Department stores worldwide are facing challenging times. In the past few years we have seen many department stores marking down prices to move excess inventory, including Nordstrom and Macy’s, the darlings among the global department stores. Others like JC Penney and our homegrown Myer and David Jones are still in the process of turning their businesses around.

Even today, with economic conditions in the US and Europe improving (but now under the Brexit shadow), department stores, which straddle the line between luxury, value and convenience, continue to lose market share. Department stores currently account for only 11% of the total US apparel market, down from 26% in 2005. This slump has given rise to questions and fears about the overall health and relevancy of the department store model in today’s retail and economic environment.

Australian department store headwinds

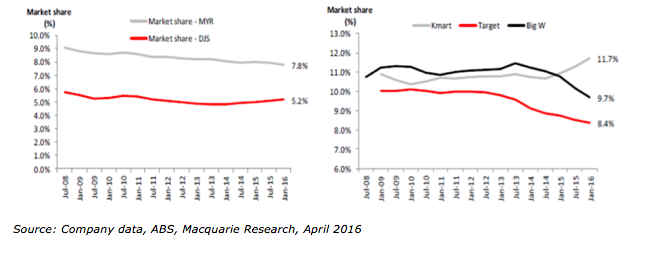

Myer and David Jones have had some tough years with both companies taking drastic measures to turn their businesses around and make them more relevant to today’s consumers. Target and Big W continue to struggle with Wesfarmers announcing major write-downs and restructuring costs in relation to Target, and Woolworths undertaking a comprehensive review of Big W.

Only Kmart has been successful in growing market share. It is a well-managed business and has stayed relevant at a time when consumers were cutting back spending. This phenomenon is similar to dollar stores and Walmart in the US performing well during the GFC and is common during times of economic hardships.

Also affecting the department store sector is the growth of specialty retailers both local and international and the advent of online shopping. A slew of international specialty retailers has set up here and this shows no signs of abating. Then there is online shopping – the elephant in the room. When the Aussie dollar was more or less on par with the US dollar, Australians discovered the joys of shopping online. While the depreciating Aussie dollar has made this less desirable, the ease of shopping coupled with the ability to compare prices means harried Australian consumers continue to shop online.

Shopper habits change during economic hardships

During the GFC, shoppers didn’t stop shopping but they did look for cheaper and newer options. They stepped out of their comfort zone and tried new formats and new stores. Those who used to shop at Macy’s ventured into Walmart and dollar stores. Those who shopped at Myer and David Jones tried out Kmart, Target and Big W. This changed shoppers’ perception of value and some continue to frequent these discount chains even as economic conditions improve.

Ibis World reports that the department stores sector in Australia declined by a compounded annual growth rate (CAGR) of 0.1% over the past five years while the discounted department stores sector grew at an annual rate of 2.1%.

Figure 1: Australian department stores losing market share (except Kmart)

The department store model is losing relevancy

The root cause of the problem goes deeper than shoppers looking for cheaper options. Department stores are unable to remain relevant and viable in an environment characterised by changing consumer behaviour. As Kevin Graff, retail consultant, says, “Department stores are being ‘out-retailed’ by specialty retailers.” Department stores were formed on the premise of convenience, but this exact business model is now working against them.

Younger consumers with little time to spare find department stores inconvenient and time consuming. They are difficult to get to (most are situated in malls which means you have to park elsewhere and walk to the store), they are difficult to navigate (consumers have to walk past myriad sections that they have no interest in to buy just that one product they’re looking for) and they do not have enough staff or pay counters (consumes even more time as clients have to go in search of these). And to top it all off they are usually more expensive.

On the other hand, specialty retailers who also straddle the luxury–discount border and thus compete directly with department stores may offer a smaller range of products but boast a better selection in their chosen product range (i.e. women’s clothing, swimwear, active wear or toys), more competitive prices, higher quality merchandising, better in-store and service experience as well as a comprehensive online presence.

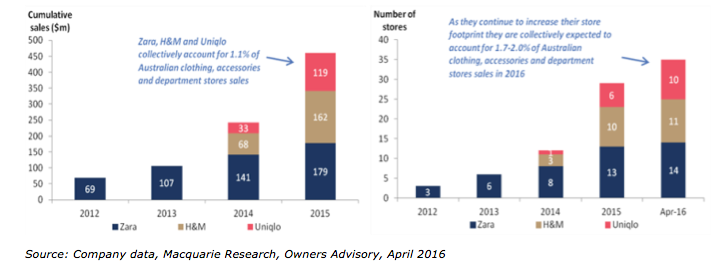

Department stores’ autumn and winter styles usually consist of the traditional dark and dreary clothing. However, hipper specialty retailers like Uniqlo have bucked this trend and are selling bright colours all year round. International specialty retailers like H&M, Zara and Uniqlo have been successful in growing their presence in Australia. While they only accounted for around 1.1% of total sales across clothing, accessories and department stores in Australia in 2015, Macquarie Research expects them to continue to grow their footprint within the country, accounting for around 1.7–2% of sales in 2016.

Figure 2: International specialty retailers increasing presence in Australia

Online shopping is the elephant in the room

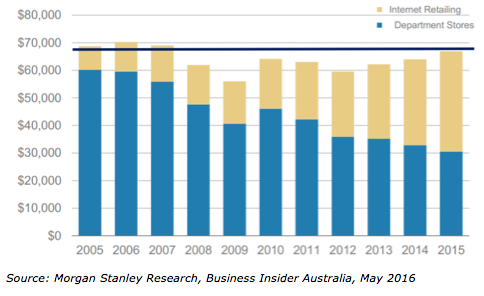

Shoppers can go online while travelling home on the train and order a pair of shoes from the US or China at a fraction of the cost, time and effort it would take to shop at a department store. This trend continues to play havoc on retailers. Amazon is now referred to as middle class America’s new department store, and Morgan Stanley reports that “internet retailers (led by Amazon) have added US$27.8 billion to their apparel revenue since 2005, while department stores have lost US$29.6 billion”. It expects department stores to only account for 7% of the total apparel market in the US by 2020, down from 26% in 2005.

Figure 3: US department stores in a losing battle with internet retailers

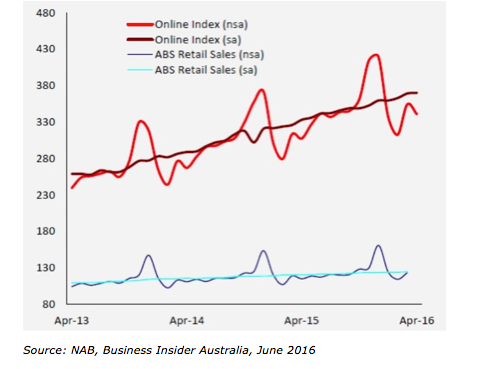

The story is no different in Australia. NAB’s latest online retail index reports that Australian online retail sales surged 10.8% in the year to April 2016 reaching a phenomenal A$19.6 billion, growing 3x faster than traditional brick and mortar retail sales.

Figure 4: Australian online retail sales growing 3x faster than traditional retail sales

Australia’s biggest retailers entered the online game late and are still playing catch up to international retailers. Citigroup reports, that on average, online sales at Australia’s largest 10 retailers, represent only around 6% of total sales - well below global online sales penetration of 11%. Australian consumers are bypassing these giants altogether and opting to shop at international e-commerce sites such as Amazon, eBay, asos.com and boohoo.com.

We prefer specialty retailers and remain cautious on department stores

While the department store model may be outdated, not all is over for retail. Experts believe that adopting an omni-channel strategy will allow these department stores to stay relevant even in today’s environment. However, they have to act quickly and decisively. Those who take measures to complement their retail presence with a well laid out online strategy, superior customer service and who provide an experience rather than a service stand to gain in this day and age.

Our preference in the retailing sector is specialty retailers like Baby Bunting (baby goods), Adairs (high end linen and homeware), JB Hi-Fi and Harvey Norman (electronics) and Premier Investments (Smiggle – children’s stationery). These companies have built a sustainable competitive advantage within their chosen products, boast good growth prospects and continue to exert their dominance by expanding locally and internationally.

John O’Connell is Chief Investment Officer at Macquarie BFS and Founder of Owners Advisory by Macquarie. This article is general information and does not consider the circumstances of any individual.