The superannuation industry isn’t quite sure what a comfortable retirement is, even as it desperately works to help members achieve that elusive goal.

It’s no surprise given the complexity of the task, which is affected by lifespan, personal expectations, government legislation, savings rates, market performance and more.

Many different opinions

But the problem is that members are likely to become disengaged and lose trust when they read conflicting articles about how much they need to save such as:

- A couple will need about $640,000 in super savings to have a comfortable retirement.

- A couple that saves at least $1 million in super will only generate about two-thirds of their pre-retirement income.

- A couple needs about $1.5 million in super to generate an income equivalent to average weekly earnings.

- A professional couple will need about $2 million in super at retirement.

These numbers stand in stark contrast to the median super balance at retirement (for those aged 60 to 64 years of age) of just $100,000 for men and $28,000 for women. Whatever estimate is chosen for a comfortable retirement, it’s out of touch for at least half the population.

The current crop of widely-ranging estimates also leaves much to be desired for wealthier Australians. Super accounts for just a small component of net household wealth according to the Productivity Commission and wealthier people tend to have more assets outside of super. It’s just not possible for super funds to estimate the level of super their members require when they don’t know the level of non-super assets they have and how they’re being used.

The amounts many Australians actually spend

Milliman’s quarterly Retirement Expectations and Spending Profiles (ESP) provide that type of information by analysing 300,000-plus retirees’ spending data.

The Retirement ESP shows that Australians aged 65 to 69 spend a median of just $31,068 (from all sources including super, non-super savings and government benefits) each year. To fund this expenditure with 75% certainty would require a superannuation balance of approximately $130,000 invested in a balanced fund. This also includes the substantial contribution of the age pension (set at a maximum of $20,745 a year, the maximum basic rate for a single excluding supplements), which funds a major portion of retirement income.

This isn’t to say that $130,000 should be a goal. It shows that even small differences in savings can have a hugely positive impact on members’ actual retirement lifestyles. This is the basis for true engagement.

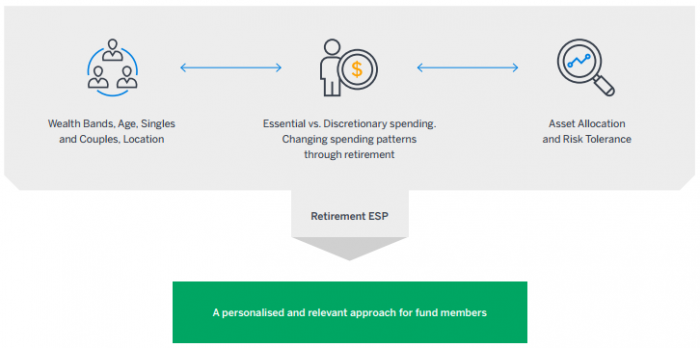

More detailed market segmentation also reveals the behaviour of retirees by wealth bands, age, singles versus couples, location, as well as showing their essential versus discretionary spending and how it changes through retirement.

Retirement and Expectations Spending Profiles

This type of quality data is crucial given most people will not seek personal financial advice. However, data is just one component of delivering a personalised retirement experience. A combination of data and analysis can provide a sophisticated profile that can ultimately underpin and deliver the right products to the right members at the right time.

Each member must ultimately define their own comfortable retirement but it’s only by understanding their reality that super funds can help them achieve it.

Wade Matterson is a Principal, Senior Consultant, and leader of Milliman’s Australian Financial Risk Management practice and a fellow of the Institute of Actuaries of Australia. Read more about the Milliman Retirement ESP here. This article is general advice only as it does not take into account the objectives, financial situation or needs of any particular person.