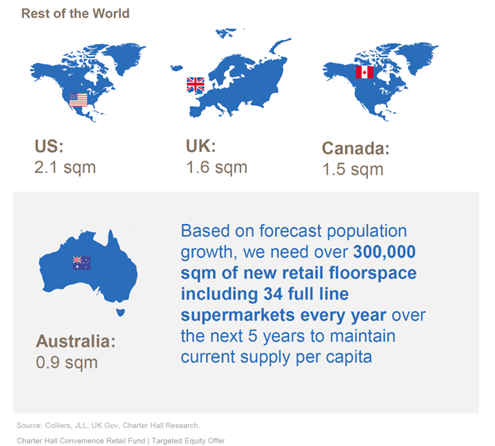

They like the very defensive core attributes of it. If you can get a good Coles or Woolies Neighborhood Center in a great catchment, it's basically irreplaceable. You cannot get approval to build something else in that area and what we have seen is strong supermarket turnover growth as we continue to have densification of metropolitan areas and a failure to deliver new supply into those markets.

Source: JLL, Charter Hall Research. At 3Q25.

We tend to prefer to stay away from the big centres, which are heavily reliant on discretionary retailing, like apparel. It's not because they're bad investments, per se, but we like the defensive characteristics of convenience retail - the tenants who continue to have great cash flows, great balance sheets at all points in the economic cycle.

JG: So it's a more defensive retail holding for investors?

SB: Absolutely, and at this point in the cycle where cap [capitalization] rates have gone to and where we expect them to go in the next few years, we're targeting an IRR [internal rate of return] of 11% for a new high-net-worth fund that invests into that exact same institutional convenience retail portfolio. To get that return historically, you used to have to move up the risk curve and do some asset repositioning, potentially mixing in some developments, whereas we're targeting that from arguably the most defensive core part of the commercial real estate space.

Australian retail floorspace vs other comparable countries

JG: What's the biggest risk that you see for the property sector right now?

SB: I think we're through the biggest potential risks. A few years ago, there were some questions in some of the asset classes on whether there would be some distressed selling. When we talked about some of those office [property] declines earlier - would those flood the market?

What I would say is this cycle has been different to the GFC in that the valuation declines have been more gradual, and most managers entered this cycle with materially lower levels of gearing. You get distress typically when banks force a manager to do something, and we've seen limited examples of that occurring in the market.

I think the greatest risk is that retail investors, high net wealth clients and advisers miss this point in the cycle. Understandably, many of them have had a tough run in the last few years in terms of returns and those valuation declines. But if you look at what the big institutions and some of the most sophisticated investors are doing, they're looking at this as a buying opportunity. They know that the best returns are for those that come early in the cycle.

I really hope it isn't like other price cycles, where sometimes the retail investors wait to see that valuation growth over a couple of years, and they tend to invest late cycle. The biggest risk is missing out on some of these outsized returns from core real estate by waiting too long.

James Gruber is Editor of Firstlinks. Steve Bennett is Chief Executive Officer of Charter Hall Direct, part of the Charter Hall Group (ASX:CHC). Charter Hall is a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.