Background: At a recent UNSW virtual research seminar, Calise Liu and Alan Xian presented their research on developing a COVID-19 Susceptibility Index. This interview explores the research and its potential applications. Calise works at Finity Consulting, which specialises in actuarial and strategic analytics consulting. Alan has nearly finished his PhD at UNSW and will start a role at Macquarie University later this year.

David: With your actuarial backgrounds, what motivated you to get involved in COVID-19 research, which to many is the domain of medical researchers?

Calise: Once you have data (and there is a lot of data available), many of the skills required to analyse that data are universal. We had read a lot of medical literature but hadn’t seen the translation of those results to the Australian population. Actuaries are particularly well-placed because we have expertise in modelling large demographic data sets. Of course, we are not medical experts and so we made sure to get specialist medical input. We held discussions with six medical experts on the design aspects of our research.

David: Why the focus on susceptibility?

Alan: There was already a lot of research modelling transmission of the virus. We noticed a research gap in terms of investigating susceptibility at a demographic level. Susceptibility, the risk of severe illness or death if an individual were to contract the virus, is important in many ways. At a government level, susceptibility tells you how bad it could be in each region if an outbreak were to occur. This then informs decisions around resource allocation and how quickly you want to be able to identify and treat known cases.

David: Explain how you have developed the Susceptibility Index.

Alan: We combined age characteristics (60-69, 70-79, and 80+) with five health aspects (known as co-morbidities): cardiovascular disease, respiratory disease, cancer, diabetes and obesity. Unfortunately, the data shows that certain groups – notably the elderly with multiple health issues – are many times more likely to have severe reactions if infected with COVID-19, compared with young healthy people.

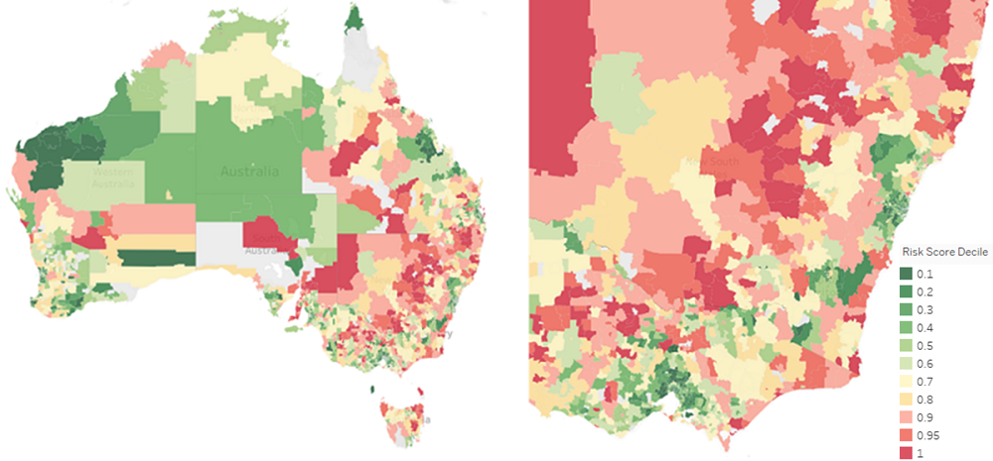

Calise: By combining our susceptibility score with Finity’s Defin’d dataset of socio-demographic and geographic attributes, we can explore COVID-19 impacts by area, household composition, income band, industry and more. We found some evidence of vulnerable populations away from capital cities, where multiple risk factors are more concentrated. We used heatmaps to visualise the susceptibility risk (red indicates areas with, on average, highest susceptibility).

The news is both good and bad. So far, most of the cases have occurred in areas with relatively-lower susceptibility. However, this is something to consider when looking at when, where and how to relax restrictions.

David: When you combine the demographic data with age and health factors, do any socio-economic effects emerge?

Alan: Unfortunately, we find that at-risk communities commonly have low socio-economic characteristics (i.e. low income). This isn’t surprising – when we spoke to our medical experts, they were aware that health issues and co-morbidities tend to present more strongly in poorer socio-economic groups. As a result, the disadvantaged segments of Australia may require additional resources as we start relaxing isolation measures.

David: What are the implications for government policy?

Calise: We think our work can inform policy in a number of ways. Our model provides an exposure measure for the Australian population that can serve as a foundation for various extensions. Transmission information can be overlaid to assess the impact of various policies. Our analysis can also highlight areas where outbreaks of COVID-19 may be particularly devastating, guiding decisions around allocation of financial and medical resources. Conversely, the additional economic information could be incorporated to examine trade-offs between simulating economic recovery and minimising risk to public safety.

David: I know this is early days, but have you been able to share this research with authorities?

Alan: We have had some interest from the Department of Health. We are happy to work with any interested parties to see how our work could be of assistance.

David: Finally, Alan, you’ve effectively put your PhD on hold, and Calise, you’ve been supported by Finity, but most of this research is outside of work hours. Do you think that this may be a feature of your future careers, jumping into projects outside your core line of research where you see the opportunity to contribute?

Calise: I think many young people view contribution as an important part of their career. I’m fortunate to have an analytical skillset which can be applied to different problems.

Alan: I do have to finish my PhD soon and am looking forward to that light at the end of the tunnel. Luckily, I have supportive supervisors who share my view that these contributions are worthwhile pursuits. At the start of my PhD, what I really wanted was to produce societally beneficial research and so these projects are very exciting.

Individuals with co-morbidities or symptoms associated with COVID-19 should follow the government advice and take extra precautions which can be found here.

If you would like to know more about the Susceptibility Index you can read more here.

David Bell is Executive Director of The Conexus Institute, a not-for-profit research institution focused on improving retirement outcomes for Australians. Calise Liu is a Fellow of the Institute of Actuaries of Australia and an intern at Finity Consulting. Alan Xian is a PhD candidate at UNSW.