Bonds have been a beautiful investment over the past couple of decades, compounding returns at a decent clip while faithfully filling their traditional role as buffers in down markets. But now that interest rates are close to all-time lows, their future return prospects are much lower.

In this article, I’ll explain why investors saving for retirement should consider shifting their asset allocations to lean more heavily on stocks. I’ll also run through some of the pros and cons of doing that, especially when it comes to downside risk.

Assumptions needed for planning purposes

We generally avoid making predictions about long-term market returns. But for planning purposes, investors need to use some type of return assumptions instead of just throwing up their hands in the face of unpredictable future returns.

Looking at long-term historical norms is a place to start. Over the past 92 years since 1928, Treasury bonds in the US have averaged annual returns of 5.15%, while medium-quality corporate bonds have returned 7.22%. If you subtract inflation, real returns are 2.17% for Treasuries and 4.22% for corporates.

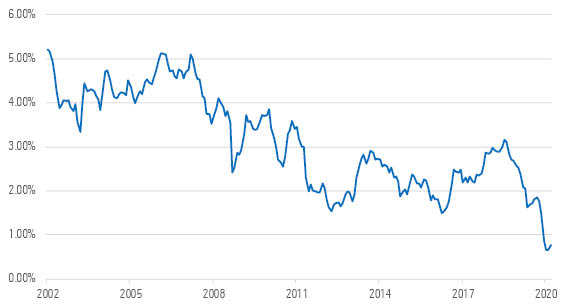

But it’s highly unlikely that bond returns will reach the same level over the next 10 years. The yield on the 10-year Treasury has steadily declined over most of the past 20 years, and the Fed’s recent interest-rate cuts have pushed yields down even further, as shown in the chart below.

Exhibit 1: 10-Year U.S. Treasury Yield Over Time

Source: U.S. Treasury/multpl.com. Data at 31 May 2020

Yield makes up much of the return bond investors earn, so rock-bottom yields suggest future returns are likely to be far lower than in the past, and may not even keep up with inflation. Lower future returns have profound implications for retirement planning. Investors who stick with the same asset-allocation guidelines that worked in the past will likely fall short of their goals.

How should portfolios change?

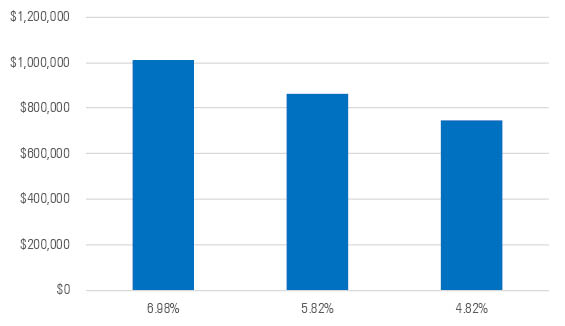

Take a hypothetical 50-year-old investor who starts with a $300,000 balance invested in a portfolio combining 60% stocks and 40% bonds. If she’s able to sock away $500 per month over a 15-year period, the outcome looks pretty good if you assume the same rates of return we’ve seen over the past 15 years. But if we ratchet down the return assumption for bonds to 1.5% annually, the investor ends up with about $150,000 less, which might translate into a year or two of retirement spending.

Even those projections might be too aggressive because they assume equity returns stay at the same level over the next 15 years. With a more conservative assumption of 7% nominal returns for stocks, the ending balance would total about $264,000 less.

Exhibit 2: Potential Savings Gap

Source: Author's calculations. Return assumptions are based on weighted returns for a 60/40 portfolio. Assumes a starting balance of $300,000 plus $500 monthly investments over a 15-year horizon. Date as at 31 May 2020.

Stocks to the rescue

Of course, the safest way to improve a long-term portfolio’s prospects is to boost contributions (or reduce withdrawals, if you’re retired). But a higher equity allocation could help fill some of the gap.

If we shift to an 80/20 mix and stick with the more conservative return assumptions, the ending balance gets a bit closer to the original level, reaching $870,000. Even shifting to a 90/10 mix (which would be more aggressive than the typical target-date fund with a 15-year time horizon) doesn’t quite get the ending balance back up to the original level. It would reach about $939,000 instead of more than $1 million.

How much is too much?

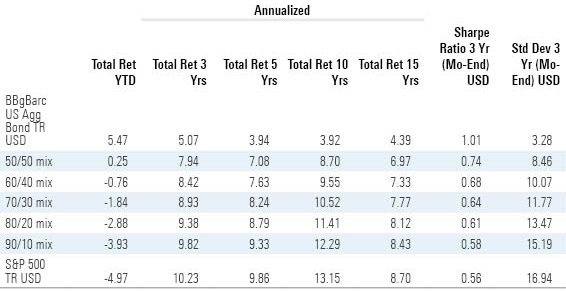

Of course, higher equity allocations come at a cost. As shown in the table below, there’s a direct relationship between equity exposure and risk. These numbers are for the US market but the same principles would apply in Australia.

The standard deviation (a measure of risk) for a portfolio combining 80% stocks and 20% bonds is about 34% higher than the traditional 60/40 asset mix.

Exhibit 3: Risk/Return Trade-offs for Different Asset Mixes

Source: Morningstar Direct. Data through 5/31/20.

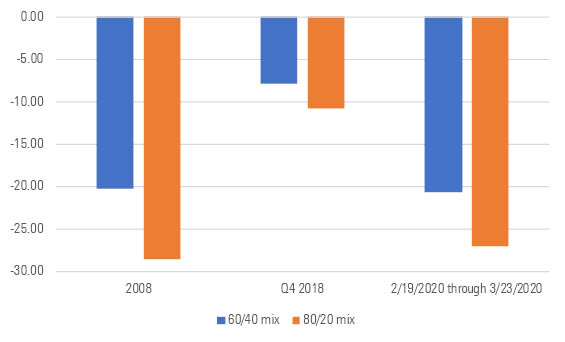

Looking at performance during previous market downturns is another way to gut-check your risk tolerance before making any shifts to your asset allocation. For example, in the COVID-19 correction from 19 February to 23 March 2020, a portfolio with an 80% equity weighting would have lost about 27%, compared with a 21% loss for a portfolio with a 60% equity stake (using the US data above).

Exhibit 4: Performance in Previous Market Downturns

Source: Morningstar Direct. Data as of 31 May 2020.

Conclusion on the right allocation

Ultimately, the 'right' asset allocation is incredibly personal. Risk tolerance is a key input, but so is risk capacity, the amount of risk you can take given your proximity to needing to spend from your savings. If you’re within a few years of retirement, having an allocation to safer assets like cash and bonds won’t just lower your portfolio’s volatility; it will help ensure that you don’t have to invade your equity assets when they’re down.

At the same time, low bond yields don't bode well for future returns. That suggests overweighting bonds is apt to reduce returns, and may result in a shortfall for investors who allocate too much to them in the name of safety.

Investors will likely need to pursue multiple strategies to help address the potential savings gap. Significantly increasing pre-retirement savings and reducing planned spending can improve your odds of success.

But if you’re willing to take on additional risk - and confident that you won’t be tempted to sell during market drawdowns - increasing your equity exposure can help fill part of the shortfall.

Amy C. Arnott, CFA, is Director of Securities Analysis for Morningstar. This article is general information and does not consider the circumstances of any investor.

Register for a free trial of Morningstar Premium on the link below, including the portfolio management service, Sharesight.

Try Morningstar Premium for free