Analysis of corporate credit comprises three key areas of assessment: volatility, financial ratios and structure. Everyone knows and uses financial ratios, or at least the rating agency shorthand of them which is summarised in labels such as ‘AAA’ or ‘BB’. The most common financial ratios are leverage, interest cover and gearing. (Property transactions substitute loan to value ratio for balance sheet gearing and infrastructure often uses debt to regulated asset base.)

Structure is less well understood, but most observers at least know that secured is better than unsecured and that covenants are a good thing.

Volatility is the simplest of the three key areas to test, but it is often the most ignored. As credit can suffer losses when a business underperforms but doesn’t usually share in the upside of business outperformance, volatility of earnings and cashflows is undesirable. Convertible bonds and debt structures that come with warrants or options seek to address the perceived imbalance of risk sharing. However, these bells and whistles are used to allow lenders to obtain a share of the upside in more volatile companies rather than protecting against downside. Vanilla loans and bonds are therefore best suited for companies with relatively stable cashflows.

Recent examples of bond price volatility

The recent months have given us fresh examples of what can happen when potentially volatile companies take on meaningful levels of debt. American Eagle Energy Corporation raised US$175 million in secured bonds in August 2014. The first interest payment was due in March 2015. The company skipped the payment and is now negotiating with creditors in order to salvage some value for shareholders. The drop in oil prices means that it isn’t generating enough cashflow to service its debts. Its cost of doing business is simply too high with oil prices at nearly half the level when the debt was issued.

Fortescue Metals spent a good part of March 2015 trying to extend its debt profile and then reassuring investors that its failure to do so wasn’t a big deal. The bond markets clearly disagreed with the 2019 bonds dropping from 98.5% after the proposed debt restructuring was first announced to 78% at the time of writing. Comments from the CFO that the business is “bulletproof” and from the Chairman that the four largest iron ore producers should jointly restrict supply didn’t help perceptions.

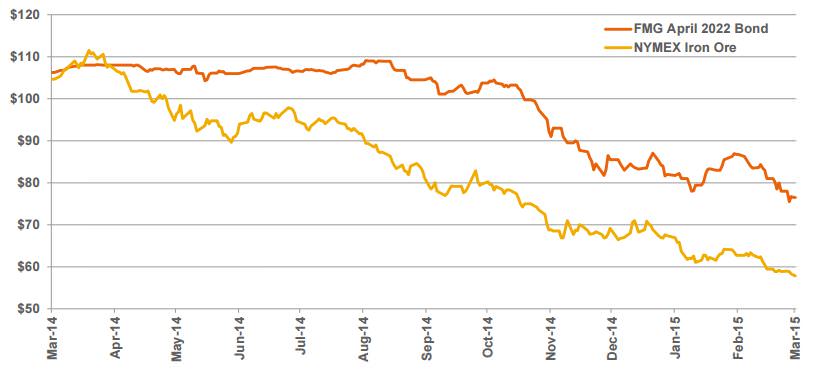

Based on iron ore prices at month end, Fortescue is thought to be cashflow negative after interest and maintenance capital is taken into account. With substantial principal repayments due in 2017 and 2019 Fortescue is now looking for other ways to raise capital, which are thought to include sales of mines or rail infrastructure. There have been missed opportunities to sell infrastructure, raise cheap long term debt or to raise additional equity in the years since the previous 2012 debt scare. Chart 1 shows how the bond market has reacted to changes in the iron ore price.

Chart 1: Price of Fortescue's 2022 bonds versus iron ore price

Source: Morningstar

Commodity producers are amongst the most volatile companies, with the long term graphs of commodity prices showing enormous fluctuations. When times are good, new capacity enters the system but it has long lead times and before production ramps up prices can rise sharply. When demand falls or oversupply occurs it again takes time (typically years) for the supply of the commodities to drop back to balanced levels and prices can drop sharply. Agricultural commodities can also suffer from a high level of price volatility. Unexpected weather that knocks out a season of production in one part of the world quickly boosts prices for those elsewhere who are still able to supply. Companies that service industries dependent upon volatile commodity prices also get caught up in the cycle, as the focus on costs and amount of new capital invested varies substantially as the profit margins in the industry wax and wane.

Managing volatility is often overlooked

Old-fashioned mechanisms for mitigating volatility such as hedging and weather insurance have been discarded by many. Had either American Eagle or Fortescue wanted to, they could have locked in their selling prices for several years at healthy levels back in 2014 using futures or long term supply contracts. The trend in the last ten years has been for shareholders to discourage commodity producers from hedging, preferring to keep the revenues of the businesses variable and subject to market forces in what was expected to be a seller’s market. The balance of power has now changed and the lack of long term hedging looks set to render many higher cost producers insolvent.

Volatility goes beyond commodity producers and their related industries. Other volatile industries are often referred to by equity investors as ‘cyclicals’. These include airlines, hotels, construction and some retailers with spending on these items seen as discretionary and subject to being cut in a time of recession. These too can be an inappropriate match for traditional debt funding.

A current example of the outcome of a volatility assessment is to avoid buying Qantas unsecured bonds but to invest instead in Sydney Airport debt. Qantas has shown over the last seven years that it is good at making excuses but not good at making profits. Airlines are known to be notoriously volatile with a long history of insolvencies and government bailouts. Conversely, mainline airports have shown a much lower level of volatility and financial issues. When downturns occur, airlines typically bear the brunt with airports, aircraft manufacturers and aircraft leasing companies typically remaining profitable. Savvier debt investors have also been lending to airlines via lease structures. In the event of an airline’s insolvency the planes often remain under contract with all payments made. The fall-back position is having a hard asset to seize (ideally a late model plane) that can be redeployed elsewhere.

Footnote: Post the writing of this article, Fortescue announced its March 2015 quarterly production report and the bonds and shares rallied in response to expectations of lower iron ore production costs.

Jonathan Rochford is Portfolio Manager at Narrow Road Capital. This article is for educational purposes and is not a substitute for professional and tailored financial advice. Narrow Road Capital advises on and invests in a wide range of securities.