Copper has played a vital role in civilisation since its discovery in the Neolithic era nearly 10,000 years ago. More than many other commodities, copper represents progress, and when it is in demand, it means industries and economies are moving forward.

Often known as Dr Copper for the uncanny way its price anticipates future economic activity, at the time of writing, copper prices hit all-time highs of $US10,460 per tonne (US$4.76/lb). Coming up from 3-year lows in the midst of the COVID-19 induced recession in 2020, current prices reflect a strong rebound as the global economy switches back on. But are these prices merely a post-COVID phenomenon or is there more to it? This article discusses the forces at play and strategies to benefit from the electric metal’s strength.

What is pushing prices higher?

There are a few forces at play that are affecting the price of copper, but for ease of explanation a simple way to group them is into supply and demand factors.

Supply factors:

- COVID-19 dislocation: As we are well-aware, the COVID-19 pandemic resulted in widespread lockdowns leading to a drop off in global copper supply at all points in the supply chain. As the COVID-19 crisis eases (in some areas), supply chains are able to return to their normal pre-pandemic operating levels.

- Lack of new discovery: According to S&P, of the approximately 1 billion tonnes of copper resources discovered since 1990, only 8% has been discovered in the past decade. This is despite exploration spend between 2009-2019 seeing a 68% increase on the prior decade. Given it can take 20 years for production to commence following discovery, this represents a long-term supply-side issue.

- Diminishing ore quality: Copper ore is finite in supply and its quality has declined, which means more rock needs to be mined and processed in order to extract the same amount of copper. In Chile, the world’s largest copper producer, average copper ore grades have deteriorated by 30% since 2005. Even with reductions in ore quality, miners can’t perpetually ramp up production, there is a limit to annual production and how much copper remains to be mined.

- Scrap supplies: While scrap metal supplies of copper are a viable and important source of supply, scrap historically takes time to respond to market dynamics, and considering COVID-19 related logistical constraints, deficits are expected in the near-term, further strengthening copper prices.

Demand factors:

- Post COVID-19 activity and fiscal stimulus: The return to ‘normal’ activity, as well as making up for lost time through the COVID-19 lockdowns are a strong but shorter-term impact. Against the backdrop of mega trends such as mass urbanisation, demand for copper for use in building construction is one of the largest markets (e.g. water pipes, electric wiring) and while COVID lockdowns can slow a trend, they can’t stop it completely. Government fiscal stimulus is resulting in increased economic activity and thus demand for copper.

- Clean energy transition: The US climate summit saw declarations by a number of nations to net zero emissions targets and the US re-signing the Paris Agreement. Crucially China’s President Xi also pledged to cut coal consumption starting from 2026 and reiterated the country’s 2060 carbon neutrality target. Two of the world’s largest economies reminded us that they are aligned in their pursuit of lower carbon emissions and promotion of renewable energy. Without copper there can be no decarbonisation meaning demand for copper where it relates to clean energy is set to grow strongly in the years ahead. According to the International Energy Agency, it is estimated that around 45% of demand for copper will come from clean energy technologies in 2040, up from just 24% in 2020. Total demand for copper by clean energy technologies is estimated to see a three-fold increase by 2040, requiring investment in the near-term and production to ramp up drastically to meet demand. Against some of the supply factors mentioned above, this will likely put pressure on copper prices.

Can the price keep going up?

In the near-term the precise degree of inventory reductions will be a key determinant of copper prices. Speculative positioning is rather extended, China may well slow its purchasing given high prices and moderation in consumption growth may moderate causing a price correction.

If scrap supply is able to respond sufficiently to stop major refined inventory drawdowns, the copper price would also suffer. A bull case would see easier than anticipated Chinese policies, Fed yield curve control and European growth surprises, whilst a bear case would see global policy support waning, a growth slowdown and positioning unwinding sharply.

Are the rising copper prices reflected in your copper stocks?

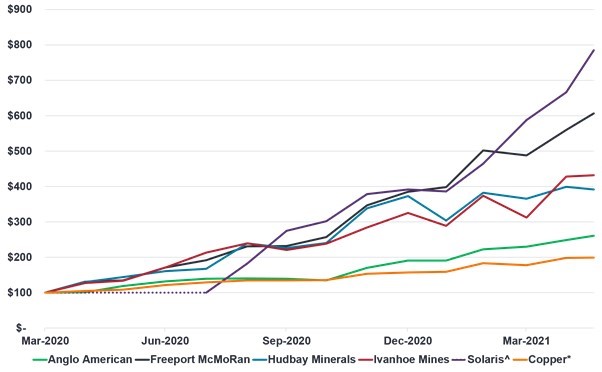

Five copper stocks that we hold are Ivanhoe Mines, Freeport McMoRan, Anglo American, Solaris and Hudbay Minerals (as at 30 April 2021 and holdings are subject to change). In the chart below, we plot the copper price relative to these companies’ stock prices as a growth of $100 chart since the COVID crisis in March 2020.

In our view, copper equities are the best investment vehicle for exposure to copper. Historically commodity equities have outperformed their underlying commodities due to their additional growth, value creation potential and an equity risk premium to harvest.

Growth of US$100 in copper stocks

Source: Bloomberg, Janus Henderson Investors. As at 23 May 2021. *LME Copper 3 Month Rolling Forward. ^Solaris listed in July 2020 and therefore shows no change from March to July 2020. Past performance is not a guide to future performance. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

We see attractive opportunities in copper producers, developers and explorers. While there may be shorter-term volatility in copper and share prices, we are witnessing a long-term trend driven by the decarbonisation of the global economy, while large sources of new supply will be slow, expensive and difficult to bring to the market.

The Anthropocene Epoch is used to describe the current period in Earth’s geologic history when human activity has induced a significant impact on the planet. As we reverse this impact through a new green industrial revolution that offers cheap, clean energy, copper is very much part of the solution.

Tal Lomnitzer is a Senior Investment Manager in the Global Natural Resources team at Janus Henderson. This article does not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice.