These are presentations from the Sohn Hearts & Minds Investment Leaders Conference in Sydney on 11 November 2016. Each high-profile portfolio manager is given 10 minutes to explain their investing strategies and include one major investible insight.

David Prescott

David is a Founding Director of Lanyon Asset Management, a value-oriented equity fund manager established in 2009. Prior to founding Lanyon, David was previously Head of Equities at institutional fund manager, CP2 (formerly Capital Partners).

Best idea: Cross Harbour (Holdings), listed in Hong Kong

Low interest rates and central bank activity have encouraged buyers to push some yield assets, such as REITS, utilities and infrastructure, to absurdly high prices. But opportunities remain.

Toll roads are regulated monopolies, with growing and predictable cash flows, little incremental costs in later stages and contract terms specified in long dated contracts. Accelerating increases in toll prices and increased use lead to predictable revenue increases. In final years of a concession, toll roads often make massive profits, but most prices have been pushed too high.

Cross Harbour (Holdings) is listed in Hong Kong. Only three tunnels cross the harbour to Kowloon, and this concession will produce massive free cash flows until 2023. The current share price is $10.70 but the valuation of the parts is estimated at $19.23, even with a testing discount rate. It includes $6.14 of cash and has a large margin for safety. It’s off the radar of many large investors as it’s a small cap. The Chairman rarely speaks to investors, and many accuse it of having a lazy balance sheet.

We believe there are catalysts to realising value such that it’s not a value trap, especially a potential special dividend that will to lead to a rerating.

Peter Cooper

Peter founded Cooper Investors in 2001. He started in the industry in 1987 as a specialist industry analyst, and by 1993, Peter ran the Australian equity portfolios for BNP and for 7 years was with Merrill Lynch as a Managing Director. Over 5 years the specialist equity portfolio was number 1 in the Intech Australian Equity Survey.

Best idea: Brinks

Brinks is a major turnaround story. It is a transport company with a focus on security and carrying cash and bullion. It is listed in the US in an industry growing at 10% pa. It is the largest in the industry but least profitable despite its US$750 million turnover.

There has been a lost decade of board incompetence and poor management, with poor technology and insufficient investment in infrastructure. Past CEOs have been either conservative or without industry experience, leading to mismanagement of the business. Turnarounds are risky because employees and some customers resist, but execution risk here is considered low. As well as a new CEO, there are new directors, experienced in the transport industry.

Cultural change needs an external influence, and new CEO Doug Pertz specialises in turnarounds. He previously managed Recall as part of Brambles, which is similar to Brinks with its warehouses and trucks. There is much low-hanging fruit, with hundreds of things that can be done to improve productivity, such as rationalising its 220 depots.

There is great potential to leverage the existing client base because they do not spend enough on marketing. At the moment, 60% of profit comes from emerging markets, a sector which is growing significantly. Brinks has a strong balance sheet with good borrowing capacity.

Madeleine Beaumont (pictured on home page)

Madeleine Beaumont has been a Senior Portfolio Manager of Australian Fundamental Equities at BlackRock Asset Management Australia Limited since June 2015. She began her career in stockbroking, then transferred to the buy-side at SBC Brinson. At M&G, the investment arm of Prudential PLC, Madeleine was rated the number 2 Consumer Analyst.

Best idea: Fairfax

Fairfax owns Domain, which has had sales growth over 33% pa for the last three years, and is now the No 2 in real estate advertising. It has won awards for the best app, taking advantage of the trend to mobile consuming.

Domain is Fairfax’s key asset, where they are injecting a lot of support and money. It is relatively cheap to advertise on Domain, giving future pricing opportunity. It has a data rich platform, with the ability to delve deeper into the value chain for other products such as mortgages and insurance.

The key driver of profit is property turnover, and Australia is at a 23-year low in market turnover. This is because most people believe prices will continue to rise and are unwilling to sell. But there are always life events which lead to property sales and changes which stimulate turnover activity.

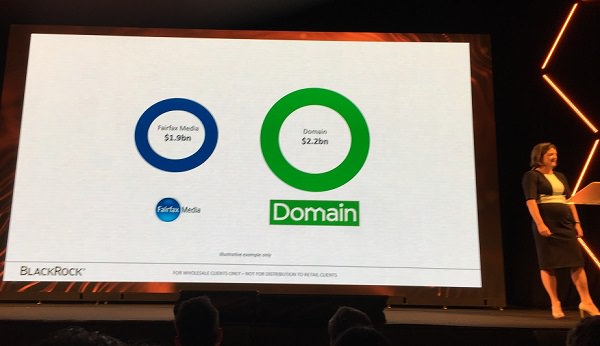

Blackrock believes Domain is worth more than the market value of Fairfax. Fairfax is synonymous with newspapers, but it is rapidly reducing its exposure to print, and already earns 60% of revenue from non-print sources.

Current media ownership laws are out of date and local players will have future opportunities. Fairfax is also in radio and New Zealand, and Stan is largely being ignored in valuations despite having over 600,000 active subscribers. Fairfax has a 6.5% free cash flow and pays a 4.8% dividend.

We believe it has a cheap valuation and a strongly-aligned management team. People will always be buying and selling homes and investments, making Domain an excellent business.

Patrick Hodgens

Patrick Hodgens is Head of Equities at Macquarie Investment Management and lead portfolio manager of the Macquarie High Conviction Fund, winner of the Money Management / Lonsec Australian Equities (Broad Cap) Fund Manager of the Year award in 2016.

Best idea: Chorus

The best lesson I have learned is there is a big difference between an exciting industry and an exciting investment. The best opportunities often come from a boring industry.

Evolution Mining, Qantas and Bluescope are my second, third and fourth best ideas, but Chorus is at the top. It is listed on the ASX and is a New Zealand telecommunications company. It is building the country’s ultrafast broadband network and therefore has high capex at the moment. The share price was marked down in previous years due to a regulated pricing regime but it has recovered strongly.

This opportunity was found by focusing on what is happening now not in the past, being unconstrained and investigating where others are not looking.

It’s a yield stock with a difference. In recent years, the Australian ‘yield basket’ (companies like banks and utilities which are sometimes considered alternatives to bonds) has outperformed the ASX 200 to become 36% of the index from only 7% in 2008. However, it has fallen out of favour in recent months. We look for the future yielders which have improving and sustainable cash flows. Chorus’s capex spend will fall in the near future giving it a rapid increase in free cash flow. Sustainable and growing cash flows will translate into dividends.

We believe this is the cheapest yield stock in the market today. It can be bought for less than half its intrinsic value but it requires patience and investing for the long-term. The stock has halved and then tripled. The regulatory regime is now certain for at least the next three years, and by 2020 and beyond it will look like a typical infrastructure company and perhaps buy back some shares.

This is general information and the investments may not be suitable in many portfolios as the personal circumstances of investors are unknown. Cuffelinks accepts no responsibility for the performance of the investments and this is the author's version of the talks.