Can Australians look forward to increased leisure time in their retirement years, or do they face days of penny-pinching?

The effectiveness of our superannuation and retirement income system in providing a reasonable standard of living for all is a long-running topic of debate in Australia. But certain parts of our system have been held up as a gold standard in a white paper prepared by Morningstar's US head of retirement research David Blanchett and behavioural research lead, Steve Wendel.

In Debating the state of retirement: Morningstar researchers agree to disagree, the pair discuss America's retirement savings regime, including:

- Whether there is a retirement savings crisis unfolding in the US

- Would the Australian system of superannuation work there

- The viability of compulsory employer or employee pension contributions

- Why people love Social Security but dislike annuities.

Their discussion is pertinent for Australians because of the recently kick-started Retirement Income Review. Just last week, Treasurer Josh Frydenberg effectively relaunched the government's review of retirement – albeit with a watered-down aim to “provide a fact base to inform policy development” rather than specific recommendations for change.

The fraught issue of retirement savings is also looming large in the US, where Morningstar's Wendel suggests society has decided older citizens should also be able to live comfortably in retirement, and be able to transition into this life-stage without a significant shock.

"In my research, over 50 per cent of mass affluent Americans are likely to face a significant shock, and even more of everyday Americans," he says.

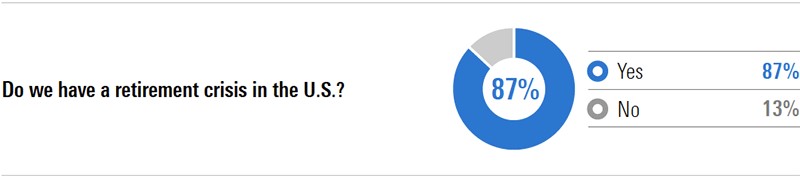

However, Blanchett stops short of calling this a looming crisis, suggesting the reality of retirement for most people will be somewhere between the idealistic picture of regular sunset beach walks and the worst-case scenario of subsisting on a diet of canned tuna.

"It is true that many retirees will face shortfalls when they retire because they aren’t saving enough, but I wouldn’t call it a crisis because people seem to make things work and they have Social Security benefits.

"If you look at a recent poll by Vanguard, while half of people think there’s a crisis, relatively few people describe their situation as a crisis in Canada, the US, the UK, and Australia," Blanchett says.

But Wendel disagrees, making the point that just because humans have a natural tendency to adapt to adversity doesn't mean they should have to.

"If you beat someone up and take all of their money, eventually they will adapt. They will probably become relatively happy again.

"The question at hand isn’t whether people adapt and can find happiness. Of course, they do. It’s rather whether they should have to," Wendel says.

Social Security versus the Age Pension

The US's safety net of Social Security – in our case, the Age Pension – is a perennial issue in politics and a fierce battleground for Australia's major political parties.

A polarising point is the use of the family home in the assets test that determines eligibility for the Age Pension. The Australian government has also included several non-super assets in its Retirement Income Review terms of reference, as referred to recently by Graham Hand, managing editor of FirstLinks. These non-super assets include:

- a means-tested age pension

- voluntary savings, including home ownership.

- compulsory superannuation.

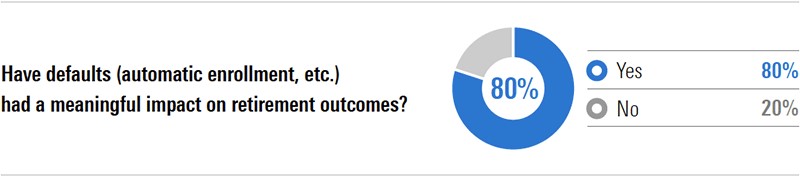

The final point above is another key topic raised by Blanchett and Wendel, as they compare the US's relatively recent introduction of "auto-enrolment" with Australia's system of mandatory superannuation contributions by employers.

"Auto enrolment is the single most powerful tool that I think anyone has found to increase savings rates," says Wendel.

Introduced in 2012, US employers are encouraged – though not mandated – to auto-enrol new employees into contributing between 3 per cent and 6 per cent of their income into a pension plan, known as a 401(k).

Wendel and Blanchett agree that the public policy issue of compelling employers to contribute money toward their employees' retirement fund should be considered.

Blanchett says systems like Australia’s 9.5 per cent minimum SG contribution "really get you to a good place that’s more palatable for employees."

He notes that his parents' generation once had high forced savings rates through company pension plans – a situation that no longer exists.

"If the employers are doing it, we can get there."

Wendel and Blanchett also question whether an Australian-style system would even work in the US. They argue a forced savings plan would cause an employee "revolt" whereas a measured introduction via employers would be more palatable.

Do annuities have a role to play?

When Australia's Retirement Income Review was launched in 2017, annuities looked set to become a cornerstone of the government's solution to helping our large ageing demographic fund their retirement.

Though this has since shifted slightly, it appears annuities will still play a large role in the final recommendations.

The complexity of annuities makes them a tough sell for financial service providers but in the US, where Wendel says they're strongly disliked – even hated.

"Annuities have been pushed and hocked and researched for decades. And people hate them. Let’s be frank, people hate them."

Fear of rising healthcare costs

Another problem with the way the financial services industry approaches retirement income is that it doesn't address people's fear of rising healthcare costs in their senior years.

"We're helping people with regular expenses, great. But we're not addressing their fear of unknown medical expenses. The 'Oh no, what will happen…what if…' scenario," Wendel says.

He points out that the majority of people hold onto their assets much longer than the industry generally assumes they will.

"In the first 20 years of retirement, only about a quarter of their assets are being sold off and used. And so, what are we saving for? The problem is that I think we’re solving the wrong problem," says Wendel.

“If I spend this money now, and I feel comfortable on this path, and then I have this horrible event and then I die on the operating table because I can’t pay for that, or I can’t afford to go on this vacation."

Glenn Freeman is Senior Editor at Morningstar Australia.

Try Morningstar Premium for free