If you knew your incoming boss thought something the business does is 'absolutely abhorrent', would you fix it before he arrived? I know I would. So is NAB redesigning and repricing some of its products before Ross McEwan becomes CEO, since that's what he thinks about many of the current pricing practices. My dictionary defines 'abhorrent' as 'inspiring disgust and loathing'. There's not much wriggle room there.

Or has McEwan forgotten how Australian banks often price their products? Shortly after McEwan took over RBS in 2014, he acknowledged:

"We happen to be the least trusted bank in the least trusted sector in the marketplace."

He set about restoring trust, and he has already said his goal will be to make NAB the most trusted bank in Australia. He also said in 2014:

“It is absolutely abhorrent to give better rates to a new customer than someone who has been with you for 30 years. We have 16 million customers – it is time we need to focus on them rather than winning one or two more ... We do not want to build a bank by sucking people in with better rates only to dump them six months later. That is what created problems in this industry.”

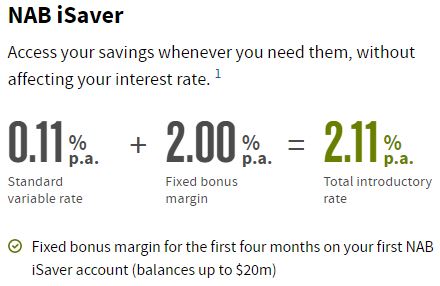

Ross McEwan hates introductory rates. He said RBS would not win business by offering attractive new deals that are not available to its existing customers, but that's exactly what NAB and other Australian banks do regularly. Here are a couple of examples:

1. NAB iSaver account offers a four month introductory rate of 2.11% for new customers then the rate falls to a miserly 0.11% as a reward for loyalty.

2. Balance transfer rates on credit cards only last for a limited time. At the end of the balance transfer period, any of the transfer amount not paid off shifts to the higher cash advance rate.

There is even a video explaining how this works. Elsewhere, there are 'special' and 'standard' term deposits, and home loan rates not available to refinance an existing home loan.

It's what is called a loyalty tax, as I've written about before, and former ACCC Chairman Allan Fels makes similar criticisms of the insurance industry. Add your thoughts on the merits of introductory offers in Have Your Say.

On to some brighter notes ...

Continuing our popular Interview Series, Megan Scott of Martin Currie Australia explains how she manages her wide range of responsibilities as part of a global investment business.

On investing, most Australian listed property trusts (A-REITs) had a strong FY19, and Patrick Barrett checks whether it will continue. Investors in bank hybrids have also had a good run, but with much tighter margins, both Jonathan Rochford and Justin McCarthy ask if it's time to sell.

Dick Smith put franking credits on the front page again (well, maybe page two) when he suddenly discovered his big refund, and Jon Kalkman and Tony Dillon do the numbers for him.

Miles Staude draws on the proven lessons from the Warren Buffett teacher, Benjamin Graham, to show value investing will again have its day, maybe when we're not at all-time highs.

This week's White Paper from AMP Capital is a detailed study on the role of 'green bonds', while the NAB/nabtrade hybrid rate sheet below shows how low many margins have fallen.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.