In 2000, when CBA bought Colonial State Bank and its wealth manager, Colonial First State (CFS), CBA hired me as a consultant on the deal. One of my roles was to determine how much funding CBA could source from CFS portfolios. CBA expected CFS fund managers to invest more into CBA deposits.

It showed a fundamental misunderstanding of the responsibility of a fund manager to act in the best interest of its investors, not the bank's shareholders. The CFS fundies explained their fiduciary duty and told me where to stick my bank balance sheet. Ouch!

The confusion arises because a banker is not a fiduciary in its customer relationships. A bank is entitled to prefer its own interests above those of its customers, and the bank generally has no duty to advise customers of a more advantageous deal. Banks offer lower deposit rates and higher lending rates to existing customers than new customers without any compunction.

There is therefore inherent conflict when banks own wealth management businesses. To some extent, it can be managed by strict rules about conflicts of interest, but there are cultural differences. In 2011 when CBA paid $373 million for Count Financial, it was driven by the assumption that Count clients would go into CFS funds and platforms. It never happened, and now CBA has run up the white flag and given up on wealth management. CEO Matt Comyn explained:

"(CFS Group) will benefit from independence and the capacity to focus on new growth options without the constraints of being part of a large banking group ... It also responds to continuing shifts in the external environment and community expectations, and addresses the concerns regarding banks owning wealth management businesses."

In fact, it does not address the main vertical integration concerns about funds management, platforms and advice in the same corporate structure, and it passes that problem to the next management team. In commenting on the word 'independent', ASIC said that under s923A of the Corporations Act, a licensee can only describe itself as independent if it is operating without any conflicts of interest.

Following the FOFA legislation, advice scandals and the Royal Commission, CFS staff who manage the FirstChoice platform must go through a more arduous process to include in-house funds than those of external managers. Internal compliance demands evidence that funds from Colonial First State Global Asset Managers, and alliances such as Realindex, Aspect Capital and Generation, are both cost and performance competitive. It's a way of managing the vertical integration conflicts, but it does increase the compliance, legal and administrative work on selecting funds for the platform.

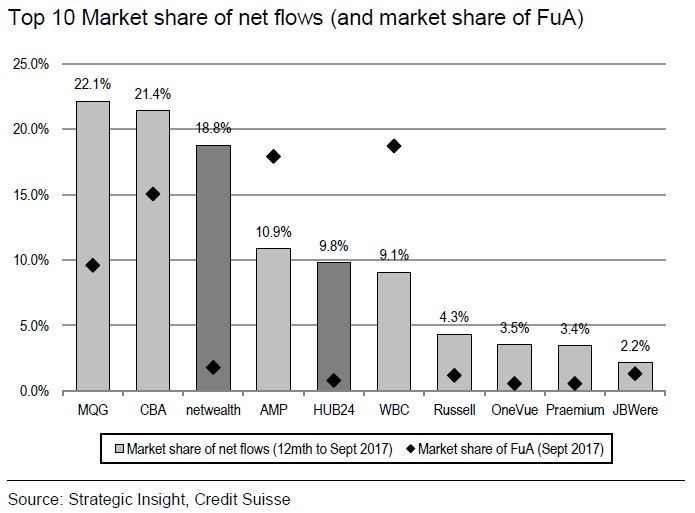

CBA had a harder decision than ANZ and NAB, as its wealth business is more substantial and successful. As the following chart shows, CBA entities not only have a much larger market share of funds, but they are doing well on new flows. The chart also shows why Hub24, netwealth, OneVue and Praemium are sharemarket darlings, gaining more flows than their market share.

wealth management

Matt Comyn wants to go back to banking basics, and he threw Aussie Home Loans and Mortgage Choice into the demerged entity to avoid further Royal Commission fallout. But nobody is asking why he kept broker CommSec in CBA. Probably because he once ran CommSec and feels he understands it, but it barely qualifies in the "focus on its core banking businesses". The separation ends the 'bancassurance' and 'allfinanz' models that bankers loved in the 1990s.

Graham Hand is Managing Editor of Cuffelinks.