The August 2018 reporting season always provides investors with fresh insights as input for portfolio adjustments and strategy re-alignment. Last month was no exception (definitely not!), but before we get to the nitty gritty of how corporate Australia is faring, let's zoom in on the statistical data first.

Guidance and expectations

As the bulk of broker reviews and responses are in the public domain, 307 companies in the FNArena universe have reported with 145 (47%) broadly in line with guidance and expectations, leaving 87 (28%) doing better and 75 (24%) disappointing. The overall context for Australian companies is business has become tougher since February 2018 when 37% of companies did better than expectations and 25% disappointed, although there is a noticeable switch to in-line reporting (i.e. results as expected).

In a check against data gathered from all prior seasons since August 2013, only 28% of companies outperformed market expectations, underpinning the suggestion that it is not easy out there in the real economy.

The 24% ‘misses’ metric in August 2018 sits right in the middle of historic comparables, on par with August and February 2016, but also better than each of the reporting seasons since. So with less misses and less upside surprises, does this make for a middle-of-the-road reporting season, unspectacular but decent?

Probably yes. Earnings estimates have fallen, as they do most seasons, but Australian companies ex-resources are still expected to continue growing at circa 7%, on average, which is not bad compared with years past. Banks continue to be laggards, while resource companies reap the benefits from expansion restraint and higher-for-longer product prices.

Valuations not cheap but some warranted by growth

Valuations, in general, remain far from cheap, but they have been around present levels for a while now. The average Price-Earnings (PE) ratio for the S&P/ASX200 is around 15.7x, but many companies with robust growth under the bonnet are trading on much higher multiples, and have been for a number of years now.

When we take this into consideration, the number of spectacular misses and subsequent capital punishments have arguably remained relatively benign, and August 2018 was not an exception in this department. Yet evidence suggests there is more at work behind historically high PE multiples for selected growth stocks than simply investor exuberance or momentum traders' delight, as some value investors would like us to believe.

Stockbroking analysts issued 83 recommendation downgrades through the month (only counting those in relationship to financial results) and 45 upgrades. Back in February, the balance was in favour of more upgrades (88 versus 53) but that is rather the exception. What stands out is the circa 3.46% average increase for consensus price targets through the month.

History shows February is usually the season when price targets jump more but not in 2018. February saw an average increase of 4.3%. Combined with August's 3.46% makes for the highest annual increase since FNArena started keeping records in August 2013.

Most of the increases in February and August this year can be attributed to the high growth, high PE stocks that have kept on performing this year. Think CSL (ASX:CSL) and REA Group (ASX:REA), but also Afterpay Touch (ASX:APT) and WiseTech Global (ASX:WTC).

In terms of share market performance, the S&P/ASX200 Accumulation Index (including paid out dividends) performance to end August rose 7.23%. Again, considering most equity markets outside the US are barely in positive territory or deep into the negative, this does not look like a bad achievement.

One has to acknowledge though, the Australian share market remains one key beneficiary from funds flowing out of emerging markets and this, more than local corporate results, has underpinned share market momentum thus far.

Financial results versus consensus price targets

In my view, the best way to judge how companies are performing is through measuring the impact of their financial report on analysts views and forecasts. And the best measurement of such impact is via consensus price targets. Looking at the share market or an investment portfolio from this angle can trigger fresh insights.

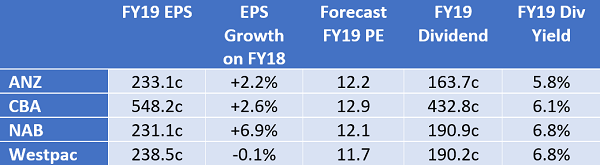

The price target for Commbank (ASX:CBA), for example, has increased to $73.94 from $73.63 prior to its FY18 release. Given the share price at the time of the release was actually higher, it shouldn't surprise us that CBA shares have since been sliding lower (they paid out one final dividend too). The table below shows the FY19 expectations for the major banks, showing healthy dividends (before franking) for the near future.

Source: FNArena

Put in a broader sector perspective, at least the target is no longer falling, even though it might be too early to make robust predictions about the worst of sector challenges now being behind us. It equally serves as evidence that the golden years for Australian banks, when each reporting season would add several percentages on top of existing targets, will not resume anytime soon.

On the other hand, price targets for first mover lay-by facilitator Afterpay Touch (ASX:APT) jumped by an average of nearly 69% to $22.33 post the release of FY18 financials and the announced expansion into the UK. This is also where the stock settled at first, before investors taking profits pushed it lower.

And if we really want to know how bad the latest profit warning by iSentia (ASX:ISD) actually was, let's consider the price target has fallen to 44c from $1.01, and that's not taking into account this is a stock that has traded as high as $4.85 since it IPO-ed in June 2014, with valuations and price targets sliding ever lower as more bad news and disappointments have accumulated.

G8 Education's (ASX:GEM) price target has now sunk to $2.36 from $3.03 (-22%). Telstra's (ASX:TLS) average target, in contrast to the strong rally in the share price, has now fallen a further 6.5% to $2.95. And if anyone wonders how disappointing the market update by Origin Energy (ASX:ORG) really was, its price target has since lost more than 6.5% to $9.54.

Rudi Filapek-Vandyck is an Editor at the FNArena newsletter, see www.fnarena.com. This article has been prepared for educational purposes and is not meant to be a substitute for tailored financial advice.