How much time have you spent reading about tariffs over the past two months? If you’re like me, it’s been hundreds of hours. And how many of these hours have been useful to your investing? If you’re like me, the honest answer would be zero.

In a recent interview, Emma Fisher of Airlie Funds Management alluded to this, saying that we’d all become economists:

“There’s a great saying: In bull markets, everyone becomes a long-term investor; in bear markets, everyone becomes a macro economist.”

And specifically on tariffs, she said:

“We saw it in COVID. A lot of people focused on ‘hey, I’m going to figure out where the virus is going next and become an expert in virology.’”

What Fisher suggested was that we spend so much time worrying about what’s in the news, and what’s happening with the economy, politics, geopolitics, and so on, that we forget what’s important to investing and building wealth.

For her, it’s bottom up stock picking. For us, it’s a little different, as we’ll detail later.

But an obvious question is: why do we spend these thousands of hours on things that don’t really matter?

The answer is simple: we’re trying to beat the market and get rich quick.

That leads us to do all sorts of silly things. Buying stocks like lottery tickets, hoping they’ll be the next Nvidia. Buying the latest hot trend – gold as an example right now. Buying the latest hot fund manager without studying whether their outperformance is sustainable.

What should we be focusing on, then?

Zooming out on what really works

Investing isn’t a science, though more investors should treat it as such. That’s because there are a few ‘laws’ that are as iron clad to investing as gravity is to science.

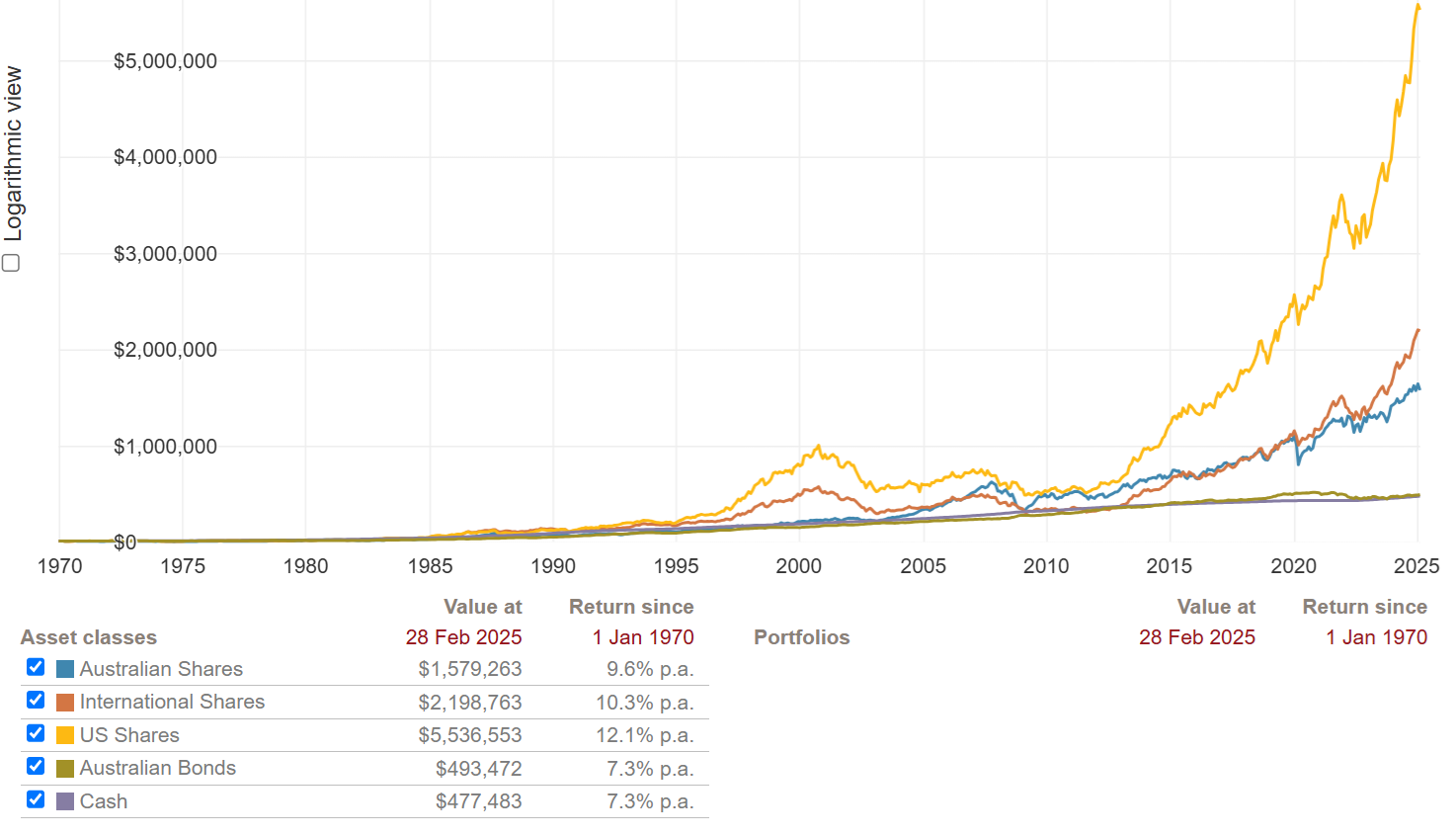

1. Stocks are the best asset class over the long-term.

In the long-term, stocks thrash every other asset class, whether it’s cash, bonds, gold, or anything else.

Asset class performance in AUD

Source: Vanguard

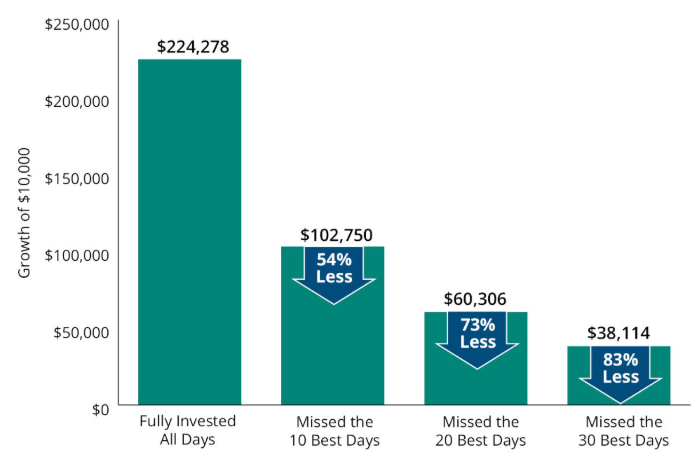

2. Staying in the market matters.

To reap the benefits of stock’s long term returns, it’s essential to stay invested. If you don’t stay invested, then you risk missing out on the best days in markets, which can have a huge impact on your returns.

That’s why trying to time markets is a waste of time, and detrimental to building wealth.

S&P 500 Index Average Annual Total Returns: 1995-2024

Source: Hartford Funds

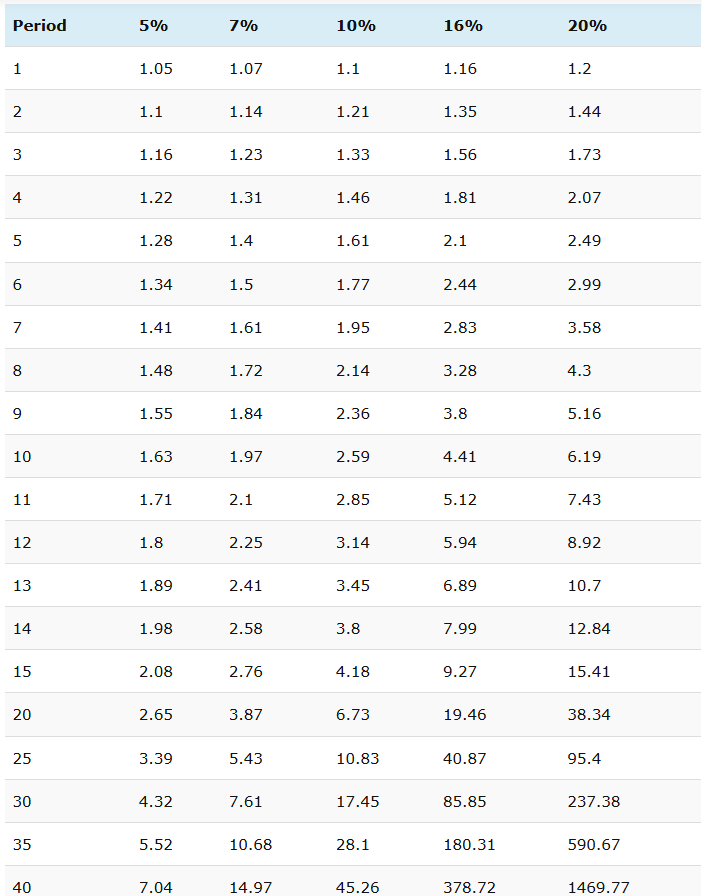

3. Compounding is magic

If you invest in stocks and hold onto them, then you let compounding work its magic.

The compound interest table below is one of the most important tables in investing, and one that should be taught to every adult and child.

Compound interest table (future value of $1)

Source: Young research

The table shows the snowball effect of compounding returns.

Historically, the Australian share market has returned about 10% per annum (p.a.), including franking credits. At that rate of return, $10,000 turns into $67, 300 in 20 years and $452,600 in 40 years. And it gets even better if you can invest further savings along the way.

Boiling it down to an equation

If I had to boil wealth down to a simple equation, it would be this:

Saving + investment + time = wealth

The problem is that most investors don’t save enough, don’t invest enough, and don’t allow enough time.

Why? Because most have a goal of getting rich, but they don’t have a system for reaching their goal. Goals without systems are worthless.

Let’s say that you want to invest $10,000 in the Australian stock market and achieve the goal above of turning that money into close to $450k in 40 years’ time, by compounding the money at 10% p.a. What’s the best way of achieving this goal? There are three main options:

- Investing in a low-cost ASX 200 ETF.

- Investing in a managed fund.

- Investing in ASX shares directly.

The first option has a high probability of working. The latter two options require greater research, use of your time, and willpower, and consequently have less probability of working.

The power of automating your finances

I’ve been involved in investing for a long time, and I’ve become a big fan of automated investing - using apps and platforms to invest an initial amount of money in ETFs/managed funds, and then regularly top that up with savings.

There are many apps that investors can use to do this now. The mix of technology and convenience is luring younger investors into these apps, and I view this as a good thing.

Why automate? Because it provides a system for investing, like the one I mentioned above.

Why don’t more investors do this? Because it’s boring and requires discipline and sacrifice.

But it can be worth it.

Going back to the compound interest table, though with a twist this time. If we initially invest $10,000 in an ASX 200 ETF and add $1,500 per month over 40 years, and the ETF has compound returns of 10% p.a., then you’d end up with a little of $10 million.

That’s the power of saving, investing, and time. And it’s the sure-fire way to building wealth.

James Gruber is Editor at Morningstar.