It has been another challenging year for superannuation, including for industry regulators, market professionals, fund administrators and trustees managing an SMSF. We have seen the completion of the Financial System Inquiry (FSI) as well as mixed economic and market conditions. Here are three challenges I am most focused on heading into 2015.

1. Are equity markets cheap or expensive?

For anyone involved in investment management, the issue of whether equity markets are cheap or expensive is nearly always front of mind. How can the issue of valuation not be clear-cut? The answer is simply that there are many definitions of value. Key for me is whether we should put more emphasis on outright or relative (to other asset classes) value measures.

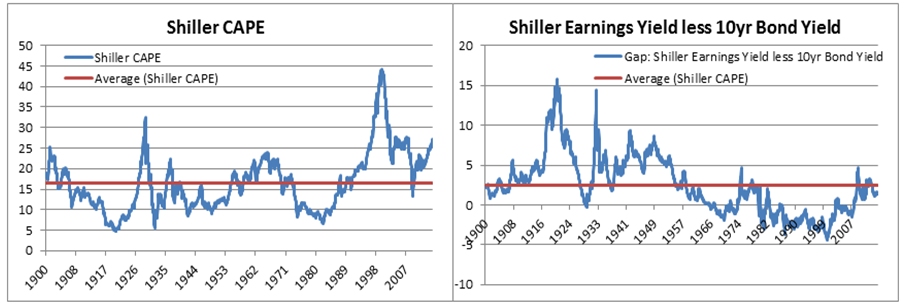

There are many charts (including the one at left below) which consider outright asset class value. A simple example is a price-to-earnings ratio (Shiller’s well-known CAPE) which at present suggests that equities look expensive. The alternative relative value (to bond yields) approach, presented in the right chart below, suggests that equities are offering a premium above bond yields close to their long term average.

Source: Robert Shiller, Yale University

Many market participants focus on outright value measures, yet the relative value approach has merit as it focuses us on where the best return on capital is available. When the two approaches contrast, we are faced with determining whether a market is good value or not.

2. Financial literacy and the Standard Risk Measure

I’ve previously raised concerns about the ability of APRA’s Standard Risk Measure to inform the public of prospective investment risk (see Cuffelinks article Is APRA’s Standard Risk Measure helpful? for more detail). This statistic was devised in consultation with industry bodies ASFA and FSC and has recently returned to the forefront when Pauline Vamos, CEO of ASFA, commented in her keynote speech at the ASFA Conference that they acknowledge there has been criticism and they are open to ideas of a better measure (for a good summary of Pauline’s speech see Sustainability of the super system in a time of disruption).

Who will be using and relying on this information and will they benefit?

- For the financially illiterate (meaning those who don’t understand compounding, inflation and time value of money), a measure of risk will not really help them – they need education and advice. The financially illiterate likely make up the majority of the population (potentially 60% as explored in Do clients understand what advisers are saying?)

- No single industry professional worthy of the title ‘professional’ would rely on a single measure of risk. They would consider risk in many different ways through both quantitative and qualitative lenses.

It is hard to identify the beneficiary of the limited information provided by the Standard Risk Measure. Perhaps the real leadership opportunity for industry bodies such as ASFA is to be firmer in their feedback to APRA that such a measure can make the uninformed feel dangerously well-informed. The risk section of a PDS could clearly state that one should consider all facets and dimensions of risk and the Standard Risk Measure should not be the sole assessment of risk.

3. Super funds and post-retirement design

The FSI made recommendations regarding a retirement outcomes focus (for Cuffelinks’ summary of the Final Report see David Murray moves the goalposts), such as:

- seek broad political agreement for the overall objectives of superannuation, since super does not have a consistent set of policies

- super funds should provide retirement income projections for members to improve engagement

- trustees of super funds should select a comprehensive income product for retirement (CIPR) for their members, effectively pooling risk to ensure income throughout retirement.

The first point is well made. The FSI has established its own baseline objective:

“To provide income in retirement to substitute or supplement the Age Pension.”

Unfortunately what is missing here is specific guidance as to the trade-off between the level of income and the variability and security of that income. Some of the models used by academics are highly relevant; the question is whether regulators and industry could understand these powerful but complex models.

Retirement outcome modelling is full of variability which is difficult to model – variability in return outcomes and mortality outcomes are just two of many sources (see How much variability exists in retirement outcomes? for further discussion). However without such a tool (which I call an ‘outcome engine’), we cannot deliver on the final two points listed above in a fully-formed manner.

Consider member projections first; all member projections at present, even those provided by ASIC, are primarily focused on expected outcomes. This means the projection information provided to individuals (many of whom may be financially illiterate) is roughly 50% likely to be achieved (or 50% likely to not be achieved). Is that an appropriate basis on which to provide such information? For me this type of information on retirement projections has eerily similar shortcomings as the Standard Risk Measure…

The design of the CIPR will be a less than perfectly-informed decision by trustees in the absence of a highly-specified outcome engine to assist with the decision making process. Most trustees would have to rely on gut feel to make their decision on the most appropriate CIPR specification. The post-retirement product space is constantly evolving, but without a powerful outcome engine to assess the benefits of innovations, I feel trustees will be left exposed.

FSI complexity is in the implementation

The recommendations around retirement outcomes in the FSI have merit but implementation will be complex. A simpler solution would have been an additional regulatory requirement for super funds to have an outcome engine which considers all relevant sources of retirement outcome variability in place as a component of their product design processes within three years.

There is a real leadership opportunity for super funds to bring the appropriate skills into their businesses to develop their own outcome engines. While I have previously discussed this issue (see ‘Outcome engines’ should be the heart of your business) the FSI Report only confirms my belief that outcome engines will be a top three business issue for the leading super funds for the next five years. This is one of the best opportunities for worthwhile collaboration between industry and academia.

Wishing everyone all the best for the festive season and 2015.

David Bell is Chief Investment Officer at AUSCOAL Super. He is working towards a PhD at University of New South Wales.