We had a great response to the challenge to take the HILDA financial literacy survey to see how readers of Cuffelinks compared with the broader Australian population. About 2,200 readers have so far taken part, and the survey is still open if you haven’t attempted it already (which you should do before reading further!).

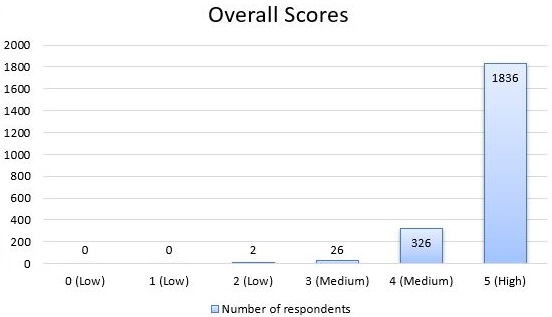

Cuffelinks readers scored an average of 4.8 out of 5, compared with HILDA’s average of 3.9. At the date of this article, 84% of Cuffelinks respondents scored 5 out 5 (high level of financial literacy), compared to 42.5% for the original survey.

Based on the many comments posted on last week’s article, it seems that the financial nous of Cuffelinks readers caused some to read too much into the questions, drawing in other factors that changed their interpretation. The key to success was to keep it simple and assume that all other factors remained equal (or at least, inconsequential).

The five questions respectively covered: numeracy, inflation, portfolio diversification, risk versus return, and money illusion. Here’s what we have learned from this exercise.

Q1 – Numeracy

Asked how much money you would have after one year if your $100 in the bank earned 2% interest per year. The simple (and correct) answer was $102.

While the question stipulated no fees, no additional deposits, and no withdrawals, it was silent on the frequency of interest payments and the effects of compounding. Our readers are definitely aware of these additional concepts, but they take the question from simple numeracy to compound interest calculations!

Even so, 99% of Cuffelinks readers were not so easily side-tracked.

Q2 – Inflation

When your savings are earning 1% in interest while inflation is tracking at 2%, in 12 months, you’ll have 1% more in cash to pay for goods that have inflated in price by 2%, so you’d be able to buy less than you would today.

We had 99% of readers pick that returns would not keep up with the increase in the cost of living.

Q3 – Portfolio diversification

Q3 wanted to know if investing in just one company was safer than investing in a number of different companies. Anyone who remembered the phrase ‘don’t put all your eggs in one basket’ cracked this question, which included (again) 99% of Cuffelinks readers.

Q4 – Risk versus return

This one asked if investments with high returns were likely to be higher risk. The key word being ‘likely’. Investors should demand higher returns for higher risk, otherwise, why would the riskier investment appeal to anyone?

This question tripped a few extra people, with 97% answering correctly.

Q5 – Money illusion

The final question was the most controversial among the comments. It asked if you’d be able to buy more, less or the same as today if, in 2020, your income had doubled and the cost of everything you buy had also doubled?

Assumptions that clouded a clear response included income tax (bracket creep), pre-tax or after-tax dollars, whether savings would double too, effect on disposable income, and not spending all income.

Sticking to the basic understanding of money illusion, the correct answer was ‘the same’ and 89% of Cuffelinks readers got the point.

A selection of comments

- 5 is a tricky one – do we consider bracket creep?

- Tend to agree. If everything doubles, then the amount you save doubles (even if it is only a very small proportion of the total) and hence you will be able to buy more in 2010.

- I suspect you will find that the majority of respondents from Cuffelinks will only score 80% on the quiz as we would all assume that in a progressive taxation system, double income does not equate to double disposable income.

- #5 is a ridiculous question, really. There seems to be an inherent assumption that right now you spend every cent you earn on “buying things” and that there’s no such thing as tax, or progressive tax brackets – if your income doubles then your disposable income, which you “buy things” with certainly doesn’t – but I doubt you’re expected to think of that. Also the scenario of the price of “everything you buy” and your income both doubling in three years is completely unrealistic.

- I scored 100% because I only considered the calculations required to answer the questions.

- Personally I found each of the 5 questions open to interpretation.

- I answered question 5 based on the rate of tax being higher for the doubled income, and subsequently was marked incorrect. The question would probably be better written to specify that

- For all we know Q5 was deliberately included to gauge understanding of our tax system, which would have been a great idea !

- It seems many Cuffelinks readers are just too smart for their own good (and perhaps that of their clients).

- Lesson 1: KISS!

- It is great to see so many Cuffelinks members forming an opinion. What is better is people involved in testing their financial literature skills. Keep the surveys coming !

- I got all five right and would consider myself as highly financially literate. Just read and answered the questions on their merit. My engineering background I expect. No second guessing.

- These questions are so basic as to be laughable. The results say a lot about the apathetic state of affairs with approaching retirees in the importance of self-educating themselves about their retirement planning. No wonder unscrupulous financial advisers see this market segment as an easy target!

- The designated answer to 5 is wrong. Assuming that your income in greater than your expenditure, there is an increase in the unexpended income.

- I disagree agree with the answer to Q4 – higher returns does not always create higher risk. The higher returns works the opposite way = more assets over time

- Got all 5 right. I knew studying investing and economics was good for something!!!

- I thought it was a joke at first almost looking for the trick in the questions

- I refer to your questionaire which I responded to achieving 4/5 failing on question 5.My answer was MORE the reason being “ most peoples expenditure would not be the total of their income thus having some in reserve but then again how much if any is saved”.I am just being pedantic and thought the question may have had a sting in the tail.Out smarted myself. Thank you for testing my brain.

- I consider myself not all that sharp, but I scored 100%, I just answered the question. I have a mate who I would consider far more financially literate than me and he scored not so well. Simply because he wanted to interpret the questions via an incredibly complex set of variable parameters.

- As far as I can see things, the keep it simple approach has worked for me, diversify, manage cash and one retires early with sufficient funds to have a good life.

- I formed the opinion that the questions were basic maths nothing more nothing less

- With double income, even allowing for taxation implications, I would expect my disposable income would be greater than expenses at double the original cost.

- Based upon the majority of feedback alone, I would suggest the cuffelink readers are smarter, in seeing beyond the simplicity of the questions, but too smart to realise that the question were not designed for their genius, but to seek to ascertain the general level of basic financial literacy, which quite sadly is at a low level.

- These exchanges illustrate the problems that reasonably financially literate people have with financial conversations – even starting with very simple questions. This underscores the vital role of trusted and competent planners in guiding people towards mutually agreed decisions.

- Planners also need better common ground to build relationships with their clients. A simple dialogue based on time (a key variable which we all understand) is likely to be much more effective than one which is initially financially based.

Leisa Bell is Assistant Editor at Cuffelinks.