One question investors often ask about claiming depreciation on a rental property is "how will these claims affect capital gains tax (CGT) when the property is sold?"

CGT can be complex for investors, particularly since it depends on the individual investor's situation.

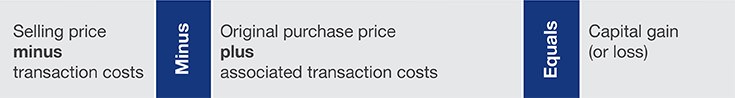

Introduced in September 1985, CGT is basically the tax payable on the difference between what you bought an asset for and what you sold it at. When you sell a property, this triggers what is called a ‘CGT event’ where you either make a capital gain or loss, which you can calculate using the following method:

To explain the implications of property depreciation on CGT, here are six facts investors should be aware of:

1. What is property depreciation?

Property depreciation is the wear and tear on a building and the plant and equipment items within it. The Australian Taxation Office (ATO) allows owners of income-producing properties to claim this depreciation as a deduction in their annual tax return, meaning they pay less tax. Property depreciation is made up of two main parts; capital works deductions and plant and equipment depreciation.

2. How do capital works deductions affect CGT?

Capital works deductions are available for the wear and tear on the structure of the building. Examples of items which can be claimed include bricks, walls, floors, roofs, windows, tiles, and electrical cabling. The capital works deductions reduce the cost base of the property, which will add to the capital gain and therefore increase the amount of CGT applicable on sale.

3. How does plant and equipment depreciation affect CGT?

You can claim depreciation deductions for the mechanical and easily removable plant and equipment assets contained in an investment property. When a property is sold, a gain or loss is calculated separately on these items. As outlined by the ATO on its website, you can make a capital gain if the termination value of your depreciating asset is greater than its cost. You make a capital loss if the reverse is the case. That is, the asset’s cost is more than the termination value.

Learn more: Invest smarter with a tax depreciation schedule

4. What CGT exemptions apply for a principal place of residence?

Properties which are owned by someone who resides, occupies or lives in the property as their home are exempt from CGT so long as the dwelling is used mainly for residential accommodation and is located on land under two hectares in size.

If, as the owner of a primary place of residence, you choose to move out and rent it, a CGT exemption is available for up to six years after you have moved out so long as you don’t own another primary place of residence.

If the owner moves back into their investment property, then moves out and rents the property again, a new six-year period will commence from the time they last moved out of the property. There is currently no limit to the number of times a property owner can do this so long as each absence is less than six years.

You can only class one property as a primary place of residence and therefore exempt from CGT at any one time, with the exception of the following rules which apply if you treated both properties as your primary place of residence within a six-month period:

- the old property was your primary place of residence for a continuous period of at least three months in the 12 months before you sold it and you did not use the property to provide an assessable income in any part of the 12 months when it was not your primary place of residence

- the new property becomes your primary place of residence.

5. Are property investors eligible for a discount?

A 50% exemption on CGT is available to individuals or small business owners who hold an investment property for more than 12 months from the signing date of the contract before selling the property.

6. Is it worthwhile claiming property depreciation if it will later add to the capital gain?

The short answer is yes. During the term of ownership, you can claim capital works and plant and equipment as a deduction at your marginal tax rate. These deductions will reduce tax liabilities, therefore generating additional cash flow for the investor each year.

When you sell a property, if you have held it in your name for more than 12 months, you will be eligible for the 50% exemption. This means that only 50% of the capital works deductions during ownership will carry through to the ‘CGT event’, making it far better for you as a property investor to claim the capital works deductions and take advantage of the additional cash flow during ownership. Depreciation claims also provide you with an opportunity to invest further or reduce loan liabilities.

When considering selling an investment property, you should talk to your accountant about the implications of CGT and your available exemptions. A specialist Quantity Surveyor can also provide advice on the depreciation deductions for any investment property.

Bradley Beer is a qualified Quantity Surveyor and Chief Executive Officer at BMT Tax Depreciation.