The price of gold rose at its fastest pace in a decade in 2020, ending the year trading at USD 1,888 per troy ounce. Despite a pullback in the first six months of 2021, including a sharp fall in June, gold is back on the radar of investors after a 70% rally between September 2018 and August 2020. At one point, the precious metal hit all-time highs in nominal terms above USD 2,050 per troy ounce.

The price rise over this period and the factors driving it have also resulted in a notable increase in demand among developed market investors.

This is best visualised through the almost 900 tonnes and USD 48 billion worth of gold purchased through gold ETFs globally in 2020, a number that in monetary terms more than doubled demand seen in any previous calendar year.

The increase in demand is not only being driven by retail investors including SMSF trustees, but HNW investors, Family Offices, and increasingly, institutional portfolio managers, many of whom are allocating to gold for the first time.

Our latest report, The case for gold: A special report for institutionally managed superannuation funds, highlights the multiple reasons superannuation funds may wish to incorporate a modest allocation to the precious metal in their portfolios.

Time period studied

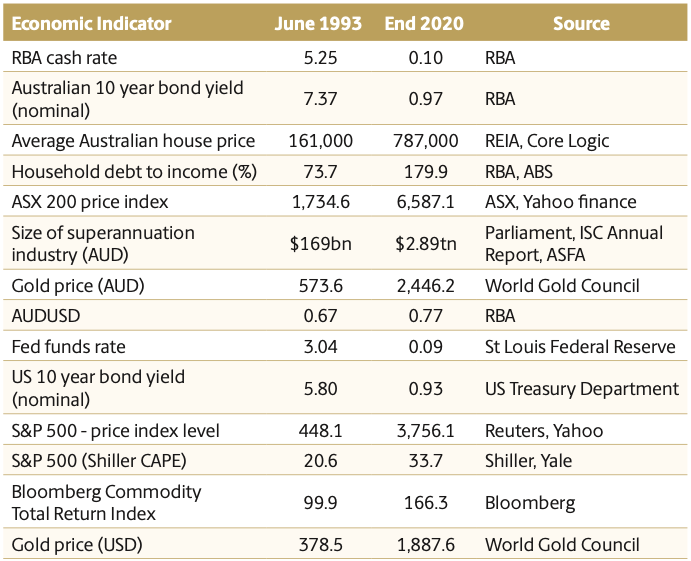

The findings contained in the report cover the time period from June 1993 through to the end of December 2020 for growth strategies, essentially capturing the entire compulsory Superannuation Guarantee era.

The table below highlights some of the key economic indicators and how they have changed over that time period. Oh, to be able to buy a house for $161,000 again!

What do the numbers say?

Historical data analysis suggests strategic allocations to gold would have improved risk adjusted returns (RARs) for diversified investment strategies from conservative through to all growth portfolios.

This is primarily due to the fact gold has historically had a positive correlation to rising risk assets, and negative correlation to falling risk assets.

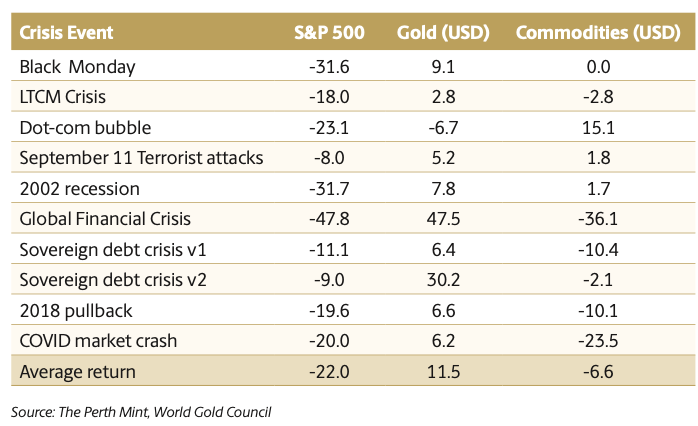

The latter is seen in the table below, which highlights the performance of the S&P500, gold, and a basket of commodities in some of the major risk off events that have afflicted markets in the past 30 plus years.

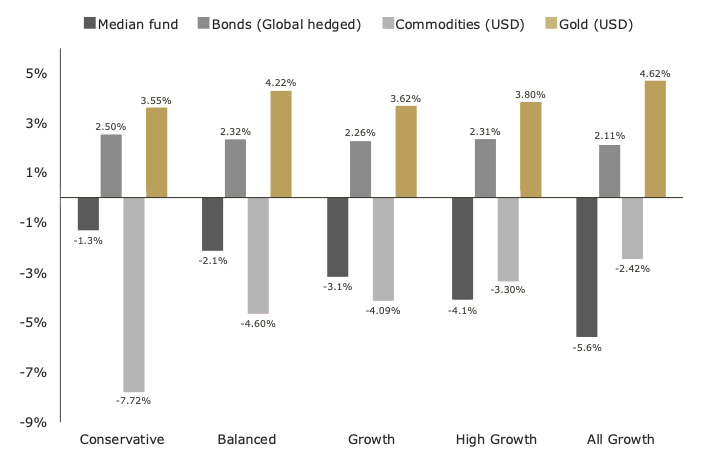

Within the context of superannuation portfolios, the chart below reinforces the above point highlighting the average returns for a range of asset classes in the quarters median superannuation funds fell in value, as well as the average decline of the median funds themselves.

Average US dollar and global asset class and median fund returns (%) in quarters median funds declined in value

Source: The Perth Mint, Chant West

Given gold is characterised by some investors as a risk asset and by other investors as a defensive asset, the above chart also highlights the returns from commodities and fixed income in the quarters when median funds declined in value, with gold the clear outperformer.

This flows through to the detailed findings in our report which model the portfolio impact of 1% through to 5% allocations to gold, bonds and commodities. This modelling demonstrates that gold has historically provided portfolio benefits not easily replicated by another asset class.

It’s not all about performance

While improved risk adjusted returns alone could justify a gold allocation in a portfolio, they arguably do not fully capture the benefits of holding the precious metal, given they only look at performance and volatility, rather than the full range of risk investors need to factor in when allocating capital.

All other things being equal, an allocation to gold will also likely improve the liquidity, as well as lower the investment costs, dispersion and credit risk of an institutionally managed portfolio.

These attributes are particularly relevant when assessing the precious metal against other alternative assets.

The findings from the research report are just as relevant for self-directed investors, including SMSF trustees.

Not only do SMSF trustees face the same challenge in terms of low to negative real rates, which impact their cash and term deposit holdings, but they also lack the scale to allocate to many alternative assets, from private equity to unlisted infrastructure to hedge funds (with some exceptions).

Given gold is liquid, efficient to allocate money to, and has a track record of protecting portfolios during equity market turbulence or a long period of low to negative real interest rates, it could be useful to SMSFs and the intermediaries who advise them on their portfolios.

But isn’t gold expensive now?

Given gold hit all-time highs in nominal terms in 2020, it’s fair to question whether now is the right time to look at incorporating an allocation to the precious metal in a diversified portfolio.

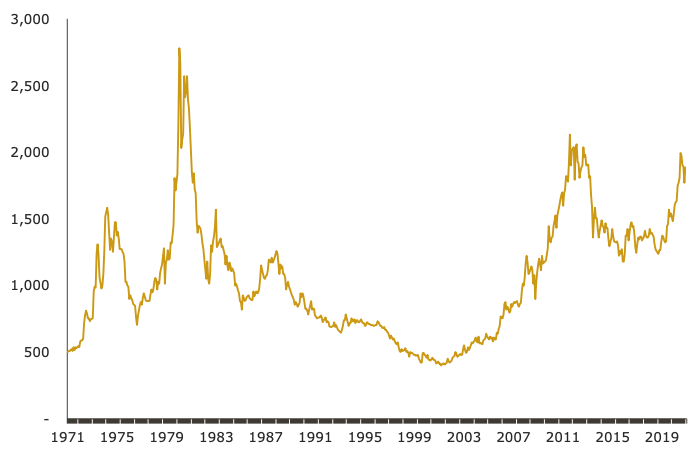

While no longer as cheap as it was, a variety of metrics from measuring the real gold price relative to inflation (see chart below), to gold’s share of global financial assets, to its price relative to equity market indexes, all suggest it is still inexpensive relative to history.

Real gold price – 1970 to 2020

Source: The Perth Mint, Reuters, St Louis Federal Reserve, US Bureau of Labour Statistics

To that end, the almost 15% pullback in the USD gold price in the past eight months looks like a healthy correction in an ongoing bull market.

Outlook

Like all asset classes, gold isn’t perfect, with its short-term volatility and the lack of income it generates likely to remain a barrier for some investors for the foreseeable future.

From an economic standpoint, while economic growth has picked up in 2021, ageing demographics, high private and public debt levels and the likelihood of a continued pushback against globalisation, may provide headwinds.

From a monetary perspective, policy makers stress we will remain in a low to negative real interest rate environment for years to come, with central bank balance sheets continuing to expand.

Finally, from a market perspective, current valuations and real yields suggest traditional diversified investment strategies will deliver lower returns in the future.

Combined, these factors may well provide a favourable backdrop for gold, given it has a proven track record of:

- Generating strong long-term returns in its own right.

- Generating positive absolute returns and outperforming other assets in low real interest rate environments.

- Being positively correlated to rising equity markets and negatively correlated to falling equity markets.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.