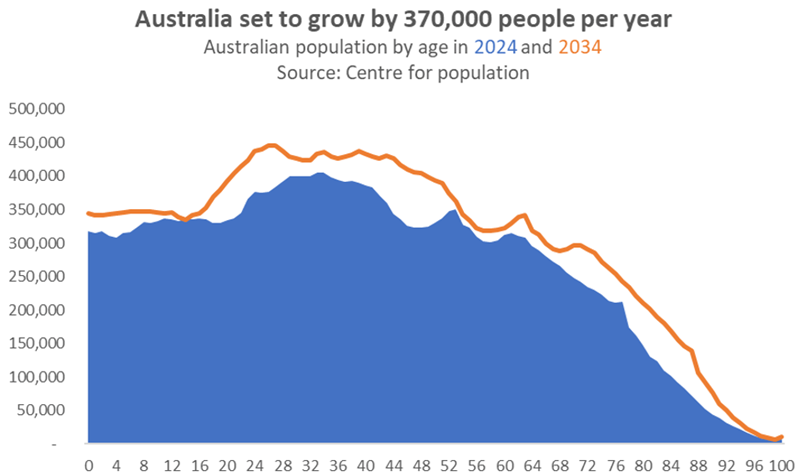

Today we are looking at my favourite chart when analysing the next ten years ahead.

It’s a decidedly simple chart that tells us about the future of Australia. Today we will quickly see what this chart tells us about future housing demand and shifts in consumption patterns.

We are comparing the current Australian population by single year of age, with the projected population ten years from now.

The data comes from the Centre for Population – that’s a bunch of demographers sitting in Canberra who provide Treasury with data to put into the budget papers. It’s rock-solid data that also integrates the latest Australian Bureau of Statistics research.

Forecasting the population ten years into the future is much more precise an exercise than you might think.

We have a very clear idea of the number of babies that will be added to the nation year after year and deaths are also very predictable. Since two thirds of population growth in Australia comes from migration that’s the harder to predict figure.

That said, as a nation we set migration targets and essentially dictate the migration intake. We wouldn’t be off by more than a few hundred thousand people in our migration forecasts.

Since about three quarters of migrants are aged between 18 and 39, we know that the population forecast for the 50 and over cohort will be correct – any variation from the forecast would largely impact people in their 20s and 30s.

Source: The Centre for Population

What the population will look like in aggregate

Let’s see what the future holds. The first observation is that we will see growth, lots of it.

Australia will grow its population by 14%. That’s more than 3.7 million people (or roughly three Adelaides). We must feed, shelter, educate, care for, and entertain 30.9 million souls by 2034.

The growth won’t be evenly distributed across the full age spectrum.

There won't be many more children

We will be adding relatively few children (0-17). The segment grows by less than 6%. That means we must add more childcare facilities, schools, and sporting infrastructure but at a lower rate than total population growth.

As I explained in a previous column, we will still be running out of teachers though.

Young adults (18-25) will grow by 16%. That growth is heavily driven by international students. If we were to close our borders, this segment would be slowed the most. That of course won’t happen.

International students are too important a funding source for our universities. With fewer international students, fees for local enrolments would need to go up or we would need to collect more tax dollars.

Neither option is remotely feasible. Expect massive growth in international student accommodation. Most members of this age group live in the inner suburbs as renters and will drive demand for apartments. Our inner suburbs will densify even more.

Early career professionals will be slow growers

Early career professionals (25-34) are only growing by 11%. In the past decade, the massive Millennial generation occupied the 25-34 segment.

Therefore, despite many migrants adding to this cohort growth will stay below the national average.

This cohort will still overwhelmingly be renting and will not have had kids yet. About half of them will work in knowledge jobs located in the CBDs of our big cities.

They will want to live centrally to frequent hospitality venues, visit events, and minimise commuting time. As they start coupling up, they will operate as dual income households without children and have cash to spare. A great cohort to be selling too.

Millennials will see a healthy rise

Millennials will be occupying the 34-51 segment. All kids in childcare and primary school will have Millennial parents. This cohort sees growth of 16%, which is slightly above the national average.

Considering the extremely high female workforce participation rate of Millennial women, the demand for childcare will be higher than ever. The current system couldn’t cope with such increases.

Millennial families will have moved to the urban fringe since this is where the lion share of family-sized houses were for sale. Councils on the urban fringe must prepare now for the very predictable increase in demand for such services.

Gen X'ers will be outnumbered

The 52-64 segment sees humble growth of 6%. Almost all people in this age segment are already in Australia. Migration isn’t topping up the population over 50 years of age.

Baby Boomers occupied this segment in the recent past and now hand over the impactful 50s to the poor forgotten Gen Xers. These are the upgraders, the parents of teenagers that want a larger home. It remains to be seen how many large enough homes at the right price point will enter the market.

If current market conditions remain, this cohort will stay largely put.

A larger army of grey nomads

The 65 and over cohort grows by 29% – that’s two times the rate of the national average rate. Caravan parks will be booming as the army of grey nomads swells to record size.

In many respects the 65-74 segment is the best consumer cohort. They have time, money, and energy. All other cohorts tend to miss at least one of the three.

Downsizing will start becoming a mass-phenomenon by the 2030s as older Baby Boomers see their health decline and the family home becomes a nuisance to manage (or even a physical hazard). Baby Boomer homes are located in the middle suburbs of Australia.

Throughout the 2030s, these homes will enter the market and many of them will be bulldozed to make room for three townhouses – densification of the middle suburbs is all but guaranteed.

Over 85s will boom

The most dramatic growth occurs in the 85+ segment which will increase by a massive 68% to 974,000 (up from 580,000). Half of the 85 and over segment needs care.

If you’ve been to an aged care home recently, you will know that we import care workers from overseas. The 85+ cohort alone guarantees a continuation of our high migration approach. Also, anyone operating a business in aged care, healthcare, or funeral homes will have a lucrative decade ahead.

This is just the top-level overview of what type of forecasting can be done with this simplest of charts.

Demographer Simon Kuestenmacher is a co-founder of The Demographics Group. His columns, media commentary and public speaking focus on current socio-demographic trends and how these impact Australia. His latest book aims to awaken the love of maps and data in young readers.

This article was originally published by The New Daily and is reproduced with permission.