This is an edited version of a presentation by Jacob Mitchell, Founder and CIO of Antipodes Partners, at the Pinnacle Insights Live 2023 event.

We've been observing for some time now, and it really started in 2018 with the Trump Tax Cuts: fiscal activism. There's been a real shift in the backdrop. And it was a result, I think, of the failure of QE. QE stimulated asset prices, but it was less than optimal when it came to stimulating the economy. So, it led to very wide wealth differentials, populism, then we had Trump, and then we had COVID.

And through all of this, what we saw was the response to every crisis was stimulation on the fiscal channel and also central banks reinforcing that. So, central banks normally act in a countercyclical manner, and they were reinforcing it with procyclical central bank policy. And it really reflects the fact that we think the central banks are increasingly captive to their political masters. We've really gone down the pathway of losing central bank independence.

Out of this, you'll start to see policy-led winners - that increasingly fiscal stimulus will start to go towards decarbonization, towards onshoring, and infrastructure projects. We're seeing it, but we're going to see a lot more. Let's unpack what that means for the composition of investment in the economy.

Tangible vs intangible investments

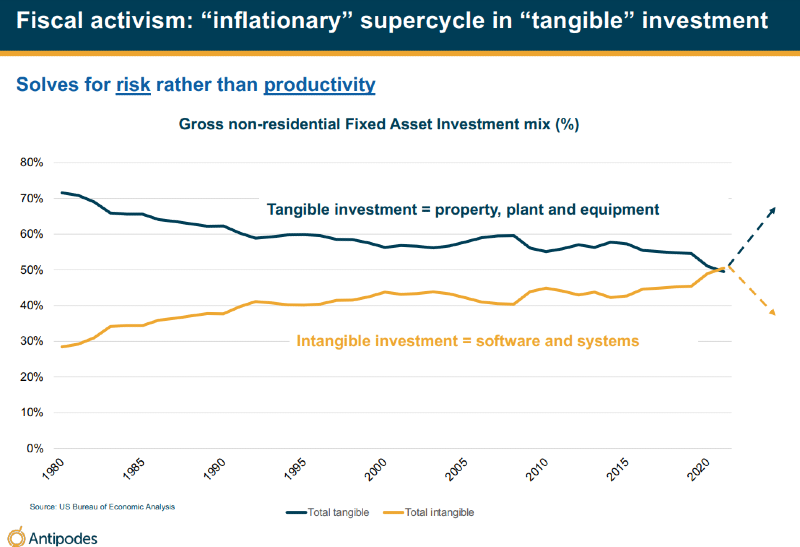

If you go back to 1980, most investments – 70% of investments went into tangible stuff, equipment structures as opposed to intangible, which is software and intellectual property. Fast forward to today and the split is 50-50.

We know why that happened. We had the emergence of the Internet; we had ecommerce, streaming video-on-demand, social media; and we also had things like the digitization of the enterprise, the emergence of the cloud. All of those things – the interesting thing about them is some of them led to productivity growth. Not all of them. I don't think Netflix has improved productivity, but the digitization of the enterprise definitely did.

Now, what we see happening is that's not going to go away, but the step change is going to come in tangible. It is all of the investment we need to solve for climate risk, to solve for geopolitical risk. And we think it will end up being more inflationary because it doesn't have a big productivity payoff.

Structurally higher inflation

The inflation backdrop - we think pressures are there; structural pressures are there. You have this fiscal activism, you have the wage pressure, which is a combination of the participation rate having fallen through COVID in the U.S. and in the U.K. We also have a big skills mismatch and part of that mismatch is really the change. And when you change the investment in the economy in a major way, you don't necessarily just all of a sudden get the skills that you need to take that tangible investment forward. You need electrical engineers, because it actually is just a super-cycle in investment in the power sector. Those skill shortages are real. The Fed is very concerned about the level of wage growth in the U.S. economy, and that's why it's been tightening.

Then you have China. China is no longer a low-cost manufacturing hub. We have the aging population in the West. We're losing workers, but we still have to take care of our elderly folk.

We have AI. AI, machine learning, certainly will start to deflate some of the service sector. AI will be very powerful actually in removing some of the most expensive jobs from the economy. But that is a longer-term trend, and it won't necessarily fix the issue that Fed has in the medium term.

We've seen this story before

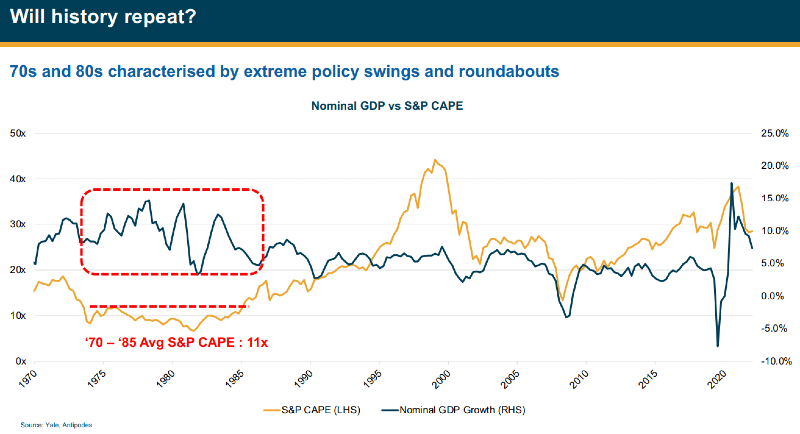

Have we seen this playbook before of fiscal policy being much more active, of central banks having to try and deal with governments and their policies, which ultimately reflected a much more volatile nominal GDP growth era? And we have.

It was the 70s and the 80s. Nominal GDP growth went through these big swings. And we know equity markets don't like volatility. It drives up the discount rate and it results in lower multiples, and that's what we saw in that period. The average multiple on the U.S. market on a cyclically-adjusted CAPE basis was around 11 times versus where we are today at 30 times. We think there is a real risk of volatility in the economic cycle, and it's already starting. You can see that leads to a derating.

What you're seeing with the euphemistically-described Inflation Reduction Act in the U.S., which should be more accurately titled the inflation reacceleration act, is US$400 billion of investment targeting the energy transition. And we say $400 billion, but actually no one really knows, because it's open-ended. It's actually production credits; it's investment credits; it's manufacturing credits; and there's no cap. And renewables are already competitive in Midwest of the U.S.; they're very competitive in the sunny parts, the windy parts of the U.S.

You don't need these incentives to encourage utilities to invest. It's actually happening anyway. So, it will really accelerate the market opportunity.

A large cap stock to play the theme

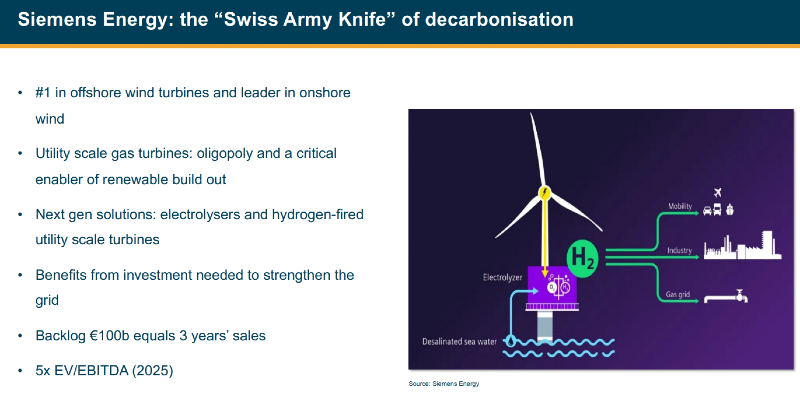

Siemens Energy: we describe it as the Swiss Army knife of decarbonization. It's a leading manufacturer of wind turbines and a leading manufacturer of high-voltage transmission equipment. It also solves for hydrogen. And look, this investment cycle is genuinely structural. Even if you just take the reality of having to decarbonizing the existing power grid, if you want to remove hydrocarbons, we need to resize the power grid by 3X. It's very hard for investors to get their heads around that number, and that's why we think this is a great opportunity to buy. You don't need to go onto the lunatic fringe. You can buy very sensible companies run by sensible people on sensible multiples because they were perceived to be cyclical companies that are transitioning to a structural growth profile.

In summary, we need to position for a real change in regime: fiscal activism and a super cycle in tangible investment. We need to be selective around yesterday's winners. We really should be focusing on tomorrow's and take advantage of the current valuation divide in markets. There are some very attractive choices. And as always, a pragmatic value approach in this environment is about finding resilient businesses that offer us a margin of safety and are really well-placed to deal with this economic volatility and looking for opportunities to protect our investors via hedging out tail risks when we see that sort of risk when it's very cheap to do that.

Jacob Mitchell is Founder and Chief Investment Officer of Antipodes Partners, part of the Pinnacle Group, a sponsor of Firstlinks. This article is an edited transcript of a February 2023 presentation and the general information does not consider the circumstances of any investor.