Covid-19 has created one of the biggest market falls (or drawdown) in Australian equity earnings in history, even bigger than during the GFC. Income investors are understandably concerned about the impact the shutdowns and ongoing social distancing will have on the ability of Australian equities to pay dividends.

This article discusses our forecast of the near-term dividend outlook and examines how active managers can help investors navigate this unique moment with the objective of creating a sustainable income stream.

Equity income and Australian dividend outlook

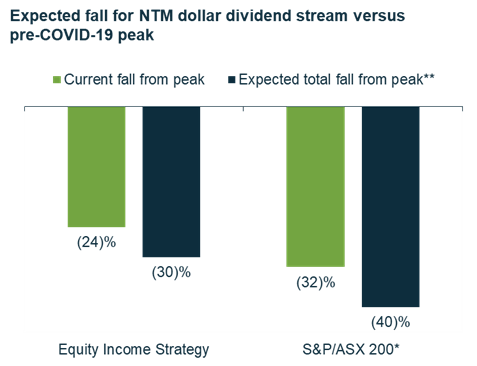

The near-term outlook for dividends remains challenging. At the time of writing, based on broker consensus estimated for next 12 months dividends, the dollar dividend stream from the February (pre-COVID-19) peak for the broad market (S&P/ASX 200) will be down more than 32% (and down 24% for the stocks in our Equity Income strategy).

We expect the income stream to come down further as dividend forecasts published by stockbroking analysts have yet to fully account for the effect that the reduced company earnings will have on dividends.

Our own 2020 COVID-19 dividend profile work suggests that the full extent of downgrades to the income stream for the broader Australian market will be in the order of approximately 40% down on February estimates (and for our Equity Income strategy, down ~30%) as shown below. See notes at end of the article for more details on Next 12 months (NTM) calculations.

A crisis and an opportunity

We recognise that the fall in income is a critical issue for investors such as retirees who rely on that income for their living expenses. However, without minimising the seriousness of that issue, we believe this crisis is an opportunity for active managers like ourselves to build a diversified portfolio of businesses with the ability to generate sustainable dividends at once-in-a-lifetime valuations.

For an income-oriented strategy, successfully navigating these market conditions requires a balancing act that entails a nuanced approach satisfying both of the following two conditions:

- Ensure that the long-term income potential of the portfolio remains robust, i.e. focus on the long-term business outlook and dividend potential of the portfolio companies.

- Deliver the best possible income stream over the course of the near-term business disruptions caused by the pandemic, i.e. ensure that there is a reasonable level of income in the coming 12 to 24 months to support income requirements.

The need to optimise across these two parameters illustrates an important benefit of active management over passive or ‘smart beta’ strategies at this critical juncture.

For example, a passive manager who indiscriminately sells stocks where the dividend is cut to $0 will likely be selling uniquely profitable and monopolistic businesses at historically low valuations. Similarly, buying stocks in sectors where dividends haven’t been reduced to chase higher short-term income will entail paying a significant valuation premium and must be done with a discriminating eye towards long-term dividend sustainability. The combined effect of such a robotic approach to income investing is likely to result in a significant impairment of the long-term income potential for investors in these passive, yield-chasing strategies.

What’s called for at this moment of market dislocation is a case-by-case assessment of each company’s prospects by a seasoned team of sector specialists to parse the likely winners from losers. We use a dual track framework that examines both the short- and long-term income potential of each portfolio company.

Deep fundamental analysis of short-term impact

Since the start of the covid-19 crisis, each stock in our portfolios and investible universe has undergone a '2020 COVID-19 Dividend Profile' to accompany the 'Sustainable Dividend' analysis. This analysis more precisely calibrates each stock's downside income risk, and understands which stocks should see dividends recover relatively quickly versus those that are likely permanently impaired.

Our recent focus has been on the following market segments:

- Companies that 'make money while you sleep' rather than those that have a more 'transactional' nature

- Exiting positions that are most vulnerable to the adverse outcomes from social restrictions, and

- Purchasing undervalued companies that have not acted as defensive as they genuinely are.

Quantifying dividend sustainability and long-term income potential

Portfolios are constructed from stocks based on their ability to pay a forward looking 'Sustainable Dividend' rather than a current or consensus dividend. We judge each company’s dividend paying power by assessing their free cash flow generation through different stages of the economic cycle. The analysts then model a two-year bear-case scenario, i.e. can a dividend be paid in eight out of the next 10 years? The 8/10 approach considers a significant downside scenario for each company and what level of dividend they can pay post a crisis.

The unprecedented impacts from covid-19 mean that for a number of companies, short-term expectations for dividends have fallen below the sustainable dividend forecast. Critically, though, where the long-term sustainable dividend potential remains robust, we continue to hold them.

"We continue to think that it is usually foolish to part with an interest in a business that is both understandable and durably wonderful. Business interests of that kind are simply too hard to replace." - Warren Buffett

Using this dual track analytical framework balances long-term dividend potential and short-term income protection. The aim is to re-position income strategies to remain well positioned to provide investors with portfolios built on a foundation of sustainable dividends for the long-term.

Will Baylis is a Portfolio Manager for the Legg Mason Martin Currie Equity Income Fund. Legg Mason is a sponsor of Firstlinks. The information provided should not be considered a recommendation to purchase or sell any particular security. Please consider the appropriateness of this information, in light of your own objectives, financial situation or needs before making any decision.

For more articles and papers from Legg Mason, please click here.

Source: Martin Currie as of 29/05/2020, Next 12 Months (NTM) Income yield is calculated using the weighted average of broker consensus forecasts of each portfolio holding –because of this, the returns quoted are estimated figures and are therefore not guaranteed. Assumes zero percent tax rate and full franking benefits realised in tax return for Martin Currie Equity Income.