'Gifting assets' before applying for a pension often will not increase the amount of age pension received. The gifting and deprivation rules prevent you from giving away assets or income over a certain level in order to increase age pension and allowance entitlements. For Centrelink and Department of Veteran’s Affairs (DVA) purposes, gifts made in excess of certain amounts are treated as an asset and subject to the deeming provisions for a period of five years from disposal.

What is considered a gift for Centrelink purposes?

For deprivation provisions to apply, a person disposes of an asset or income when they engage in a course of conduct that destroys, disposes of or diminishes the value of their assets or income, without receiving adequate financial consideration in exchange for the asset or income.

Adequate financial consideration can be accepted when the amount received reasonably equates to the market value of the asset. It may be necessary to obtain an independent market valuation to support your estimated value or transferred value or Centrelink may use their own resources to do so.

Deprivation also applies where the asset gifted does not actually count under the assets test. For example, unless the ‘granny flat’ provisions apply, deprivation is assessed if a person does not receive adequate financial consideration when they:

- Transfer the legal title of their principal home to another person, or

- Buy a new principal home in another person’s name.

What are the gifting limits?

The gifting rules do not prevent a person from making a gift to another person, but cap the amount by which a gift will reduce a person’s assessable income and assets, thereby increasing social security entitlements.

There are two gifting limits as follows:

- A person or a couple can dispose of assets of up to $10,000 each financial year. This $10,000 limit applies to a single person or to the combined amounts gifted by a couple, and

- An additional disposal limit of $30,000 over a five-financial-years rolling period.

The $10,000 and $30,000 limits apply together, meaning that assets can be gifted up to $10,000 per financial year without penalty, but without exceeding the gifting free limit of $30,000 in a rolling five-year period.

What happens if the gifting limits are exceeded?

If the gifting limits are breached, the amount in excess of the gifting limit is considered to be a deprived asset of the person and/or their spouse. The gift is assessable as an asset for five anniversary years from the date of gifting, and subjected to deeming under the income test. After the expiration of the five-year period, the deprived amount is neither considered to be a person’s asset nor deemed.

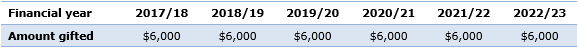

Example 1: Single pensioner – gifts not impacted by deprivation rules

Sally, a single pensioner, has financial assets valued at $275,000. She has decided to gift some money to her son to improve his financial situation. Her plan for gifting is as follows:

With this gifting plan, Sally is not affected by either gifting rule. This is because she has kept under the $10,000 in a single year rule and also within the $30,000 per rolling five-year period.

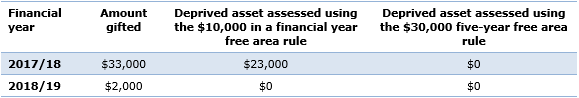

Example 2: Single pension – gifts impacted by one gifting rule

Peter is eligible for the age pension. He has given away the following amounts:

In this case, $23,000 of the $33,000 given away in 2017/18 exceeds the gifting limit (the first limit of $10,000) for that financial year, so it will continue to be treated as an asset and subject to deeming for five years. In 2018/19, while gifts totalling $35,000 have been made, no deprived asset is assessed under the five-year rule after taking into account the deprived assets already assessed, i.e. $33,000 + $2,000 – $23,000 = $12,000, which is less than the relevant limit of $30,000.

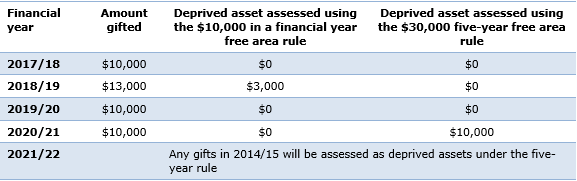

Example 3: Couple impacted by both gifting rules

Ted and Alice are eligible for the age pension. They give away the following amounts:

(Note, the bottom line in the table above should say: "Any gifts in 2021/2022 will be assessed as deprived assets under the five-year rule." Note that the dates will change as this article ages).

In this case, $3,000 of the $13,000 given away in 2018/19 exceeds the gifting limit for that year, so it will continue to be treated as an asset and subject to deeming for five years. The $10,000 given away in 2020/21 exceeds the $30,000 limit for the five-year period commencing on 1 July 2017, so it will also continue to be treated as an asset and subject to deeming for five years.

Are some gifts exempt from the rules?

Certain gifts can be made without triggering the gifting provisions. Broadly speaking, these include:

- Assets transferred between the members of a couple, such as where a person who has reached age pension age withdraws money from their superannuation and contributes it to a superannuation account in the name of the spouse who has not yet reached age pension age.

- Certain gifts made by a family member or a certain close relative to a Special Disability Trust.

- Assets given or construction costs paid for a ‘granny flat’ interest.

Trying to be too smart by gifting prior to claim

Any amounts gifted in the five years prior to accessing the age pension or other allowance are also subject to the gifting rules.

Deprivation provisions do not apply when a person has disposed of an asset within the five years prior to accessing the age pension or other allowance but could not reasonably have expected to become qualified for payment. For example, a person qualifies for a social security entitlement after unexpected death of a partner or job loss.

Liam Shorte is a specialist SMSF advisor and Director of Verante Financial Planning. This article contains general information only and does not address the circumstances of any individual. You should seek professional personal financial advice before acting.