Moving yourself or a loved one to a nursing home can be emotional and difficult. While some have their nursing home accommodation costs fully covered by the government (based on a means test), most will have to pay their own way.

The average lump sum room value is A$334,000. Choosing how to pay can make this time even more challenging, particularly for those with low financial literacy.

This is an important and complex decision. It can affect your income, wealth, means-tested aged care fee, and bequests. Here are some things to consider before you decide.

Three ways to pay

You can pay for a nursing home room in three ways.

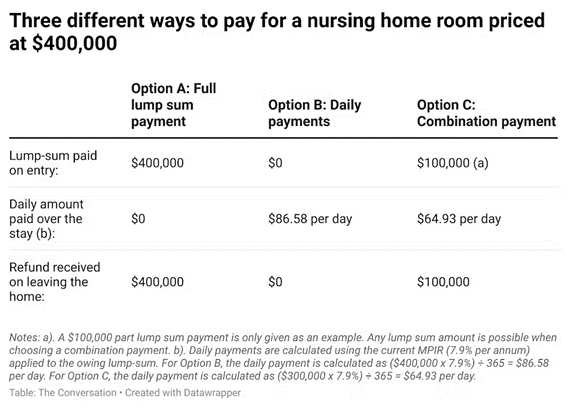

You can pay the entire room price as a one-off, refundable lump sum (a “refundable accommodation deposit”, sometimes shortened to RAD). This lump sum is refunded to the resident or their estate when the person leaves the nursing home (if they move or pass away).

The refund is guaranteed by the government, even if a provider goes bankrupt.

People who don’t want to pay a lump sum can instead choose rent-style, “daily accommodation payments” (sometimes shortened to DAP).

These are fixed, daily interest-only payments calculated on the total room price. The rate at which they are calculated is known as the “maximum permissible interest rate” or MPIR.

The maximum permissible interest rate is set by the government and is currently 7.9% per annum. The formula for a daily accommodation payment is (RAD × MPIR) ÷ 365.

Unlike lump sums, daily accommodation payments are not refunded.

The third option is a combination payment. This means paying part of the room price as a lump sum, with daily payments calculated on the remaining room amount. On leaving the home, the part lump sum is refunded to the resident or their estate.

With a combination payment, the consumer can choose to pay whatever amount they like for the lump sum.

The table below shows three different ways someone could pay for a room priced at $400,000.

So which is best? It’s impossible to say. It depends on a person’s circumstances, family situation, finances, preferences and expected length of stay.

Why do some people choose a lump sum?

One downside of a lump sum (or part lump sum) is that choosing this option means this money is not invested elsewhere.

By handing over the lump sum, for example, you forgo returns you could have made by investing this same money into property or stocks over the period of your nursing home stay.

On the other hand, paying lump sum means you get to avoid the daily interest payments (the 7.9% in the table above).

So you could potentially be better off paying a lump sum if you think there’s no way you could make investment returns on that money that are substantially higher than the interest you’d be charged through daily payments.

One advantage of choosing a lump sum is it’s considered an exempt asset for pension purposes; some people may get more pension if they pay the lump sum.

The lump sum, however, does count as an asset in determining the means-tested care fee.

And if you sell your house, remember any money leftover after you pay the lump sum will be counted as assets when you’re means-tested for the pension and means-tested care fee.

Why might some people prefer daily payments?

Not everyone can can afford a lump sum. Some may not want to sell their home to pay one. Some may want to hold onto their house if they think property prices may increase in the future.

Daily payments have recently overtaken lump sums as the most popular payment option, with 43% of people paying this way. However, recent interest rate rises may slow or reverse this trend.

And if a spouse or “protected person” – such as a dependant or relative that meets certain criteria – is still living in the house, it’s also exempt from assets tests for the pension and other aged care fees.

If the home is vacated by a protected person, its value is still excluded from the pension means test for two years (although rental income is still assessed).

If you do not anticipate a lengthy nursing home stay, daily payments may potentially be the easiest option. But it’s best to consult a financial adviser.

What does the research say?

My research with colleagues found many people choose the lump sum option simply because they can afford to.

Those owning residential property are more likely to pay a lump sum, mostly because they can sell a house to get the money.

People who consult financial advisers are also more likely to choose lump sums. This may be due to financial advice suggesting it’s tough to earn investment returns higher than what you’d save by avoiding the interest charged in the daily payment option.

Some aged care providers prefer lump sum payment since they use these to renovate or refurbish their facilities. But providers are not allowed to influence or control your decision on how to pay.

The recent Royal Commission into Aged Care recommended phasing out lump sums as a payment option, leaving only daily payments. While that would reduce the complexity of the payment decision and remove the incentive for providers to sway decisions, it would also reduce consumer choice.

Is there anything else I should know?

Some 60% of people we surveyed found the decision complex, while 54% said it was stressful.

It is best to seek professional financial advice before you decide.

Services Australia also runs a free Financial Information Service that can help you better understand your finances and the payment decision. But it does not give financial advice or prepare plans.

You have 28 days to choose a payment method after admission, and six months to pay if you choose a lump-sum payment.

In the interim, you will be charged daily interest payments on the room price.

Anam Bilgrami, Research Fellow, Macquarie University Centre for the Health Economy, Macquarie University

This article is republished from The Conversation under a Creative Commons license. Read the original article.