People often ask me why listed company dividend yields in Australia are so high. The average dividend yield across the Australian stock market is currently 4.1% or twice the world average. It is the highest in the world apart from Russia, Portugal, Turkey, UAE, Qatar and Nigeria.

There is a good reason for this. In the early stages of a country’s development, dividend yields start at high levels because investors are nervous about getting their money back if they have to wait too long. In the 1880s, dividend yields in Australia and the US both ran at 6% to 8%. As a country matures, investors develop trust in the corporate sector’s ability to invest wisely for future growth and so they let boards retain more of their profits to invest, and pay less back as dividends. In this sense, Australia is still like an early stage emerging market.

A history of reckless spending

Investors have a well-deserved distrust of Australian directors' and CEOs' ability to invest excess cash wisely, and so they demand profits be returned as dividends instead. Australian companies have a long history of wasting money on ego-boosting projects, usually in the form of reckless overpriced overseas ventures undertaken in booms. Then they are forced to sell, close or give the assets away after wasting billions of dollars. This trait has infected our big banks, miners, telcos, retailers, and hundreds of other companies. Success stories like Westfield, Macquarie, CSL, Seek, Cochlear, Sonic and Computershare are rare exceptions in a sea of red ink from failed expansions.

Australia is a small country in the middle of nowhere, and our directors find it hard to resist the temptation to chase the dream of free travel and adventure in pursuit of fame and fortune, all with shareholder money! Grand plans are usually hatched at the tops of booms, often with debt, with assumptions that prices will keep rising forever. They never do of course.

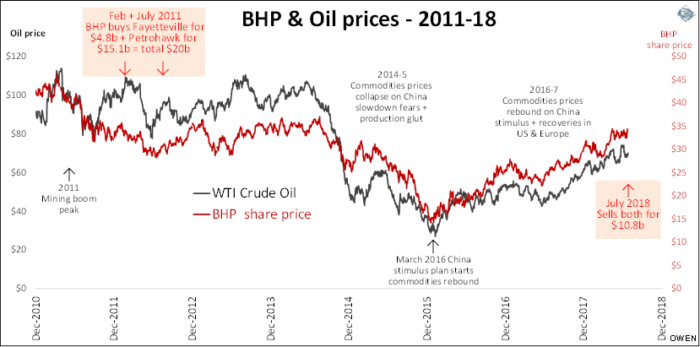

At the top of the 2011 mining boom when oil prices were above $100 per barrel, BHP spent $20 billion buying two shale oil operations in south eastern USA – Fayetteville for $4.8 billion and Petrohawk for $15 billion. BHP’s CEO was South African former management consultant Marius Kloppers, and Chairman was former Ford CEO Jac Nasser. Nasser had spent his career at Ford begging Canberra for handouts for Ford Australia, and begging Washington for handouts for Ford US. Neither knew much about mining or running profitable businesses without taxpayer support. BHP then spent the next six years throwing even more money at the troublesome projects while progressively writing off billions.

Click to enlarge

In theory, shareholders appoint the custodians of their companies

Finally last week, BHP announced the sale of both projects - Fayetteville for just $300 million and Petrohawk for $10.8 billion. At the same time, it wrote off another $3 billion, bringing losses to around $20 billion. That’s US dollars, not Australian dollars!

In the meantime, CEO Kloppers was fired and replaced by Scotsman Andrew Mackenzie, a real miner, and Chairman Nasser was replaced by former Amcor CEO Ken MacKenzie, with real experience running a very profitable business.

It is good to see BHP back in good, or at least better, hands once again. But we still don’t trust them. Thankfully, they are handing back all of the cash proceeds of the Petrohawk and Fayetteville sales to shareholders. They are also paying out record dividends from the windfall recovery in commodities prices over the past two years. The BHP share price is drifting up again, mainly because prices of commodities are rising, not because of good management.

The scary thing is that it could have been much worse. Kloppers and Nasser tried to use BHP to take over rival miner Rio Tinto for $150 billion in early 2008 when the iron ore price was at its all-time peak of $200 per tonne. It is now just $65 per tonne, and Rio was rescued by the Chinese government.

The problem is we can’t blame the CEOs, directors and chairpersons for bad decisions even if they had no relevant experience when there were appointed. In theory, they are put there by shareholders, so that’s where the blame lies. In reality, it is a cozy club because the big shareholders – which is mainly the big institutional super funds – stand by idly and let it happen. For small shareholders, it is easier to just watch from a safe distance and get out when we see trouble brewing.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.